In the fast-paced world of real estate, all-cash offers are often viewed as a golden ticket to transaction success. The allure of immediate liquidity, coupled with the absence of contingencies tied to financing or appraisal, positions these deals as highly appealing for sellers. However, it is crucial that one does not overlook the possibility of such transactions falling through.

Diving into this intriguing subject matter, the forthcoming exploration seeks to demystify the circumstances under which an all-cash offer might collapse. It will provide a comprehensive understanding of cash purchases and present the pros and cons associated with them. Not only will this exploration delve into potential deal breakdown scenarios, but it will also equip readers with strategies for preventing failed transactions and recovering from them if they occur. In doing so, it aims to empower stakeholders in real estate—buyers, sellers, or professionals—with knowledge and practical insights on how to navigate these situations effectively.

Understanding Cash Purchases

While cash purchases are generally seen as more reliable, it is important to note that even these cash offers can fall through, with a study revealing that nearly 4% of all-cash deals collapse before completion. The reliability of cash offers hinges on various factors such as the buyer’s financial solvency and the accuracy of their financial disclosures. Moreover, while the all-cash offer success rate is generally high compared to financed deals, there are instances where even well-prepared buyers face obstacles in finalizing transactions.

The risks associated with cash offers may include issues related to sell my house fast Fort Worth property title or inspection findings that lead the buyer to back out. It is also possible for an all-cash deal to fall apart due to unforeseen personal circumstances affecting the buyer’s liquidity. These challenges pose significant implications for both sellers and buyers when evaluating all-cash offers. Sellers must scrutinize proof of funds thoroughly while buyers need to ensure they have buffer funds set aside should unexpected costs arise.

Understanding these potential pitfalls enhances one’s ability in determining whether an all-cash deal presents more advantages than disadvantages. Thoroughly understanding these complexities not only aids in making informed decisions but also assists participants in structuring transactions most beneficially. While each transaction carries its unique set of challenges with all-cash deals, being prepared helps mitigate potential risks effectively. Armed with this knowledge, we can now delve into exploring the benefits that accompany cash transactions within property sales.

Benefits of Cash Transactions

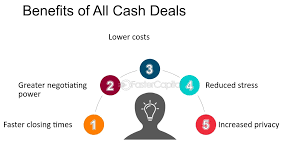

Undeniably, transactions conducted in liquid assets present numerous advantages, such as expedited closings and reduced risk of loan denial, ultimately providing a sense of security and peace for both parties involved. Cash offers are often more attractive to sellers as they typically involve fewer contingencies and can close much faster than traditional financed deals. The absence of financing also eliminates the risk associated with loan approval, which is one of the leading causes for deals falling through. Consequently, this expedites the entire transaction process by bypassing bank appraisals and lender-required repairs that can lengthen closing timelines.

Moreover, a cash transaction provides an edge in a competitive market by standing out amongst multiple offers due to its perceived certainty and speed. However, it is essential to be aware of potential cash offer pitfalls during these transactions. These may include factors affecting cash offer sell my house fast Texas completion such as issues related to clear title or property inspection concerns that could impact the deal’s success rate. Although these challenges exist, ensuring a secure cash transaction is achievable by conducting thorough due diligence before proceeding with any arrangement.

The allure of securing a successful cash home sale without facing closing issues with cash offers can be quite enticing for most homeowners. Nevertheless, it is crucial to remember that every transaction carries inherent risks regardless of how the purchase is financed. As we delve deeper into this subject matter in the following section, an understanding will be gained on how these associated risks can influence both buyers’ and sellers’ decisions within real estate transactions involving liquid assets.

Risks Involved

In the realm of real estate transactions, certain risks are associated with cash offers that can affect their completion, despite the numerous advantages they present. For instance, while a quick property sale is often the perceived benefit of an all-cash offer, it might not always be guaranteed. The buyer’s ability to produce the promised funds at closing is one such risk. Failure to do so can result in an immediate home sale falling through and can disappoint sellers who were banking on a speedy real estate transaction.

