The real estate market, renowned for its dynamic and unpredictable nature, has frequently been the subject of speculation. The question at hand – ‘Are house prices likely to drop?’ – is one that has considerable implications for homeowners, prospective buyers, and the broader economy. This article embarks on a comprehensive exploration of this crucial query, delving into current market trends, economic indicators, interest rates’ impact, supply and demand dynamics, government policies as well as potential predictive factors.

Indeed, the future trajectory of housing prices is influenced by an intricate web of interconnected variables. A thorough understanding necessitates careful examination of historical data patterns juxtaposed with contemporary trends and expert forecasts. Thusly armed with information about these influences and their possible outcomes in various scenarios can lead to greater decision-making confidence regarding real estate investments. Whether one is intimately involved in the property market or merely intrigued by its workings and effects on the wider economy; this investigation promises valuable insights into the possible future directions of housing prices.

Current Market Trends

According to recent market trends, a significant drop in house prices appears unlikely as data from the National Association of Realtors indicates a consistent increase in median home prices by 15.8% as of March 2021, compared to the previous year. This surge, reflective of real estate market trends globally, suggests that despite the economic turmoil caused by COVID-19 pandemic, property values continue to rise. Key factors affecting house prices such as low mortgage rates and limited housing inventory have been instrumental in driving this trend. Delving further into housing market forecast projections, it is imperative to understand the dynamics at play.

A strong demand for homeownership fueled by low interest rates has set off a competition among potential buyers thus pushing up property value trends. Furthermore, an unprecedented shift towards sell my house fast Fort Worth remote working has increased demand for larger living spaces with added amenities – another factor contributing significantly to current upward pressure on house prices. Additionally, investors are showing increased interest in residential real estate due to its perceived stability and reliability as an asset class during times of uncertainty, thereby influencing the overall real estate investment outlook.

While it is important not to discount possible fluctuations or reversals in these trends moving forward; as they can be subject to unexpected changes influenced by broader economic indicators and policy decisions like adjustments in interest rates or fiscal policies affecting homeowner tax benefits. It’s evident that understanding the complex interplay between these variables will provide valuable insights into future housing market movements. The following section delves deeper into how economic indicators influence housing price forecasts without skipping any vital information.

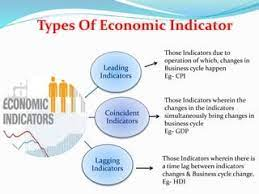

Economic Indicators

Fluctuations in the real estate market can often be anticipated by observing key economic indicators such as unemployment rates, interest rates, and gross domestic product (GDP) growth. These factors provide a basis for house price predictions and allow savvy investors to time the real estate market effectively. For instance, an increase in unemployment rates may indicate a potential decline in house prices as fewer people have the means to purchase property. Conversely, strong GDP growth could signal rising home values due to increased consumer confidence and spending power.

Market analysis for home sellers also takes into account these economic indicators. In a competitive market where multiple sellers vie for buyers’ attention, understanding these dynamics becomes crucial. If interest rates are low, it means borrowing costs are less expensive which generally encourages more people to consider purchasing homes thereby potentially increasing demand and driving up prices. Similarly, if GDP is growing robustly it suggests that people may have higher incomes or feel more financially secure, again possibly leading to greater demand for housing.

Examining these indicators does not guarantee precise predictions about sell my house fast Texas future house price movements but they do offer valuable insights into possible trends. They serve as tools that can help both buyers and sellers make informed decisions about when might be the best time to enter or exit the market. As this discussion moves forward into assessing how specific factors like interest rates impact the housing market directly, one must remember that these economic measures are interconnected and should be considered together rather than in isolation.

Interest Rates Impact

The impact of interest rates on the real estate market is akin to a seesaw; when rates climb, the affordability and thus demand for property tend to descend, potentially leading to a cooling of the market. This phenomenon can be attributed to higher mortgage costs that increase monthly payments for homeowners, thereby making it more expensive for potential buyers in terms of overall cost. Consequently, this reduces their purchasing power which might prompt them to delay their decision until rates stabilize or decrease. For those who need to ‘sell my house fast’, an uptick in interest rates can present hurdles as it shrinks the pool of prospective buyers.

