In the vast landscape of real estate, two distinct paths diverge from a common origin – that of cash buying and mortgage buying. These trails, worn down by countless footprints, each lead to the same destination: property ownership. Yet the journey along either route varies vastly in experience and implications. This divergence prompts an exploration into the distinctive contours and potential pitfalls each path possesses, offering a comprehensive understanding of their unique advantages and disadvantages.

The forthcoming discourse seeks to elucidate these differences by delving into aspects such as the buying process, financial ramifications, and overall impact on the real estate market. It is intended not just to inform but also empower readers with knowledge that could shape their decision-making process when traversing this terrain. By dissecting both strategies under a scholarly lens, it aims to provide an impartial perspective that will enable individuals – be they first-time homebuyers or seasoned investors – to choose wisely between these two avenues towards property acquisition.

Understanding the Differences

Understanding the differences between cash buyers and mortgage buyers is vital in real estate transactions, much like knowing the difference between two sides of the same coin, as it dramatically influences both the negotiation power and speed of sale. Cash buyers, often referred to as cash home buyers, are individuals or entities who purchase properties outright with their own funds. This means they do not rely on lenders or financial institutions for loans or mortgages to finance their property purchases. On the other hand, mortgage buyers, also known as conventional mortgage buyers, require a loan from a bank or other lending institution to acquire a property.

The processes followed by these two types of purchasers differ substantially due largely to their funding methods. Cash home buyers typically have an easier time closing deals because they don’t need approval from any third party lenders; this can result in quicker transaction times and less red tape overall. Mortgage buyers keywords include credit checks, down payments, interest rates – all factors that come into play when securing a loan from a financial institution. The process can be lengthy and requires detailed scrutiny of the buyer’s financial history and current status.

Understanding these differences allows one to see why sell my house fast Fort Worth cash transactions may hold certain advantages over financed ones – particularly in competitive markets where sellers might favor quick sales without contingencies tied to financing approvals. It also sheds light on why some individuals opt for traditional mortgages despite potential complexities – such as being able to leverage large amounts of capital while maintaining liquidity for other investments or expenses. One must then weigh these considerations against each another when deciding which route best suits specific investment goals and constraints. In terms of immediate payment benefits—another crucial aspect within real estate dealings—it is important to delve deeper into what each method offers.

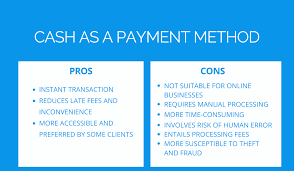

Benefits of Immediate Payment

Immediate settlement offers tremendous advantages, such as the potential for a reduced purchase price due to the seller’s appreciation of swift transactions, eliminating the uncertainty and stress associated with lengthy finance approval processes. For those who wish to “sell my house fast,”this can be an attractive option. It can also eliminate many of the traditional hurdles associated with selling property, including home inspections and appraisals. By offering quick cash for houses, immediate payment buyers provide sellers with a level of certainty that is often absent in more traditional real estate transactions.

Some key benefits of immediate payment include:

- Swift transaction: The process moves faster compared to mortgage-based purchases which require time for loan approval.

- Reduced stress: The need for continuous communication with lenders and fear of loan disapproval is eliminated.

- Flexibility in closing date: Sellers have the freedom to choose a convenient date since there are no bank regulations involved.

- Fast cash property sale: Sellers receive instant payment without having to wait weeks or months for financial processing.

- No repair costs: Immediate cash offer buyers typically buy properties ‘as is,’ thus saving sellers from costly repairs.

With an instant cash home sale, sellers gain control over their sell my house fast Texas selling timeline, allowing them to move forward quickly without waiting on banks or other lending institutions. This can be particularly beneficial when timing is essential such as during relocations or when dealing with financial hardships. Yet while these benefits are substantial, it’s crucial not to overlook possible drawbacks attached to this method of transaction. As we delve further into this topic in our subsequent section discussing ‘downsides of immediate payment‘, one will discover that what may seem like an easy solution initially might possess hidden complications that warrant careful consideration before proceeding.

