The process of buying or selling a property is punctuated by numerous crucial stages, one of which is the escrow stage. This stage serves as a safeguard for both buyers and sellers, ensuring that all terms are met before the transaction proceeds to completion. The duration of this process varies widely depending on several factors and understanding these variations can equip individuals with the necessary knowledge to navigate this phase more efficiently.

For potential homebuyers and sellers, gaining insight into how long escrow takes can significantly enhance their aptitude in handling real estate transactions. By exploring key steps involved, identifying potential areas of delay, and adopting strategies for increased efficiency, participants in this market can acquire mastery over this aspect of property exchange. This article aims to impart comprehensive knowledge about the timeline of escrow and offer actionable tips for its effective management.

Understanding Escrow

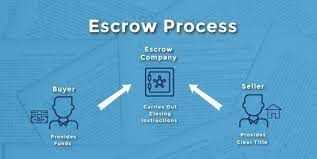

In order to comprehend the duration of escrow, a thorough understanding of its underlying concept and process is indispensable. Escrow refers to a financial agreement where a third party holds and regulates payment of funds required for two parties involved in a given transaction. It aids in making transactions more secure by keeping the payment safe until all terms of an agreement are met as overseen by the neutral third party. Understanding escrow is crucial, particularly when one intends on engaging in real estate activities such as fast home selling, where the process becomes an integral part.

Streamlining the escrow process can expedite property transfers significantly. The timeline optimization depends primarily on how efficiently each role player executes their tasks within this setup – these include title searches, inspections, appraisals, loan underwriting, and closing procedures among others. Swift sell my house fast Fort Worth property transfer tips often hinge on swift completion of these processes without compromising their integrity or accuracy. Therefore, it’s essential for both buyers and sellers to understand and participate actively in these steps to facilitate a more smooth-sailing transition.

Although there isn’t a definitive timeframe for escrows since they’re subject to varied factors such as legal requirements or contract stipulations; having knowledge about it allows strategizing towards expediting the process without jeopardizing its essence or purpose. Henceforth, the subsequent section will delve into how one initiates this procedure while taking into account all necessary variables that could potentially influence its overall time span.

Starting the Process

The initiation phase of the settlement process typically commences upon acceptance of a purchase offer, setting the pace for subsequent steps. This stage is crucial in fasttracking escrow procedures as it lays the groundwork for all forthcoming activities. It involves drafting and signing an escrow agreement, which outlines the terms and conditions agreed upon by both parties involved in the transaction. Ensuring clarity and preciseness at this juncture can help avoid any potential misinterpretation or disputes that may arise later on, hence minimizing delays in home sales.

Starting the process swiftly and efficiently requires a clear understanding of each party’s responsibilities to prevent any hold-ups further down the line. The buyer must be prompt with their mortgage application while sellers should promptly address any contingencies or requested repairs identified sell my house fast Texas during inspections to expedite proceedings. In addition to these aspects, conducting title searches early can also aid in shortening escrow duration as it enables early detection and resolution of any issues related to property ownership rights.

In speeding up home sales, effective communication among all parties involved is paramount. Regular updates on progress from both sides can keep everyone apprised, thereby facilitating smooth coordination through different stages of escrow. With proper planning and execution starting from this initial phase itself, one can significantly reduce unnecessary complications or delays throughout the entire process. Through comprehensive insight into what lies ahead, one can better prepare for key elements involved ensuring an efficient transition into subsequent phases such as arranging finances or addressing inspection-related concerns without mentioning ‘step’.

Key Steps Involved

Understanding and meticulously following each stage of the home buying procedure can significantly alleviate stress and confusion, providing a seamless transition from one phase to the next. In real estate transactions, escrow is regarded as one of the most critical stages. This process involves an unbiased third party holding onto funds and documents until specific conditions are met by both buyer and seller. Escrow serves as an assurance that all parties will uphold their end of the bargain, facilitating trust in what can often be a complex transaction.

