In the labyrinth of inheritance laws, navigating through its intricate corners and winding paths can often feel like deciphering a complex enigma. The question that frequently arises in such circumstances is – what happens when a grandchild’s parent passes away before the grandparent does? This scenario presents an array of legal complexities which demand meticulous exploration.

This article embarks on a quest to demystify those complexities, providing clarity on the mechanisms of inheritance laws as they pertain to grandchildren. It delves into pertinent topics such as distribution of estate, role of wills, predeceased beneficiaries, intestate succession and inheritance rights of grandchildren. Furthermore, it aims to provide insights into obtaining legal assistance and support in these matters. With this knowledge at hand, readers will be equipped with valuable tools to navigate their own personal labyrinths and gain mastery over the seemingly complex world of inheritance law.

Understanding Inheritance Laws

Inheritance laws, varying greatly among jurisdictions, often dictate the distribution of a deceased person’s estate, and in certain circumstances, may stipulate that grandchildren inherit their parent’s share if their parent predeceases the grandparent. These laws are complex and depend on numerous factors such as domicile state or country of the decedent, existence of a will or trust, marital status at death, number and relation of surviving family members among others. One aspect is parental inheritance which refers to property rights passed down from parents to children. In some jurisdictions this can extend to grandchildren particularly when dealing with deceased parents’ assets.

Inherited property rights come into play when discussing sell my house fast Fort Worth real estate inheritance. Real estate properties form an integral part of most estates and their distribution can be a potentially contentious issue within families. The process for dealing with deceased parents’ assets like real estate typically begins with assessing value followed by paying off any debts against the property before it can be distributed as per legal guidelines or provisions in a will. It is important to note that many jurisdictions have laws protecting spouses and minor children by providing them certain entitlements in an estate regardless of what a will may stipulate.

The complexity surrounding these issues underlines the importance of understanding how each jurisdiction treats matters related to inheritance and more specifically parental inheritance rights. This comprehension aids individuals in making informed decisions about their own estates or those they might inherit while also being prepared for potential challenges that may arise during estate distribution process. Having delved into how inheritance laws function broadly, we now turn our attention towards specifics concerning distribution of an estate when it involves possible claims by grandchildren due to predeceased parents.

Distribution of Estate

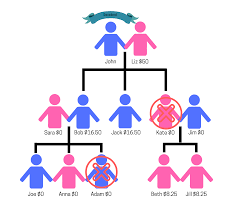

The distribution of an estate often follows a pathway designed by nature, cascading down the family tree like a waterfall, where assets typically flow to offspring before reaching subsequent generations. This process, which involves the deceased parent’s estate being passed on to their heirs, is governed by laws and regulations that vary across different jurisdictions. It encompasses many aspects such as inheritance and real estate acquisition, property transfer after death along with the consequential real estate inheritance taxes.

When it comes to planning for property inheritance, several factors come into play. For instance, if the deceased had a will or testamentary trust in place prior to their demise – this would dictate how their property is divided amongst heirs. Without these legal documents though; intestacy laws kick in which usually favor spouses and children over grandchildren. However, in some cases where an individual’s child (parent of grandchild) predeceases them; grandchildren may indeed inherit their parents’ portion. Nevertheless, it’s important to note that each case is unique and subject to varied jurisdictional laws.

Real Estate Inheritance Taxes are another critical component of sell my house fast Texas estate distribution. These can significantly affect what beneficiaries receive from the inherited properties and depend on several factors such as location of the asset and relationship between decedent & beneficiary among others. Understanding these dynamics plays a key role in ensuring smooth transition of properties after death while minimizing tax liabilities. As we delve deeper into this topic, understanding the role of wills becomes increasingly vital due to its influence on dictating terms regarding distribution of assets post-mortem.

Role of Wills

Primarily serving as a roadmap for distribution of a deceased individual’s assets, wills play an instrumental role in determining who gets what and when. When considering estate planning for real estate, the will becomes even more crucial as it can stipulate specific arrangements for inheriting real estate or passing down family property. This legal document essentially outlines the deceased’s wishes regarding how their properties should be distributed amongst surviving beneficiaries and can significantly influence whether grandchildren would inherit their parent’s portion if said parent is deceased.