When considering how rising interest rates can affect housing prices, there are several key points worth noting:

- Rising interest rates often signal a strong economy. However, if they rise too quickly or too high, it may deter potential buyers leading towards a ‘quick house sale’ situation.

- Existing homeowners with adjustable-rate mortgages could see their monthly payments increase. This could lead them toward a ‘fast property sale’ if they struggle with the increased expenditures.

- Timing plays a critical role: knowing when is the ‘best time to sell a house’ could significantly influence your return on investment.

- The right kind of marketing and sales strategies become crucial during periods of high interest rate. These include staging your home and pricing it competitively – apt ‘strategies to sell your house fast’.

Therefore, while climbing interest rates indeed pose challenges for both sellers and buyers alike in the real estate market by impacting affordability and demand dynamics–there are also opportunities inherent within these shifts. For sellers eager for swift transactions, employing effective selling strategies becomes paramount during periods of rising interests – understanding what motivates buyers under such economic circumstances can prove instrumental in achieving successful sales outcomes rapidly. Furthermore, although fluctuations in housing prices due to changing interests is one facet affecting property markets; supply-demand dynamics also play an equally influential role – paving way into our subsequent exploration: the influence of supply and demand on house prices.

Supply and Demand

Economic principles of supply and demand undeniably exert a potent influence on the dynamics of real estate markets. When the demand for houses increases, and the supply remains constant or decreases, house prices are likely to rise. Conversely, if there is an oversupply of houses but the demand is low, house prices may drop. This fluctuation in house prices presents both challenges and opportunities for individuals selling real estate quickly or seeking quick home selling solutions.

Selling tips for homeowners often advocate boosting home resale value through strategic property enhancements that attract buyers. However, these strategies must be carefully balanced with an understanding of market trends dictated by supply and demand. The following table demonstrates how different scenarios in housing supply and demand can impact house pricing:

| Scenario | Housing Supply | Housing Demand | Likely Impact |

|---|---|---|---|

| 1 | High | High | Stable Prices |

| 2 | Low | High | Rising Prices |

| 3 | High | Low | Falling Prices |

| 4 | Low | Low | Stable/Lower Prices |

For instance, fast cash home buyers might exploit a scenario like number three where high housing supply meets low demand, resulting in falling prices which provide them with more affordable buying options.

Considering these factors requires careful analysis; however, it’s worth noting that government policies also play a significant role in housing market behaviors. Government measures such as taxation laws and regulations on mortgage lending can alter the dynamics between housing supply and demand significantly. Such policies could either stimulate or stifle activity within the real estate industry which will subsequently affect house price trends.

Government Policies

Like a puppet master pulling strings behind the scenes, government policies greatly influence and manipulate the dynamics of real estate markets. These policies can directly or indirectly impact house prices, either causing them to rise or fall. For instance, tax incentives can encourage home ownership and drive up demand – and subsequently prices – while high property taxes could deter potential buyers and put downward pressure on prices.

- Interest rates: The government plays a significant role in setting interest rates through its central bank. Lower interest rates make mortgages more affordable, which can stimulate demand and push house prices up.

- Taxation: Governments often use taxation as a tool to manage housing markets. Property taxes, capital gains tax on property sales and stamp duty all affect the cost of buying or selling a house.

- Regulation: Policies regarding zoning laws, building codes, rent controls, environmental regulations etc., can all significantly impact supply in the housing market.

Government policies don’t just affect overall market trends; they also offer specific house selling tips for individual homeowners looking to navigate these complex dynamics successfully. For example, understanding how changing interest rates might influence buyer behavior could help sellers time their sale for maximum profit. Likewise, being aware of any upcoming changes in property tax legislation may allow sellers to price their homes more competitively.

As we delve deeper into this topic of factors influencing house prices’ likelihood of dropping or rising, it is crucial to acknowledge that these are not isolated elements acting independently but rather interconnected pieces within a larger puzzle called ‘predictive factors.’ The next section will explore further these predictive factors that play fundamental roles in determining future tendencies within real estate markets worldwide.

