Inheritance often brings with it a host of opportunities and challenges. One such challenge involves navigating the financial landscape surrounding inherited property. A quintessential question that arises in this context is whether to leverage the asset for loans or credits, also known as borrowing against inherited property. This practice entails using the inherited property as collateral to secure a loan, thereby providing a substantial financial solution to meet various needs or goals. The intricacies involved in this process, however, require careful examination and understanding.

This article provides an in-depth exploration of borrowing against inherited property: what it means, its eligibility requirements, benefits and drawbacks, types of loans available, application process and repayment options. Additionally, it delves into the considerations one must bear in mind along with potential risks associated with the practice. With expert advice woven throughout and practical steps outlined for ease of comprehension, this piece aims at empowering individuals to make informed decisions about leveraging their inheritance while ensuring their financial future remains secure.

What is it?

Borrowing against inherited property refers to the practice of accessing funds by using an heir’s newly-acquired real estate as collateral for a loan. This type of financial strategy is underpinned by inherited property loans, a specific form of financing that allows heirs to unlock the equity in their inheritance without necessitating an immediate estate property sale. Borrowing against inherited property can be a practical option for those who have recently received real estate through inheritance but require liquidity or capital for other purposes such as paying off debts, making investments, or covering unexpected expenses.

The process involves leveraging the value of the inherited asset, ultimately unlocking cash borrowing against inherited homes. Inherited properties often hold substantial value and hence offer significant borrowing opportunities. The ability to make use of this dormant wealth without having to sell the property outright is one of the main advantages of borrowed finance on inheritance. It provides flexibility and control over personal finances while preserving long-term sell my house fast Fort Worth ownership rights over the assets.

In terms of inherited property financing options, different lenders may provide various structures and terms depending on factors like credit history, income level and overall financial health. This could include home equity lines of credit (HELOC), home equity loans or private money loans among others. Regardless of which route an heir chooses to pursue when looking at borrowing options against their inheritance, it’s crucial they understand both eligibility requirements and potential risks associated with such financial maneuvers before proceeding further into this complex realm within real estate financing-which will be discussed in greater detail in our next section about ‘eligibility and requirements’.

Eligibility and requirements for obtaining a loan using a bequeathed real estate asset necessitate certain conditions to be met by the prospective borrower. These conditions generally revolve around three core areas: the legal status of the inherited property, the financial standing of the inheritor, and the valuation of the inherited property. Firstly, in terms of legal status, it is essential that any probate process has been completed and all ownership disputes resolved before selling an inherited home or borrowing against it can take place. This is to ensure that there are no pending claims on the property that could jeopardize its liquidation or sale.

Secondly, lenders often consider the financial capability of borrowers when extending loans on properties. The process is similar when one’s collateral is an inherited home. Here are some key factors:

- Credit history: This includes any past default payments or bankruptcy filings.

- Current income level: Lenders typically validate if your current income can accommodate additional debt repayments.

- Outstanding debts: Existing liabilities such as other mortgage payments, student loans or credit card debts may affect your eligibility.

The third requirement pertains to an accurate valuation of your inherited real estate asset – a critical step in determining how much loan you can secure against it. Prior to an inherited property sale or loan application, having a professional appraisal done helps establish this value accurately which influences both selling inherited home process and borrowed amount determination.

Assessing these eligibility requirements provides insight into what lending institutions look at when deciding whether to lend against an inheritance property. It’s vital to remember that each lender might have slightly different criteria depending on their risk tolerance levels and specific policies around inherited sell my house fast Texas real estate liquidation loans. Understanding these prerequisites not only aids in navigating through potential challenges but also maximizes chances for approval during sell inherited home probate processes or securing loans against them successfully.

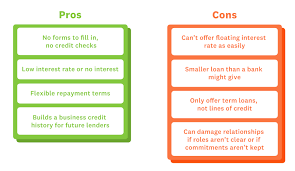

As we delve deeper into this topic in our subsequent discussion about ‘pros and cons’, you’ll gain a better understanding of the potential benefits and drawbacks associated with borrowing against inherited property. This will provide a comprehensive view to help in making an informed decision around leveraging such assets for financial needs.