Beyond merely designating recipients of an estate, wills also contain details pertinent to probate and property sales. The probate process involves validating the will, paying off any debts or taxes owed by the decedent, and distributing remaining assets according to the provisions of the validated will. In many jurisdictions, if a beneficiary named in a person’s will predeceases them, that beneficiary’s share may go through probate before being passed on to their heirs such as grandchildren. However, this scenario can often be avoided with effective real estate in estate planning that includes contingency plans.

While drafting a will is vital in safeguarding one’s intent concerning asset distribution after death,it does not eliminate all complexities surrounding inheritance issues particularly if there are predeceased beneficiaries involved. These circumstances underscore further need for thorough and expertly guided estate planning strategies that consider all possible eventualities including those related to real estate holdings. It sets the stage for discussing predeceased beneficiaries which adds another layer of complexity to inheritance laws and procedures.

Predeceased Beneficiaries

According to a survey conducted by the American Association of Retired Persons (AARP), intricacies surrounding predeceased beneficiaries constitute a significant portion of disputes in estate distribution, making it an essential aspect to address during estate planning. The complexity stems from determining who inherits when the designated beneficiary dies before or simultaneously as the testator, particularly regarding property inheritance. This scenario often warrants selling inherited property, with numerous considerations involved in the process of selling an inherited home.

- Understanding Legal Frameworks: Different jurisdictions have varying regulations concerning predeceased beneficiaries and how their inheritances are handled. It is pivotal to comprehend these legal nuances before deciding whether to sell an inherited house.

- Establishing Fair Market Value: Before selling inherited property, getting professional valuation is vital for setting realistic expectations and maximizing value when selling inherited property.

- Tax Implications: Inherited properties come with tax implications that could significantly impact net proceeds from the sale; hence it’s worth consulting tax professionals when navigating through this process.

The matter becomes even more convoluted if no will exists or if it doesn’t clearly stipulate what should happen under such circumstances. The absence of clear instructions leads to complications in administering estates, further complicating efforts toward maximizing value when selling inherited property or distributing other assets among surviving family members. However, there are established legal principles that help guide decision-making under these challenging circumstances.

Navigating through this maze necessitates adequate knowledge about estate laws and keen attention to detail while executing any actions related to a deceased person’s estate—like preparing for an inherited house sale tips—and understanding potential pitfalls. A well-formulated plan ensures smooth transitions and minimizes disputes among beneficiaries, fostering harmonious relationships within families left behind after a loved one’s demise—particularly crucial where grandchildren stand to inherit their parents’ portion following their untimely death.

The complexities associated with predeceased beneficiaries underscore the importance of comprehensive estate planning—an area that will be further explored in the subsequent section focusing on ‘intestate succession’.

Intestate Succession

Intestate succession serves as a legal compass, guiding the distribution of assets when an individual dies without leaving a will, a circumstance that amplifies the emotional toll on surviving family members grappling with their loss. This process can present inherited property challenges, particularly regarding real estate. These difficulties often include managing inherited real estate, which might involve dealing with existing tenants or upkeep costs, and navigating the legal landscape around inheriting a house with a mortgage.

Moreover, intestate succession also outlines how passing down real estate to heirs shall occur. Without explicit instructions from a will or trust, laws default to favoring direct descendants such as children. However, in instances where these direct descendants are deceased or nonexistent, grandchildren may be next in line for inheritance under specific conditions outlined by local probate law. This system aims at securing family property for future generations and maintaining the financial stability of immediate family members after the death of their loved one.

While this practice may seem straightforward on paper, its execution is often complex and fraught with potential pitfalls. It involves not only understanding intestate laws but also navigating familial relationships and sentiments attached to inherited properties. The following section delves deeper into these complexities by focusing on the inheritance rights of grandchildren in situations where their parent or parents have predeceased them.

