The intricacies of probate law, with its labyrinthine legal processes and complex technical jargon, are often a source of confusion for those facing the daunting task of dealing with property matters in the aftermath of a loved one’s death. Navigating this bewildering landscape can be especially challenging when it comes to understanding personal residential rights during the probate process. A frequently posed query is whether residence in a house undergoing probate is legally permissible.

Delving into this question requires an examination of several interrelated aspects: understanding what constitutes probate, unraveling the role and responsibilities of an executor, recognizing potential legal issues that may arise, and appreciating the significance of maintenance obligations. This article endeavors to shed light on these pertinent issues, providing comprehensive insights into the feasibility and legality of living in a house during its journey through probate. By doing so, it aims to equip readers with essential knowledge required for informed decision-making in such circumstances.

Understanding Probate

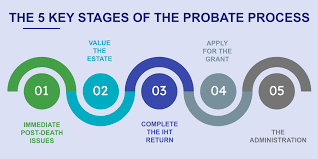

Understanding living in a house going through the probate process is essential when considering residing in a house that is currently undergoing this legal process. This procedure involves the lawful transfer of property from an individual who has passed away to their heirs or beneficiaries. Crucial aspects of the probate process include validating the will, appointing an executor, identifying and appraising assets, settling debts and taxes, and distributing remaining property as per the decedent’s wishes or according to intestacy laws if no valid will exists. Considerations like quick property sale or selling distressed properties often arise during this period.

The complex nature of probate can pose challenges for those wishing to speed up the home selling process. The real estate market after fire damage, for instance, may necessitate investor tips for damaged houses to facilitate a profitable transaction amidst challenging circumstances. Additionally, any changes in living arrangements during probate must abide by both state law and court orders governing these situations. It’s crucial to remember that while residing in a home going through probate might seem advantageous due to familiarity with the property or sentimental value attached to it, there might be legal constraints or financial implications that need careful examination.

While understanding how probate works provides insight into whether one can live in a house under this legal scrutiny, further comprehension is necessary about specific terms involved and how they impact such decisions directly. To delve deeper into these intricacies of ‘probate explained’, it would be helpful next to consider key terms associated with this process – including executors, beneficiaries, intestacy laws – and their role within the broader framework of estate settlement proceedings.

Probate Explained

Navigating the complex maze of inheritance law, a term known as probate emerges, which refers to the legal process that ensures a deceased person’s estate is distributed according to their will or applicable laws. Probate comes into play when a property owner passes away and leaves behind real estate assets. This process can be intricately tied with various aspects of real estate dealings including fast house selling options and quick sale in real estate.

The probate procedure comes with its set of challenges and complexities. One such challenge includes dealing with properties that have suffered material damage, for instance, fire damage. Fire damage and home value are often inversely related; therefore, selling a damaged house, especially one inflicted with fire damage can drastically affect its marketability. It creates an environment where potential buyers may perceive the property as less appealing owing to the costs associated with repairs and improvements necessary to restore the property’s condition.

Moreover, it should be noted that during probate proceedings, it might not always be possible for individuals to reside in a dwelling going through this process due to legalities or physical conditions like damages. However, if permitted by law or circumstance prevailing at any given time such issues could potentially open up opportunities for unique real estate transactions like selling a house with fire damage which has its own set of considerations and precautions. Understanding these nuances can equip beneficiaries better in navigating through such scenarios making them more adept at handling similar situations in future. Upon exploring how probate affects living situations and property sales under different circumstances, next is an exploration on another essential part of this intricate process – the role executor plays in managing estates during probate.

Role of Executor

In the intricate matrix of probate proceedings, the executor’s role emerges as a crucial element in managing and distributing the deceased person’s estate. The executor is responsible for gathering all assets, paying any debts and taxes, and finally distributing remaining assets to beneficiaries. In instances where property such as real estate forms a part of the deceased’s estate, it falls on the executor to decide whether to retain or dispose of such properties. This decision may involve various considerations including whether to sell the house fast or invest time in fixing issues related to fire damage before disposing of it.

| Executor’s Role | Considerations |

|---|---|

| Retaining Property | Keeping property might be beneficial if an increase in value is anticipated. However, holding onto damaged property may incur additional repair costs or possibly lower market valuation due to sustained damages (e.g., fire-damaged real estate). |

| Selling Property Fast | If urgent liquidation is needed for debt settlement or quick distribution among beneficiaries, one choice could be selling quickly regardless of its state (damaged or not). The trade-off here involves accepting potentially lower prices against speedier execution and closure. |

Henceforth, striking a balance between these aspects becomes essential. House selling tips after a fire often emphasize carrying out necessary repairs before listing since this can significantly impact fire damage property appraisal; however, this might be impractical given time and monetary constraints during probate proceedings. Hence, engaging with buyers specializing in damaged property investment might offer alternative solutions for executors weighed down by extensive repairs or low valuations.

This discussion highlights that an executor’s decisions have wide-ranging implications – from determining asset allocation among beneficiaries to affecting residential rights post-probate process completion. Thus being cognizant about these varying factors while navigating through complex scenarios is critical when aiming for fair resolution within a probate proceeding framework. The subsequent section explores how such decisions intertwine with residential rights within probate processes.

Residential Rights

Residential rights during probate proceedings often hinge on the executor’s decisions, further complicating the distribution of an estate. An executor is required to safeguard all assets within an estate, including a house that may be currently occupied by beneficiaries or other family members. However, complications can arise when the property in question is damaged. For instance, if there is a mortgage on fire-damaged property, the situation becomes more complex as this could affect its value and subsequently how it is distributed among beneficiaries.

