Owning real estate in Fort Worth, like anywhere else, comes with the inevitable responsibility of property tax. To avoid any surprises when the tax bill arrives, it’s essential to have a comprehensive understanding of property tax, its purpose, and how it’s calculated. Let’s embark on a journey to unravel the complexities of the property tax system in Fort Worth, starting with the basics of what property tax is and how it’s computed in the city.

Concept and Purpose of Property Tax

Property tax is a compulsory levy imposed on property, usually real estate, that the owner is obligated to pay. The tax amount primarily hinges on the assessed value of the property and the applicable local tax rate.In the context of Fort Worth, like other local governments, property tax serves as a primary source of revenue to fund crucial public goods and services. These include education, road construction and upkeep, public safety, and amenities such as libraries and parks. The funds collected from property tax significantly contribute to the city’s budget, enhancing the quality of life for residents and supporting development and infrastructure projects. This understanding can provide property owners with a clearer picture of how their tax dollars are utilized.

Guide property tax Fort Worth is worth noting that tax rates can fluctuate based on various factors, including the financial requirements of the taxing entities like the city, county, and school districts. These tax rates are typically determined on an annual basis.

The property tax system is designed to promote fairness, ensuring that owners of similar properties pay comparable taxes. However, given the unique characteristics of each sell my house fast Fort Worth property, achieving a fair valuation can be challenging. To address this, the city conducts regular assessments to maintain accurate and equitable property valuations.

Stay tuned as we delve deeper into the calculation of property tax in Fort Worth in the following section.

Calculating Property Tax in Fort Worth

The process of calculating property tax in Fort Worth may initially appear daunting, but it becomes simpler once you grasp the key components: the property’s assessed value and the tax rate.

Each year, the city of Fort Worth, Tarrant County, and the applicable school district set their respective tax rates. These rates are expressed per $100 of property value. For example, if a tax rate is $0.75 per $100, and your property is valued at $200,000, your tax obligation to that entity would be $1,500 (2000 * $0.75).

The Tarrant Appraisal District (TAD) is responsible for determining the assessed value of your property, which is essentially its market value – the estimated price it would fetch in a standard sale.

The calculation becomes slightly more intricate when exemptions come into play. If you’re eligible for a sell my house fast Texas property tax exemption, such as a homestead exemption, the exemption amount is subtracted from the assessed value before taxes are computed. For instance, if your $200,000 home has a $20,000 homestead exemption, you’d be taxed as if your home was worth $180,000.

While the calculation may seem straightforward, it’s crucial to account for any changes in the tax rate or property valuation each year. We’ll delve deeper into the assessment process and its impact on your tax bill in the following sections.

The Property Tax Assessment Process in Fort Worth

The property tax assessment process in Fort Worth plays a pivotal role in determining your property tax obligations. This process is managed by the Tarrant Appraisal District (TAD), an autonomous governmental body tasked with identifying, listing, and appraising all real estate within Tarrant County, where Fort Worth is situated.

Properties are assessed annually based on their market value, which is an estimate of the price the property would command under standard market conditions as of January 1st of the assessment year. The assessment takes into account various factors including location, lot size, improvements, and recent sales of comparable properties in the vicinity.

The TAD also manages any exemptions you may be eligible for, which can significantly lower the taxable value of your property and, consequently, your total tax liability.

The results of this assessment process are communicated to property owners through an annual assessment notice. In the subsequent sections, we’ll guide you through understanding your assessment notice and the steps to take if you wish to contest the assessment.

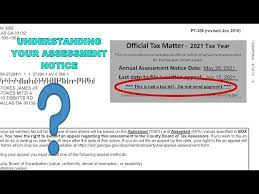

Understanding Your Assessment Notice

Upon the completion of your property’s valuation by the Tarrant Appraisal District (TAD), you’ll be issued an Assessment Notice. This document is a vital piece of information, detailing your property’s appraised value, listing any exemptions you may qualify for, and offering a preliminary estimate of your tax liability.

The cornerstone of the assessment notice is the appraised value of your property. This figure represents your property’s estimated market value as of January 1st of the assessment year. It’s important to note that this value directly influences your property tax bill.

Exemptions, if you’ve applied for any, should be carefully reviewed. For instance, if you’ve applied for the Homestead exemption, it should be accurately reflected in your notice. These exemptions can significantly reduce your property’s taxable value, thereby lowering your overall tax obligation.

The preliminary estimate of your tax liability is calculated by deducting any exemptions from the appraised value and then multiplying the result by the previous year’s tax rates. This figure is an estimate; the final amount will only be determined once the current year’s tax rates are set by the various taxing entities.