Pros and Cons

Weighing the advantages and disadvantages of securing a loan with an estate asset that has been bequeathed to you provides a balanced perspective on this financial decision. A key advantage is that it allows for immediate access to funds without having to liquidate inherited real estate quickly, which can be beneficial in situations where immediate liquidity is required. Furthermore, borrowing against inherited property may accelerate your inherited property sale process as potential buyers could find a property with no outstanding mortgage more attractive. Lastly, using the inherited property as collateral generally offers lower interest rates compared to unsecured loans.

On the other hand, there are notable downsides to consider when contemplating borrowing against an inherited property. It poses significant risks as failure to repay the loan could result in loss of possession of the property. Moreover, selling house inheritance tax implications must be taken into account. Depending on jurisdiction and amount borrowed, hefty tax liabilities might arise from selling or even just borrowing against an estate asset, potentially causing financial strain in addition to existing obligations from inheritance.

Navigating these pros and cons necessitates understanding how different types of loans work and their respective impact on both short-term cash needs and long-term financial plans. In order to maximize benefits while minimizing risks associated with borrowing against an estate asset, seeking guidance from a comprehensive estate property selling guide would be valuable before making any decision. The subsequent section will further delve into various types of loans available for individuals considering this route.

Types of Loans

Various types of loans exist for individuals who wish to leverage their bequeathed estate assets, each with its own unique set of terms and conditions that can significantly impact the borrower’s financial situation. These loan types are particularly useful when one needs quick cash for inherited houses or seeks an expedited inherited property sale. The choice of a loan type should consider not only immediate liquidity requirements but also long-term repayment capabilities, interest rates, and the potential impact on personal credit scores.

- Home Equity Loan: A home equity loan allows borrowers to leverage the equity built up in the inherited real estate as collateral. The advantage is a potentially lower interest rate compared to other forms of credit.

- Refinancing Mortgage: Refinancing an existing mortgage on the inherited property often provides better terms than the original lending agreement.

- Reverse Mortgage: Particularly applicable for seniors over 62 years old, a reverse mortgage converts part of the home’s equity into cash without requiring monthly payments.

- Bridge Loan: For those needing fast cash before an expected inherited property sale, a bridge loan offers short-term financing.

While these options provide avenues for liquidating inheritance assets quickly, it’s essential to fully understand their implications using resources like an inherited real estate liquidation guide or professional advice from real estate experts offering quick tips for selling inherited homes. Each option has its own associated costs and benefits; careful evaluation serves as a sturdy foundation in making sound financial decisions that align best with individual circumstances and goals.

Interest in borrowing against inherited property underscores the importance of understanding various loan types available on the market today. This knowledge empowers individuals by informing them about different ways they can access liquidity based on their specific needs and circumstances at any given time – whether it be through refinancing mortgages, utilising home equity loans or considering bridge loans among others. Armed with this awareness, prospective borrowers can confidently navigate towards the subsequent section that delves deeper into the intricacies of the application process.

Application Process

Understanding the intricacies of the application process for loans on bequeathed real estate assets is a critical component in managing financial decisions tied to inherited properties. This procedure often involves an evaluation of the property’s value, verification of inheritance rights, and submission of necessary documents like death certificates and probate court rulings. For a quick sale of probate property, lenders may require additional assessments to determine the market value. The aim here is to ensure that the loan amount does not exceed this value – a precaution aimed at safeguarding both parties’ interests.

The next stage in securing finance against an inherited property sale involves providing evidence that demonstrates your legal ownership or entitlement to sell. In most cases, this means producing court documents from probate proceedings or a will demonstrating your claim as beneficiary. While navigating these requirements can seem daunting, knowing some fast house selling strategies can expedite the process considerably. Tips for selling estate homes include preparing all requisite documentation ahead of time and seeking professional advice where necessary.

In navigating these complexities, it’s imperative not to overlook repayment options which can significantly impact long-term financial health. A well-informed borrower should understand their loan agreement’s terms and conditions before committing fully – an essential part of any expedited house selling in probate scenarios where speed is often paramount but mustn’t compromise due diligence. As we move forward into discussing how various repayment structures work, it’s crucial always to bear this balance between expediency and careful consideration in mind.