The key steps involved in this process tend to follow a common pattern:

- The first step usually entails opening an escrow account where earnest money deposit is held.

- Next on the list is conducting necessary inspections and appraisals for property assessment.

- Once these evaluations are complete, finalizing financing arrangements with mortgage lenders comes into play.

Incorporating fast escrow and closing tips can hasten this process resulting in quick turnaround in real estate transactions. It’s important to note that speed doesn’t necessarily compromise thoroughness – it’s about being organized, efficient, understanding how long does escrow take typically, and anticipating potential roadblocks before they occur. Regular communication between all parties helps prevent misunderstandings or errors which could delay closing the deal without delay.

While taking these steps into consideration will streamline the overall process considerably, it is also crucial to bear in mind that every real estate transaction entails unique elements that may affect timelines differently. Despite meticulous planning and efficiency sometimes delays might occur due to unforeseen circumstances or complications arising during property inspections or document verifications. This reality underscores why understanding typical issues causing such potential delays should be part of any comprehensive approach towards mastering real estate transactions involving escrows for any prospective homeowner or investor.

Potential Delays

Potential roadblocks during the escrow process can stem from a multitude of factors, each capable of introducing unexpected delays in real estate transactions. For instance, buyers may encounter hitches with securing their mortgage approval, or sellers might face challenges in transferring the property title. Additionally, problems could arise from home inspection findings that require negotiation between both parties or even repairs before the sale can proceed. These issues not only slow down escrow but also jeopardize accelerating real estate transactions as a whole.

Given these potential challenges, there are certain tips for speeding up home sales. Expedited house closing is often achievable by proactively addressing possible hurdles early on in the process. Buyers should work closely with their lender to ensure prompt processing of their loan application and take pre-emptive measures such as obtaining pre-approval for mortgages before initiating an offer. Sellers, on the other hand, can facilitate strategies for a swift home sale by conducting pre-inspections and making necessary repairs ahead of time to avoid last-minute negotiations or deal breakers.

An understanding of these common delays and how to mitigate them is crucial for closing deals swiftly in real estate. By anticipating potential issues and employing effective strategies to address them promptly, parties involved can significantly reduce unnecessary delays within the escrow period. This knowledge not only helps expedite individual property sales but also contributes to greater efficiency within the broader real estate market system overall. The next section will delve further into how this understanding plays out in successfully closing a transaction without saying ‘step’.

Closing the Deal

Successfully concluding a real estate transaction requires meticulous coordination and active participation from all parties involved, ensuring that each step of the process is completed accurately and promptly. To expedite this process, efficient home selling strategies should be employed, focusing on clear communication between buyer, seller, agents, lenders, and escrow officers. An integral part of this strategy involves understanding the quick home sale timeline which includes pre-approval for mortgage loans for buyers and title search for sellers to avoid any unexpected issues that might delay closing.

In order to achieve a rapid property transaction guide must be followed closely. This encompasses carrying out necessary inspections thoroughly yet swiftly, handling paperwork promptly and accurately as well as addressing any contingencies in the contract without delay. The speed of this process can often hinge on many variables such as market conditions or financial situations; however adherence to speedy home closing steps can significantly reduce waiting time. Indeed, by streamlining negotiations about repairs or price adjustments based on inspection results or appraisal value helps in selling your house in record time.

The completion of these tasks marks the final stage before ownership is transferred from seller to buyer. At this juncture money transfers are enacted through escrow officer who also records the new deed with appropriate county office indicating change of ownership . It’s essential at this point to ensure all contractual terms have been met before signing off; an action signifying end of escrow period but not necessarily end of responsibilities associated with the transaction. Moving forward into post-closing period will involve settling any remaining obligations like utility bills or homeowners association dues if applicable.