Lastly, the assessment notice provides a deadline for filing a protest if you disagree with the valuation. If you believe your property’s assessed value is unjust or inaccurate, you have the right to challenge it. The following section will guide you through the process of challenging your assessment in Fort Worth.

Challenging an Assessment in Fort Worth

If you find the assessed value of your property, as stated in your Assessment Notice, to be excessive, you are entitled to contest or appeal the assessment valuation. This right is particularly crucial when an erroneous assessment could lead to an inflated property tax bill.

To contest an assessment, a formal protest must be lodged with the Tarrant Appraisal District (TAD). This can be done by completing a Notice of Protest form, which can be found on TAD’s website. This form must be either postmarked or hand-delivered by the deadline specified in your Assessment Notice — usually by May 15th.

Compelling evidence is key to a successful challenge. Recent sales data of similar properties in your area that have lower values can be a persuasive piece of evidence. Other supporting documents such as photographs, contractor estimates, or any other evidence that could demonstrate your property’s market value is lower than the assessed value can also be beneficial.

Upon submission, your protest will be evaluated, and you’ll be invited to an informal meeting with a TAD appraiser to discuss your concerns. If no agreement is reached at this stage, a formal hearing with the Appraisal Review Board will follow.

Keep in mind, being well-prepared and knowledgeable about your rights when contesting your property assessment can potentially save you a significant amount of money on your property tax bill.

Paying Property Taxes in Fort Worth

Navigating the property tax landscape in Fort Worth is a multi-step journey. Once you’ve received your assessment notice, the next pivotal phase is ensuring timely payment. This process encompasses several important elements, such as familiarizing yourself with the payment deadlines, exploring the various payment methods, and understanding the potential consequences of late payment.

In the city of Fort Worth, property tax bills typically arrive in October and are due by January 31 of the subsequent year. It’s essential to adhere to this deadline to avoid penalties and accruing interest.

Fort Worth offers several avenues for property tax payment, including online transactions, mail-in payments, or in-person payments at the Tarrant County Tax Office. Each method has its unique benefits and drawbacks, which we’ll explore further in the following sections.

Delaying property tax payments can have serious repercussions, extending beyond financial penalties. Legal consequences, such as tax liens, can even lead to foreclosure in severe cases.

Let’s delve deeper into these topics in the sections that follow, to provide you with a thorough understanding of the property tax payment process in Fort Worth.

Deadlines and Payment Methods

Being aware of your property tax deadlines is a crucial step in avoiding unnecessary late fees and penalties. In Fort Worth, property taxes become due upon receipt of the bill and are considered delinquent if not paid by February 1st of the year following the tax imposition.

For example, if your property tax bill arrives in October 2022, the payment becomes due immediately and will be deemed delinquent if not paid by February 1, 2023. Avoiding these deadlines can lead to rapidly accruing penalties.

When it comes to payment methods, the Tarrant County Tax Office offers several convenient options:

- Online: The Tarrant County Tax Office’s website allows payments via credit cards, debit cards, or electronic checks. Be aware that card payments may incur a small processing fee.

- By Mail: You can send your payment along with the tax statement to the Tax Office. Be sure to postmark your payment by the deadline to avoid late fees.

- In-Person: You also have the option to visit the Tax Office in person and pay via check, cash, credit or debit card.

It’s advisable to retain proof of payment as it could be beneficial in case of any discrepancies.

In the upcoming section, we’ll delve into the ramifications of late payment, underscoring the importance of adhering to these deadlines and payment methods.

Consequences of Late Payment

Neglecting to pay your property tax in Fort Worth by the stipulated deadline of February 1st can lead to a cascade of financial and legal repercussions. Initially, a delinquency charge is imposed on the unpaid tax, commencing with a 6% penalty and an additional 1% interest in February. This penalty incrementally increases by 1% each month, potentially culminating in a 12% penalty and 7% interest by July.

If the tax remains unpaid by July 1, Tarrant County typically enlists the services of attorneys to collect the delinquent accounts, adding an extra 20% attorney fee to your financial obligations.

The consequences of continued nonpayment can escalate to the imposition of a tax lien on your property, essentially granting the government ownership rights until the debt is cleared. In the most severe cases, the county may resort to foreclosing your property to recoup the unpaid taxes.

To circumvent these dire consequences, it’s crucial to settle your property taxes promptly or contact the Tarrant County Tax Office if you foresee difficulties in meeting the payment deadline. In the subsequent sections, we will explore the various property tax assistance options available to you.

