In the quest for financial security, one often grapples with the question of how much cash should be kept in savings. It is a common notion that saving money is a wise and prudent financial decision, however, there may be such a thing as having too much idle cash. This article delves into this complex issue, aiming to provide clarity on striking an optimal balance between saving and investing.

The importance of understanding the nuances of savings cannot be overstated. While it forms an essential part of any individual’s financial strategy, it can inadvertently become counterproductive if not managed wisely. This paper offers insights into determining saving goals, assessing one’s financial security and understanding the risks associated with over-saving. Furthermore, it explores investment opportunities that could potentially accelerate wealth growth and outlines strategic planning techniques to harmonize savings and investments effectively.

Understanding Savings

In the exploration of the concept ‘too much cash in savings‘, understanding the fundamentals of savings and its role in financial management is crucial. The process of saving involves accumulating funds over a period, typically for future use or investments. In the context of real estate, effective savings management plays an instrumental role as it provides a safety net for unforeseen circumstances such as property repairs or market fluctuations. It also offers opportunities for enhancing personal wealth through strategic investment decisions.

A deeper investigation reveals that understanding savings implies recognizing its influence on various aspects of life, including property transactions. Savings are often used to finance initial deposits in real estate deals, making smart cash handling paramount for successful transactions. A significant portion of these transactions includes strategies for liquidating property investments effectively without suffering financial losses. Hence, adequate knowledge about managing savings ensures smooth execution and increases profits from such deals.

The role of savings in real estate deals cannot be overstated as it affects both purchase and selling decisions. For instance, having substantial savings could enable one to negotiate better terms when purchasing sell my house fast Fort Worth properties due to their increased purchasing power. On the other hand, sellers can utilize their saved funds to enhance properties’ aesthetic appeal before selling them off at higher prices. It is therefore evident that proper comprehension and application of this knowledge can potentially result in significant financial gains or stability within the realm of real estate operations. The next section will delve into determining saving goals as an integral part of this discussion on how much cash might be considered excessive within one’s reserve funds.

Determining Saving Goals

Establishing concrete financial objectives plays a crucial role in guiding one’s decision on the appropriate amount to hold in liquid assets. The process of determining saving goals involves an intricate balance between maintaining sufficient cash reserves and investing optimally for future growth. This equilibrium is particularly significant for real estate professionals who must juggle between maximizing home sale speed and optimizing cash in real estate transactions. Careful planning, therefore, becomes imperative to ensure that resources are not only preserved but also strategically allocated.

The art of balancing savings and real estate investments comes into play when deciding how much cash should be kept readily available versus what portion should be channeled into property assets. It may seem advantageous to invest heavily in real estate due to its potential for substantial returns; however, maintaining a robust cache of liquid funds is equally important. Cash reserves serve as a safety net during market downturns or personal emergencies, enabling individuals to weather unforeseen financial storms without destabilizing their investment portfolio.

Appropriate allocation of funds sell my house fast Texas demands an understanding of personal finance dynamics coupled with keen foresight about the larger economic landscape. In essence, it calls for striking an optimal balance between safeguarding present needs while fueling future aspirations. As one navigates this complex terrain towards achieving their saving goals, they gradually pave the way for assessing financial security – a vital aspect that further underscores the importance of prudent fiscal management techniques.

Assessing Financial Security

Navigating the landscape of financial security requires a meticulous examination of one’s fiscal health, an endeavor that resonates deeply with the desire for stability and certainty. For many individuals, this involves evaluating existing assets and leveraging strategies like cash for houses or quick home selling tips to bolster their savings. The concept of sell property fast can provide a significant boost to one’s financial cushion, especially in situations where liquid cash is needed promptly. Services such as quick house buyers offer opportunities to expedite this process, making it possible to convert tangible assets into accessible funds swiftly.

In assessing financial security, understanding the principles behind best practices for a quick house sale becomes integral. This practice entails more than merely attracting potential buyers; it involves careful planning and strategic decision-making aimed at maximizing returns on investment while minimizing risk. Effective tactics may include appropriate pricing based on market trends, enhancing curb appeal through minor renovations or staging techniques, and harnessing professional help from real estate agents or companies specialized in buying properties quickly for cash.