Downsides of Immediate Payment

While the benefits of instant transactions are undeniable, it is equally important to consider the potential drawbacks associated with such deals. Notably, a speedy property sale can lead to lower profit margins. Since cash buyers often look for bargains and quick resolutions, sellers may find themselves accepting offers that are significantly less than their original asking price or market value to secure a swift home selling process. This scenario is particularly prevalent in turbulent real estate markets where homeowners may be pressured into rapid house transactions.

Furthermore, cash sales might limit the competition around a property. Generally speaking, when prospective buyers must secure mortgages before purchasing a home, there’s an inherent delay that allows more time for multiple bids to come in. The prospect of a quick house sale can deter other interested parties who cannot match the immediacy provided by cash buyers. Consequently, this could potentially further depress the final sale price if only a limited number of bidders present serious offers.

Moreover, a significant disadvantage revolves around financial flexibility and investment opportunities missed by choosing immediate payment over long-term mortgage plans. Cash transactions tie up substantial funds that could have been invested elsewhere for better returns over time. With interest rates on mortgages historically low in many parts of the world, financing purchases through loans rather than outright cash payments may prove more financially advantageous in certain circumstances. These considerations provide ample grounds for exploring the next section: advantages of loan purchase within real estate dealings.

Advantages of Loan Purchase

In the realm of real estate transactions, opting for a loan purchase presents numerous benefits, despite its seemingly complex nature. For instance, consider an individual who finances their property acquisition through a mortgage; this strategy allows them to retain liquid assets and invest in high-yield opportunities such as stock markets or business ventures that could potentially outperform their interest rates—an example that mirrors the classic fable of the tortoise winning against the hare, steadily accruing wealth over time rather than depleting resources hastily. This traditional home financing method enables buyers to leverage borrowed money to make substantial financial gains.

Furthermore, there are several aspects which enhance the appeal of a mortgage-backed property purchase:

- Mortgage-assisted home sales often involve lower upfront costs compared to cash purchases.

- Bank-financed home sales can help improve credit scores given consistent payment history.

- This type of transaction offers tax advantages as paid interest is often tax-deductible.

- In most cases, mortgages provide protection against inflation since payments remain constant even while rent prices may increase.

- A mortgage-backed real estate deal can bring about increased purchasing power due to leveraging.

These factors contribute significantly towards making mortgage-backed purchases an attractive option for many prospective buyers. It’s not just about securing a roof over one’s head – it’s also about financial stability and growth potential. With careful planning and prudent decision-making, leveraging debt via mortgages can actually serve as a strategic tool for expanding personal wealth.

However appealing these advantages might appear though, it would be remiss not to acknowledge that every coin has two sides. While mortgages offer certain economic benefits and financial flexibility, they also come with their own set of challenges and risks that need careful consideration—leading us into our next discussion on the disadvantages inherent in loan purchases.

Disadvantages of Loan Purchase

Despite the allure of loan purchases, it’s essential to delve into the potential drawbacks that accompany such financial commitments. One significant disadvantage pertains to the inevitable interest payments associated with mortgages. While these payments are spread over a considerable period, they can accumulate into a substantial sum and increase the overall cost of purchasing a property. Furthermore, acquiring a mortgage often involves additional expenses like appraisal fees and closing costs that aren’t typically incurred in cash transactions.

The table below provides an overview of how mortgage buyers might fare compared to their cash-buying counterparts in terms of general real estate selling keywords:

| General Real Estate Selling Keywords | Mortgage Buyers | Cash Buyers |

|---|---|---|

| Home Selling Strategies | Can be complex due to financing requirements | Simplified as no need for lender approval |

| Real Estate Transaction Process | Longer due to loan approval process | Quicker as there is no need for bank involvement |

| Effective Home Selling | Could face challenges from buyer’s loan disapproval | More certainty as finance isn’t an issue |

| Top Tips for Selling Property | Have pre-approved finance ready | Verify proof of funds upfront |

A further downside resides in the fact that mortgage buyers may find themselves at a competitive disadvantage during heated bidding wars or tight sellers’ markets. In these situations, sellers often prefer dealing with cash buyers who can facilitate quicker closings and offer greater transaction security. This means despite having effective home selling strategies; mortgage buyers may lose out on desirable properties because their offers come encumbered with contingencies related to financing.