Repayment Options

Navigating the landscape of repayment options for loans tied to bequeathed real estate assets necessitates a detailed comprehension of potential interest rates, terms, and penalties. Understanding this dynamic field requires exploring multiple avenues that can facilitate a speedy home selling process or ensure manageable repayments if the inherited property sale is not immediate. From traditional lenders to fast home buyers, each presents distinct options with varying levels of flexibility and commitment.

- Traditional Lenders

- Typically offer lengthy loan terms with fixed or variable interest rates

- Depending on credit score, borrowers may secure lower interest rates

- Early repayment penalties may apply, impacting house selling strategies

- Fast Home Buyers

- Provide an avenue for quick liquidation of inherited assets

- Offer cash purchases, facilitating a fast house selling process

- Some operate under ‘as is’ conditions, reducing need for costly repairs

Informed decision-making in this area involves carefully weighing these options against personal financial status and future plans. For instance, if there are no immediate needs for large sums of money or if there’s a desire to hold onto the property longer term due to its potential value increase over time, then borrowing from traditional lenders might be more suitable. On the other hand, should urgent liquidity be required without wanting to deal with long-term obligations and paperwork associated with banks, turning to fast home buyers could pave way for a more efficient solution.

Looking ahead at considerations and risks will provide further guidance as one navigates through this potentially complex process. It’s essential to examine how different decisions can impact financial health in both short-term scenarios such as immediate debt repayment needs – as well as long-term situations like retirement planning or investment opportunities. This careful contemplation ensures that all angles have been fully considered before moving forward in borrowing against inherited property.

Considerations and Risks

Having explored the various repayment options available when borrowing against an inherited property, it is necessary to shift focus towards comprehending the considerations and potential risks associated with this financial decision. This understanding is pivotal as it shapes one’s knowledge around how to navigate through such a complicated situation intelligently.

Delving into the heart of this matter, one must recognize that there are numerous factors that should be taken into consideration before deciding to borrow against an inherited property. These may include assessing market conditions for a potential inherited property sale, understanding your creditworthiness and debt-to-income ratio, evaluating interest rates on loans, considering tax implications and legal fees among others. It is also important to bear in mind that even though you might be entitled to the property due to inheritance laws, there may still exist certain outstanding debts or liens against it. Hence, thorough research coupled with professional advice can aid in making informed decisions.

Furthermore, taking out a loan against an inherited property comes with its own set of risks – foreclosure being chief among them. Should circumstances arise where repayment becomes challenging; lenders have the right to claim the house and sell it off in order to recover their money – a scenario which could potentially leave individuals without a roof over their head or any financial fallback from the sale of said asset. Therefore, while borrowing against an inherited property might seem like an attractive option at first glance; upon closer inspection via blog title keywords and other resources available online or offline ,it becomes clear that caution must be exercised during every step of this process.

Frequently Asked Questions

Can I borrow against an inherited property before probate is complete?

Generally, obtaining a loan against an inherited property prior to the completion of probate proceedings is not feasible. Lenders usually require clear title, which is typically established only after the probate process concludes.

How does borrowing against an inherited property impact my credit score?

Borrowing against an inherited property impacts credit scores similarly to other types of loans. Timely repayments enhance creditworthiness, whereas missed payments can lead to a lower score, reflecting negatively on the borrower’s financial reliability.

What happens if I default on a loan against an inherited property?

Defaulting on any loan, including one against inherited property, can result in severe consequences. The lender may seize the property to recover their losses and it could negatively impact your credit score for several years.

Can I use the loan from my inherited property for personal expenses?

Yes, funds acquired through a loan on an inherited property can be utilized for personal expenses. However, it is essential to consider the implications of potential interest rates and repayment conditions before proceeding.

Are there any tax implications when borrowing against an inherited property?

Tax implications can indeed arise when leveraging inherited property for a loan. The loan itself is not taxable, but potential capital gains tax could accrue if the property appreciates in value over your cost basis.