Inheritance Rights of Grandchildren

The rights of grandchildren to receive assets from their grandparents’ estate come into play under certain circumstances, such as when their own parents are no longer alive. This is where the concept of probate property sale enters the picture. When a person dies without a will (in intestacy), the process of distributing their assets begins with navigating the probate process. Here, a court determines how to distribute the deceased’s estate according to state laws. If a grandparent passes away and their child (the grandchild’s parent) has predeceased them, then in many jurisdictions, the grandchild can potentially inherit their parent’s share.

Inheritance through this channel often involves selling property in probate. The court-appointed administrator or executor may need to liquidate real estate assets to settle any outstanding debts of the estate before distribution among heirs. This situation introduces several complexities that necessitate careful planning and astute decision-making for smooth execution. These complexities can include determining fair market value prices for properties and finding potential buyers willing to purchase probate real estate; hence, helpful probate real estate tips could be invaluable under these circumstances.

Understanding and successfully traversing these processes can be daunting without adequate knowledge or experience – it is not merely about knowing one’s inheritance rights but also about comprehending legal jargon and procedures associated with inheriting an asset like real estate through probate. Legal complications may arise if there are multiple heirs involved or disputes over asset division occur amongst them; moreover, they must comply with specific timelines imposed by courts for various steps within this process. All these factors underline why seeking competent legal assistance and support becomes crucial in ensuring that grandchildren effectively receive what they are legally entitled to after losing both grandparents and parents.

Legal Assistance and Support

Navigating the labyrinthine maze of probate proceedings, particularly when it comes to real estate inheritance, demands an expert legal ally whose knowledge and experience can prove instrumental in ensuring a smooth transition of assets. Probate lawyers specialize in managing the legal intricacies that emerge when an individual passes away leaving behind property and other assets. They navigate through complex laws pertaining to wills, trusts, and estates while effectively dealing with complications such as outstanding debts or disputes among beneficiaries. This expert assistance becomes even more crucial when grandchildren stand to inherit their parent’s portion after their demise.

Legal support does not just offer advice on probate issues but also provides valuable guidance on tax implications related to inheritance. Taxes play a significant role in estates of considerable value, sometimes resulting in substantial amounts being owed. Legal professionals have extensive knowledge about state-specific inheritance tax laws which can greatly affect the total amount inherited by grandchildren. Furthermore, they are equipped to deal with any unforeseen circumstances that may arise during probate proceedings such as contested wills or claims by creditors.

Essentially, having proper legal assistance and support is vital for ensuring that rights are upheld and the deceased’s wishes are respected during the distribution of their assets. It ensures a fair division of property according to stipulations set out in the will or trust document while minimizing potential conflict among family members over the allocation of assets. However complex these procedures might be, enlisting professional help mitigates much of this complexity allowing beneficiaries including grandchildren to focus on healing rather than battling bureaucratic red tape during an emotionally trying time.

Frequently Asked Questions

How does tax law impact the inheritance of a deceased parent’s portion by grandchildren?

Tax law implications on inheritance vary, potentially affecting grandchildren receiving a deceased parent’s portion. Estate taxes might be levied, which could reduce the overall value of the inherited assets. Consultation with a tax expert is recommended.

Can a grandchild contest a will if they are not included in the inheritance?

In the hypothetical case of Jones v. Estate, a grandchild successfully contested a will. Eligibility for such contestation depends on jurisdictional laws; thus, grandchildren not included in a will may indeed challenge it legally.

What role does an executor or trustee play in the distribution of a deceased parent’s inheritance to grandchildren?

An executor or trustee holds a crucial role in inheritance distribution, managing estate affairs and ensuring adherence to the decedent’s wishes. They facilitate transfer of assets, potentially including a deceased parent’s inheritance to grandchildren.

How do inheritance laws differ from one jurisdiction to another?

Inheritance laws vary significantly across jurisdictions, influenced by local culture, societal norms and historical precedents. Differences range from the rights of surviving spouses to the treatment of illegitimate children and adopted heirs.

Can grandchildren be legally disinherited by their grandparents?

Inheritance law complexities can result in a scenario where grandchildren may be legally disinherited by their grandparents. The legal provision for this varies widely across different jurisdictions and is often contingent on specific circumstances.

Other Articles You Might Enjoy

Do Houses Sell Better In Summer Or Winter