Given this understanding, one must carefully evaluate both sides – benefits and potential downsides – when considering if obtaining a mortgage aligns with their individual needs, circumstances, and long-term financial strategy. As we transition into exploring ‘making the decision,’ it becomes crucial not just to understand but also appreciate how different buying methods can influence your overall experience within the real estate market.

Making the Decision

Statistics reveal that approximately 30% of residential real estate transactions in the United States are conducted using cash, suggesting a significant proportion of buyers prefer bypassing traditional financing methods. This may be due to several reasons, including the desire for a quicker transaction process and avoiding possible complications associated with mortgage applications. The choice between cash and mortgage purchase largely depends on an individual’s financial situation, investment goals, and risk tolerance.

The decision-making process can become less daunting by carefully weighing the pros and cons of both options. Some factors to consider include:

- Speed of transaction: Cash buyers often have the upper hand when it comes to fast home selling as they do not need to wait for loan approval.

- Financial security: Mortgage buyers might feel more secure knowing that their cash reserves are intact, providing them with a safety net during unforeseen circumstances.

- Property value: Cash buyers have more negotiating power which could potentially lead to a lower purchase price thereby maximizing house value.

- Risk factor: While mortgages come with interest rates and potential foreclosure risks, cash purchases tie up liquidity that could otherwise be invested elsewhere.

Selecting whether to buy with cash or take out a mortgage is no small feat; it involves careful consideration of numerous factors. Both routes offer distinct advantages depending on one’s financial capabilities, appetite for risk, and property selling tips at hand. Regardless of the chosen path, ensuring an informed decision is paramount to achieving desired housing goals while safeguarding financial health. As we delve into final thoughts on this topic in the next section, further reflection on these points will prove beneficial in making this critical decision.

Final Thoughts

Weaving together the various threads of this discussion, it becomes evident that there is no one-size-fits-all answer to whether purchasing a property outright or securing a loan is the superior approach. The decision hinges on numerous factors including personal financial circumstances, market conditions, and long-term investment strategies. It has been highlighted that cash buyers possess certain advantages such as increased bargaining power and faster transaction times, potentially facilitating a smoother purchase process. Conversely, mortgage buyers may benefit from leveraging their investment; they can acquire assets without tying up substantial amounts of liquid capital.

The nuances of both approaches underscore the need for careful consideration in order to make an informed choice. For instance, although cash buying may offer the allure of immediate ownership and reduced costs over time due to absence of interest payments, it also entails significant upfront expenditure which could limit liquidity and flexibility for other investments. On the other hand, while mortgages might require smaller initial outlays and provide opportunities for tax deductions on interest payments, they also involve long term commitments with potential risks associated with fluctuating interest rates.

In light of these complexities inherent in both methods of property acquisition, it underscores the significance of conducting thorough research coupled with seeking professional advice before making any final decisions. This course of action enables individuals to weigh each option critically against their specific financial objectives and risk tolerance levels. Thus resulting in an optimised strategy that aligns with both present needs and future goals without compromising overall financial health or stability.

Frequently Asked Questions

How long does the process of purchasing a property typically take for cash buyers compared to mortgage buyers?

The duration of property acquisition varies significantly between cash and mortgage buyers. Cash transactions may be completed within a few days, while mortgage purchases typically require 30 to 45 days due to loan approval processes.

What are the potential tax implications for cash buyers and mortgage buyers?

Potential tax implications vary. Cash buyers may lack the mortgage interest deduction benefit, while mortgage buyers often qualify for this deduction. However, both can take advantage of property tax deductions where applicable.

Are there any specific legal considerations or complications that may arise for cash buyers or mortgage buyers?

Legal complexities can emerge for both cash and mortgage purchasers. Cash buyers might face scrutiny regarding source of funds, while mortgage buyers could encounter issues with lien priority or foreclosure proceedings.

How do the trends in the real estate market impact the decision between cash purchase and mortgage purchase?

Trends in the real estate market significantly influence the decision between cash and mortgage purchases. Rising prices may encourage mortgage purchases, while stable or declining markets might favor cash transactions due to simplicity and negotiation advantages.

Can cash buyers and mortgage buyers negotiate prices differently with sellers?

Indeed, negotiation strategies can differ between cash and mortgage buyers. Cash buyers often have more bargaining power due to the absence of financing contingencies, potentially enabling them to negotiate lower prices with sellers.