Buying fire-damaged houses can also present unique challenges. There are numerous factors to consider such as the cost of repairs and whether or not financing options for damaged homes exist. Some lenders may shy away from providing loans due to the perceived risk associated with fire-damaged property financing. Despite these hurdles, certain mortgage options for damaged homes do exist but they typically require thorough assessments of repair costs and future market values.

Whether one chooses to live in a house going through probate process largely depends on these financial considerations along with any decision made by the executor. The complexity around residential rights does not end here; potential legal issues await those who navigate this path without careful planning and understanding of probate law intricacies related to real estate properties undergoing damage restoration or reconstruction.

Potential Legal Issues

Potential legal issues often arise when dealing with properties that are part of an estate in probate, particularly those that have suffered damage and require extensive restoration or reconstruction. The costs associated with such repairs can be substantial, leading to a complex web of financial considerations for potential buyers and current residents alike. This scenario is notably prevalent within the fire-damaged real estate market, where properties might require significant investment to restore them back to a livable condition.

- Underlying problems in the fast cash for damaged houses segment:

- Properties undergoing probate might not be eligible for certain types of financing due to their damaged state. Thus, getting a mortgage for damaged properties may become problematic.

- With the house being part of an ongoing legal process, it can sometimes lead to delays or complexities in transactions. Buyers seeking quick purchases may find this situation undesirable.

Understanding these potential pitfalls is crucial when considering whether one should continue living in a house going through the probate process. It is essential to keep in mind that while residing in such a property may appear financially advantageous initially, unforeseen complications could potentially result in higher costs down the line.

The subsequent section will delve into another critical aspect related to this topic: maintenance responsibilities during probate. This includes who bears responsibility for any necessary repairs or renovations and how these duties might impact individuals residing on the premises during the probate process.

Maintenance Responsibilities

Maintaining a property during the often complex and lengthy period of probate presents its own unique set of challenges and responsibilities. The individual with probate responsibility, often called an executor or personal representative, is tasked with maintaining and preserving the estate’s assets until they can be distributed to the beneficiaries. This includes ensuring that any real estate properties, such as houses, are kept in good condition throughout this process.

In relation to house maintenance during probate, several key responsibilities must be fulfilled by the person responsible for managing the estate. These obligations encompass various facets from routine upkeep to financial obligations. Below is a table encapsulating some of these duties:

| Maintenance Responsibilities | Description |

|---|---|

| Routine Upkeep | Regular cleaning and repairing minor damages to keep the property habitable |

| Home Insurance | Ensuring that home insurance policies are current for protection against potential damages |

| Property Taxes | Paying property taxes on time to avoid penalties or legal issues |

| Major Repairs | Addressing major structural issues that may devalue the property if left unattended |

| Utility Bills | Keeping up with utility bills so services are not discontinued |

While adhering to these responsibilities may seem arduous, it is essential for protecting the value of the estate’s assets and preventing further complications in settling inheritance matters. It should be noted that failure to meet these duties could potentially lead to legal repercussions or devaluation of assets which would ultimately impact the beneficiaries’ inheritance negatively.

Understanding this integral facet of probate management prepares those involved for what lies ahead: final settlement—a procedure where all debts are paid off and remaining assets distributed among rightful inheritors—thus illuminating another side of navigating through probate successfully.

Final Settlement

Inheritance matters, once all debts have been cleared and assets preserved during the probate period, pave the way for the final settlement—an intricate process that ensures rightful distribution of estate to beneficiaries. This involves a series of legalities and formalities that need to be meticulously adhered to ensure smooth transaction. It is noteworthy that the final settlement can only proceed after all potential disputes over inheritance have been resolved and it has been ascertained that there are no outstanding taxes or bills attached to the property in question.

The process leading towards final settlement typically follows these sequential steps:

- Assessment and Valuation

- Appraisal of Property: The value of any home or property in question within an estate must first be determined by a professional appraiser.

- Asset Evaluation: Other assets like bank accounts, stocks, bonds, or personal items also need valuation.

- Distribution

- Legal Documentation: After valuation, legal documents detailing how each item should be divided among beneficiaries are prepared.

- Releasing Assets: The executor then distributes each item as per stipulated guidelines in the will or according to intestacy laws if no will exists.

It’s worth noting how extensive this procedure can be—it requires time, effort, patience and understanding from all parties involved. During this phase, those living in the house going through probate may experience a sense of uncertainty until everything is settled. However, their right to continue residing there remains unaffected unless otherwise stated explicitly in legal documents or court directives. It is crucial for occupants and beneficiaries alike to understand every aspect of this process so they can make informed decisions about their options moving forward with as much clarity as possible during such an emotionally charged time.

Frequently Asked Questions

What happens if you can’t afford maintenance costs while living in a probate house?

Inability to afford maintenance costs while inhabiting a probate house may lead to property deterioration. This could potentially reduce the estate’s value, thus impacting the beneficiaries and complicating the probate process further.

How long does the probate process usually take for a house?

The duration of the probate process for a house varies significantly, typically ranging from several months to over a year. This fluctuation is influenced by factors such as estate complexity and jurisdictional laws.

Can a house be sold while it is going through the probate process?

Yes, a property can be sold during the probate process. However, this requires permission from the court and may need consent from all beneficiaries. The sale proceeds are then added to the estate’s total value.

Can the probate process be expedited if there are people living in the house?

The expediting of the probate process is typically dependent on legal complexities and jurisdictional rules, rather than occupancy status. Therefore, residents living in a house usually do not accelerate the procedure.

What are some common emotional challenges faced by individuals living in a probate house?

Individuals residing in a probate house often experience emotional distress due to the uncertainty of their living situation, feelings of intrusion from legal proceedings, and grief over the deceased property owner.