Another potential risk pertains to market volatility. Although an efficient property sale seems attractive due to the absence of loan approval processes, sudden changes in property valuation may leave sellers at a disadvantage if they accept a lower cash offer prematurely. Moreover, there’s also the issue of due diligence – buyers making an all-cash offer could potentially bypass important inspection contingencies which might lead to post-sale disputes or legal complications.

A third concern revolves around documentation and proof of funds. An expedited house selling process might overlook thorough verification of buyer’s financial capabilities leading to unexpected delays or even deal termination if insufficient funds are established later on. These factors highlight how critical it is for both buyers and sellers involved in a cash transaction to understand these inherent risks thoroughly before proceeding with any agreement. This understanding would lay down a foundation for exploring various deal breakdown scenarios in subsequent discussions within this topic.

Deal Breakdown Scenarios

Exploring potential scenarios of deal breakdowns in real estate transactions involving full payment upfront, it is essential to consider a variety of factors that could potentially derail such agreements. For example, unexpected issues may arise during the process that might hinder a fast home selling. Such issues can range from structural problems discovered during an inspection to sudden changes in buyer’s financial circumstances. Furthermore, delays or discrepancies in paperwork or legalities can also interfere with a speedy house sale, despite being an all-cash offer.

In the context of these complications, there are three key scenarios where deals predominantly break down: unforeseen property defects, legal complications and buyer’s change of heart. Unforeseen property defects usually come into light during inspections and can significantly delay a rapid property transaction if not addressed promptly. Legal complications refer to any issue related to the legality of the property or its paperwork which can halt even a swift home selling process until resolved. Lastly, though rare with cash buyers who often are committed investors or developers, there is still possibility for them changing their mind due to various reasons like finding better opportunities elsewhere.

| Deal Breakdown Scenario | Description |

|---|---|

| Unforeseen Property Defects | Structural problems discovered during inspection that leads to delays |

| Legal Complications | Issues related to legality of the property or paperwork |

| Buyer’s Change of Heart | Cash buyers backing out due to personal reasons or finding better investment opportunities |

Without stating “In conclusion”, it becomes apparent that successfully navigating through these potential hurdles is crucial when one needs to sell my house quickly. While all-cash offers do have a higher chance of closing swiftly without many typical financing-related holdups seen in traditional sales; it does not make them immune from some common deal-breaking scenarios as discussed above. This understanding serves as an important precursor towards developing strategies for preventing failed transactions in real estate dealings involving cash payments upfront.

Preventing Failed Transactions

Strategizing to avoid botched real estate transactions, especially those involving full payment upfront, demands a comprehensive understanding of potential pitfalls and the development of corresponding preventative measures. In-depth scrutiny of the buyer’s financial capacity is an integral step in this process. Ensuring that they can genuinely afford an all-cash offer reduces the risk of transaction failure significantly. This could involve requesting proof of funds in advance before sealing any agreement. Additionally, understanding keywords for ‘do all cash offers ever fall through’ can help property sellers identify red flags early enough to mitigate potential losses.

Transaction collapse prevention isn’t limited to financial security checks; it also encompasses strategic communication and transparency between both parties involved. Open dialogue concerning expectations, timelines and contingencies allows for smoother proceedings without unwarranted surprises that could derail deals at any stage. Another measure includes hiring professional real estate agents or attorneys experienced in handling all-cash transactions. These professionals can add layers of protection by ensuring legalities are met, contracts are enforceable, and terms agreed upon are adhered to.

While prevention is better than cure when it comes to failed real estate deals, there might still be instances where deals fall through despite best efforts. It’s essential not just knowing about ‘do all cash offers ever fall through’, but also being prepared with remedial measures when such situations arise. The next section navigates this less trodden path: how one recovers from failed deals while maintaining their position in the competitive real estate market.