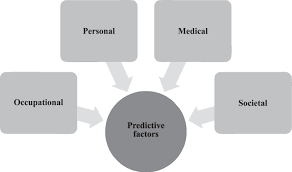

Predictive Factors

Predictive factors, encompassing a broad array of economic indicators and market trends, play a crucial role in shaping the trajectory of real estate markets globally. These include but are not limited to, inflation rates, gross domestic product (GDP) growth rate, unemployment rates, population growth or decline, and interest rates. For instance, high inflation can erode purchasing power leading to decreased demand for housing thus potentially causing a dip in house prices. Similarly, high unemployment combined with slow GDP growth can also suppress demand for homes resulting in decreasing prices.

At a more granular level, local market conditions such as the level of housing supply relative to demand significantly influence house price trends. An oversupply of houses without matching demand could result in falling property values while scarcity may drive up prices. Additionally, wider societal changes such as shifts towards remote working arrangements that reduce the importance of proximity to urban centers could depress property values in traditionally prime locations. Furthermore, technological advancements enabling virtual tours and digital transactions may create efficiencies that exert downward pressure on costs and hence prices.

The interplay between these predictive factors presents diverse possibilities regarding future house price movements. A nuanced understanding of these factors is essential for informed speculation about potential price trajectories in different locales and segments of the housing market. This complexity underscores the need for robust analytical frameworks capable of factoring multiple variables into comprehensive predictive models – which will be invaluable when considering potential scenarios that might unfold within the global real estate sector.

Potential Scenarios

Delving into potential scenarios, it is imperative to consider how diverse factors could converge in unprecedented ways to impact real estate valuations globally. Economic trends, policy changes, and unpredictable events such as pandemics can play significant roles in shaping the housing market landscape. For instance, economic downturns often lead to decreased consumer confidence and spending power, which can trigger a drop in house prices. On the other hand, fiscal and monetary policies aimed at stimulating growth may result in increased demand for housing and consequently higher prices.

In analyzing potential scenarios that could lead to a drop in house prices, one cannot overlook the issue of supply and demand. If there is an oversupply of homes on the market with not enough buyers willing or able to make purchases, this imbalance might force sellers to reduce their asking prices to attract interest. This scenario frequently occurs during periods of economic uncertainty when individuals are hesitant about making significant financial commitments like buying a home.

Another key factor that could potentially precipitate a drop in real estate values pertains to geopolitical tensions and conflicts. These elements create uncertainties that breed investor caution and fear — emotions that typically lead markets into bearish territory. Such conditions often discourage investment in real estate due to perceived risks associated with instability or conflict-related disruptions. Therefore, understanding these potential scenarios provides invaluable insights into what drives fluctuations within the property market whilst enabling stakeholders better prepare for future trends.

Frequently Asked Questions

How does a change in the local demographics affect house prices?

Local demographics significantly influence house prices. Variations in population growth, age distribution, income levels, and employment rates can either inflate or deflate property values due to shifts in demand and purchasing power.

What is the impact of natural calamities on house prices?

Like a landslide eroding a mountain, natural calamities can dramatically depreciate house prices. These disasters inflict physical damage and elevate perceived risk, discouraging potential buyers and thus reducing the property’s market value.

How does the overall quality of neighborhood schools impact house prices?

The quality of neighborhood schools significantly impacts house prices. High-quality schools often correlate with increased house prices due to the demand from families seeking optimal educational opportunities for their children.

How does the crime rate in an area influence its house prices?

Elevated crime rates in an area tend to negatively influence house prices. Properties in areas with high crime often have lower values due to perceived risks and potential disruptions associated with criminal activity.

How do technological advancements and infrastructural developments in a city affect the real estate market?

Technological advancements and infrastructural developments typically bolster the real estate market. Improved connectivity, amenities, and living standards attract buyers, driving up property values. However, such enhancements also require substantial investments, potentially impacting affordability.