Post-Closing Period

Navigating the post-closing period requires meticulous attention to detail and prompt action, ensuring that all remaining obligations associated with the transaction are settled efficiently. This period is characterized by a slew of activities such as disbursing funds, paying off existing loans, recording the deed among other crucial acts. The lender or escrow agent typically executes these tasks within one to two days following closing, but delays can occur if there are any discrepancies in paperwork or unforeseen issues.

This phase also includes resolving any contingencies which have not been met prior to closing. For example, home inspections or repairs may need completion before ownership is transferred completely. In this case, an escrow account might hold back a portion of funds until these conditions are fulfilled satisfactorily. While relatively uncommon, these situations can prolong the post-closing period significantly depending on their complexity and resolution time.

Significant factors influencing the duration of this stage include communication efficiency between involved parties and local customs regarding property transactions. However, while it’s essential for all parties to be proactive during this process to ensure smooth progression towards finality, it’s equally important to understand that certain elements may fall outside individual control – such as government processing times for documentation. As we transition into discussing tips for enhancing operational efficiency within escrow processes and beyond, keeping above points in mind can prove instrumental in managing expectations realistically and effectively navigating property transactions.

Tips for Efficiency

Transitioning from the post-closing period of escrow, it becomes evident that efficiency is a fundamental aspect in ensuring a smooth and quick escrow process. The duration of escrow can be significantly reduced by employing certain strategies aimed at fostering efficiency. These strategies not only expedite the process but also mitigate potential risks and complications associated with delays.

In order to achieve this heightened level of efficiency, several steps can be taken by both buyers and sellers:

- Streamlining communication: Ensuring clear and regular communication between all parties involved can help to avoid misunderstandings and facilitate rapid progress.

- Keeping everyone informed about each step’s status

- Promptly responding to inquiries or requests for additional information

- Utilizing effective modes of communication like email or direct phone calls

- Preparation and organization: Being well-prepared with all necessary documents and having them organized will speed up various stages of the escrow process.

- Gathering essential documents ahead of time

- Ordering property inspections as early as possible

- Staying on top of deadlines for document submission

- Proactive problem-solving: Anticipating potential issues before they arise can make it easier to address them quickly if they do occur.

- Understanding common roadblocks in the escrow process

- Setting up contingency plans for these potential obstacles

- Actively seeking advice from professionals when unsure

To further articulate, achieving efficiency in the escrow process is neither an incidental feat nor an inevitability; instead, it requires deliberate planning, proactive measures, and thoughtful execution. By streamlining communication efforts, preparing essential resources appropriately, and adopting a proactive approach towards problem-solving, individuals involved in real estate transactions can navigate the complexities inherent within this procedure with increased ease. Thus, these practical tips serve as valuable guidelines that contribute to accelerating the pace at which one traverses through the intricate journey that is the escrow process.

Frequently Asked Questions

What are some common errors that can prolong the escrow process?

Common errors that can prolong the escrow process include incomplete paperwork, delayed inspections or appraisal, issues with a buyer’s financing, and title problems. These complications may extend the completion timeline significantly.

Can the terms of escrow be changed midway through the process?

Yes, escrow terms can be modified midway through the process. However, any adjustments necessitate mutual agreement between all parties involved and could potentially lengthen the duration of the escrow process.

How do holiday periods or weekends impact the escrow timeline?

Holiday periods or weekends may prolong the escrow timeline due to delayed paperwork processing. Financial institutions and title companies often operate on business days, thus non-business days could extend the escrow process duration.

Are there any specific laws or regulations influencing the escrow process in different states?

Indeed, laws and regulations impacting the escrow process vary across states. Factors such as state-specific consumer protection laws, real estate practices, and deposit requirements can significantly influence the duration of an escrow period.

What are the options if the buyer or seller wants to back out during the escrow process?

Should a buyer or seller wish to rescind their offer during the escrow process, options vary. It depends on the contract terms and potential legal implications, which can include forfeiting earnest money or facing litigation.

Other Articles You Might Enjoy

How Long Does It Take To Build A House