Recovering from Failed Deals

Recovering from failed transactions necessitates resilience and strategic planning, despite the initial shock such occurrences might bring to property sellers. The disappointment of an all-cash offer falling through can be overwhelming, but there are ways to bounce back and learn from these experiences. Not only does this process require a reevaluation of the marketing strategy used for the property, but it also calls for a thorough understanding of why the deal fell through in the first place.

- Why did the deal fall apart?

- Was it due to issues discovered during inspection?

- Or was there a change in buyer’s financial circumstances?

- What can be done differently moving forward?

- Would professional staging or high-quality photos make the property more appealing?

- Should you consider working with a real estate agent if you haven’t already?

By addressing these questions, sellers can augment their approach towards future transactions. This not only arms them with crucial knowledge about potential pitfalls but also enhances their ability to navigate complex real estate dynamics effectively. Moreover, engaging in systematic analysis fosters confidence among sellers as they become better equipped to handle uncertainties tied to prospective deals.

The journey of recovery from failed deals is indeed challenging yet enlightening. It provides opportunities for self-improvement and growth that ultimately lead to success in future transactions. By embracing such lessons wholeheartedly, sellers gradually transform their setbacks into stepping stones towards achieving their objectives. The insights gleaned henceforth serve as guiding principles for upcoming negotiations and dealings within the realm of real estate transactions, setting up a seamless segue into discussing best practices that further fortify chances of successful sales without resorting to explicit steps or procedures.

Best Practices

Implementing best practices in real estate transactions can greatly enhance the likelihood of successful deals, mitigating the risk of potential fallbacks. One such practice involves thorough due diligence on all parties involved. This includes vetting cash buyers to ensure they have sufficient funds available and are not likely to face any legal or financial obstacles that could prevent them from fulfilling their obligations under the contract. Similarly, performing a comprehensive review of the property at hand is also essential to uncover any potential issues that could cause complications down the line.

Another critical best practice revolves around clear and open communication between all stakeholders, including sellers, buyers, and agents. Regular updates regarding progress in various stages of the transaction can help preemptively resolve misunderstandings or conflicts that might arise during negotiations or closing processes. Furthermore, it’s crucial to establish a realistic timeline for completion – this should take into account any necessary inspections or other additional steps specific to cash transactions.

Negotiation techniques also form an integral part of best practices within real estate transactions. An effective negotiation strategy not only ensures fair pricing but also sets expectations correctly for both parties involved. It encompasses agreement on important elements like closing costs and potential repairs or improvements needed on the property ahead of finalizing the deal. By adhering strictly to these best practices, stakeholders increase their chances significantly in avoiding failed all-cash offers, thus promoting smoother transactions with minimized risks.

Frequently Asked Questions

What are the tax implications of an all-cash property deal?

In an all-cash property transaction, considerations include potential capital gains tax on future sale profits, possible deductible mortgage interest absence, and potential property tax implications. Comprehensive consultation with a tax professional is highly recommended.

How does an all-cash offer impact future property resale value?

An all-cash offer, while eliminating financing uncertainties, does not inherently impact future property resale value. Resale value is primarily driven by market conditions, property condition and improvements, and neighborhood trends at the time of sale.

Can using all-cash offer for a property affect my credit score?

Utilizing all-cash offers for property acquisition does not have a direct impact on one’s credit score. This is because such transactions do not involve borrowing, hence, are invisible to credit rating agencies.

How does an all-cash property purchase influence estate planning?

An all-cash property purchase can significantly influence estate planning. It may enhance the value of one’s estate, potentially raising tax liabilities. However, it also simplifies asset management and provides increased control over estate distribution.

Are there any restrictions or regulations on making all-cash offers for international buyers?

Navigating the landscape of international real estate, all-cash offers may encounter certain constraints. These regulations vary by country, often dependent on local property laws and foreign investment rules, requiring mastery in global real estate affairs.

Other Articles You Might Enjoy

Do Empty Houses Take Longer To Sell