Property Tax Assistance in Fort Worth

Navigating the intricacies of property taxes can be daunting, particularly when grappling with financial constraints. The good news is that Fort Worth offers a range of assistance options to help property owners manage their tax obligations. These include engaging a property tax consultant and availing of tax relief programs.

A property tax consultant can alleviate the stress of dealing with the complex tax system. They can guide you through the labyrinth of calculations, exemptions, assessments, and even disputes. Regardless of whether you’re an experienced property owner or a novice homebuyer, hiring a consultant can be a prudent investment to ensure your property taxes are accurate and affordable.

On the other hand, property tax relief programs provide financial aid to reduce the amount of property tax you owe. These programs are primarily aimed at homeowners who are most in need, such as the elderly, veterans, and disabled individuals.

In the sections that follow, we will delve into these property tax assistance options in more detail, illuminating how they can benefit property owners in Fort Worth.

Working with a Property Tax Consultant

Engaging the services of a property tax consultant in Fort Worth can be a game-changer. These experts bring to the table a wealth of knowledge and experience in property tax matters. Here’s how they can be of service:

Review of Assessment: A property tax consultant meticulously examines your property assessment for any inaccuracies or inconsistencies that could unjustly increase your tax bill. They pay close attention to the property description, valuation, and comparables used by the county.

Analysis of Tax Bill: Beyond just reviewing your assessment, a tax consultant will analyze your entire tax bill. They will look for potential exemptions and pinpoint tax-saving opportunities that may not be apparent to the untrained eye.

Protest Filing: If your assessment contains discrepancies, a consultant can file an appeal on your behalf and represent you during the process, thereby enhancing your chances of a successful outcome.

Deciphering the Tax Code: The property tax code can be a labyrinth. A consultant will help you navigate it and make decisions that are most beneficial to your situation.

To locate a reputable property tax consultant, consider seeking recommendations from friends or real estate professionals, or look up online reviews. Opt for someone with a proven track record and a deep understanding of Fort Worth’s property tax system. A competent consultant will steer you in the right direction, saving you both time and money.

Finding Property Tax Relief Programs

Property tax relief programs can be a beacon of hope for property owners finding it difficult to pay their property taxes. Fort Worth offers a variety of tax relief measures to alleviate the tax burden for eligible individuals.

Homestead Exemptions: If your property is your primary residence, you may qualify for a homestead exemption. This exemption can significantly decrease the taxable value of your home, resulting in a lower tax bill.

Exemptions for Senior Citizens and Disabled Persons: Homeowners who are 65 years or older, or disabled, can apply for additional property tax relief. This reduces the taxable value of your home.

Exemptions for Veterans: Veterans with a 100% disability rating due to a service-related injury are eligible for a total exemption on their residence homestead.

Tax Deferral for Age 65 or Older or Disabled Homeowner: If you are aged 65 or older or disabled, you can defer or even suspend your property taxes for your residence homestead until you sell the property or pass away.

To apply for these exemptions, visit the Tarrant County Appraisal District’s website. There, you can access, complete, and submit the respective exemption forms to the county appraisal district. They can also provide any assistance or clarification you may need.

Remember, these programs are designed to assist you. Don’t hesitate to investigate, inquire, and explore your options. It could result in substantial savings on your property taxes in Fort Worth.

1. What is the current rate for property tax in Fort Worth?

The property tax rate in Fort Worth is established annually. In 2020, the rate for the fiscal year 2021 was set at 0.7475 per every $100 of assessed property value.

2. How does one apply for a homestead exemption in Fort Worth?

Homeowners can apply for a homestead exemption by completing a form provided by the Tarrant County Appraisal District. Submission of the form is due between January 1st and April 30th.

3. When are property taxes due in Fort Worth?

Property taxes in Fort Worth are due by January 31st of each year. After this date, late penalties and interest begin to accrue on the remaining unpaid tax balance.

4. How are properties assessed for property tax purposes in Fort Worth?

Properties are assessed by the Tarrant County Appraisal District. This entity utilizes property value data and review processes to determine comprehensive, fair market values of individual properties.

5. Is relief available for seniors or disabled persons regarding property tax in Fort Worth?

Yes, additional homestead exemptions are available for senior citizens aged 65 and older, as well as disabled persons. This often results in a lower taxable value of the property.

6. Can a property tax bill be protested in Fort Worth?

Yes, property owners can protest their tax bill if they feel the assessed value is too high or incorrect. The protest must be filed with the Tarrant County Appraisal District by May 15th of the taxing year.

Other Articles You Might Enjoy

Creative Ways Sell House Fort Worth