The impact of these strategies on financial security can be substantial; however, they should not overshadow the necessity of maintaining balance within personal finances. Over-reliance on property sales as primary sources of income or savings might lead to an inflated sense of monetary well-being that could mask underlying issues such as over-saving — an aspect warranting further exploration in terms of its risks and implications. This delicate equilibrium between taking advantage of swift asset conversion options like property sales and preserving healthy saving habits forms the next focal point for discussion regarding fiscal well-being.

Risks of Over-Saving

Excessive accumulation of liquid assets, commonly known as over-saving, presents a unique set of risks to financial stability and wealth growth. The most significant risk is the potential loss in value due to inflation. As savings accounts typically offer lower interest rates compared to other investment options, the purchasing power of an individual’s cash savings may decrease over time if the rate of inflation outpaces the interest earned on these savings. This could potentially lead to scenarios where individuals might need to sell house quickly or accept any fast house sale offers due to insufficient funds for emergencies or large expenses.

| Risks | Description | Mitigation |

|---|---|---|

| Inflation Risk | Over time inflation can erode the value of money saved in low-interest accounts. | Diversify investments across different types including those with higher returns |

| Liquidity Risk | Having too much tied up in cash can mean missed opportunities for wealth growth. | Ensure a balance between liquid savings and investments |

| Over-Reliance on Cash Savings | Relying solely on cash savings can leave you vulnerable during unexpected expenses. | Develop multiple streams of income like rental income, dividends etc |

From this perspective, it becomes clear that while having a certain amount of easily accessible funds is beneficial for handling short-term needs and emergencies, excessive reliance on cash savings could impede long-term wealth growth. For instance, accumulating substantial amounts in cash might cause homeowners to miss out on a speedy home sale because they feel financially secure and do not take active steps towards selling their property. It would be more advantageous if they had used their excess savings into improvements that increase property value or considered a cash offer for home which could yield immediate profits.

To navigate these risks successfully requires strategic planning and understanding various investment opportunities available. This includes recognizing when it may be profitable to consider tips for selling your house rapidly rather than letting valuable assets lay dormant. Transitioning into further exploration about various forms of investment opportunities will provide a more holistic view on how to manage savings effectively.

Investment Opportunities

A comprehensive examination of various investment opportunities is essential for effective wealth growth and financial security, as this approach can provide greater returns compared to holding a large volume of liquid assets. Investments such as stocks, bonds, real estate, and mutual funds offer the potential for higher returns over time. Additionally, investing in these avenues can also aid in mitigating inflation risk that cash savings face. Subsequently, the opportunity cost of keeping too much cash in savings accounts could be significant if one overlooks these viable investment opportunities.

The potential profitability from investments is further illustrated when considering strategies for selling properties quickly. A few house selling strategies include:

- Strategic pricing: Setting a competitive price that reflects current market conditions.

- Home staging: Enhancing your property’s appeal through professional staging.

- Effective marketing: Utilizing online platforms and real estate agents to reach a wider audience.

- Timing: Selling your property during peak real estate seasons.

These strategies not only expedite the process but also maximize returns on investment by potentially increasing the sale price. Thus, converting an idle asset (property) into an active one contributes to wealth accumulation more efficiently than excessive cash reserves.

Wealth management requires a nuanced understanding of balancing between savings and investments. Notably though, it does not advocate completely draining one’s savings account or recklessly plunging into all available investments without due diligence. It instead suggests an optimal mix of both based on individual financial goals and risk tolerance levels. This balance ensures sustainability and resilience against unforeseen economic downturns or personal emergencies while still capitalizing on wealth-growing opportunities offered by various investments. The next section will delve deeper into how this equilibrium between savings and investment can be achieved effectively for long-term financial prosperity without using the word ‘step’.

Balancing Savings and Investment

Having explored various investment opportunities, it is crucial to consider how these fit into an overall financial strategy. The balance between savings and investments ultimately depend on individual financial goals, risk tolerance, and time horizon. Diversifying one’s portfolio with a mix of both can effectively manage potential risks while still allowing room for growth.

While maintaining a substantial amount in savings assures immediate liquidity and serves as a safety net during unexpected circumstances, overreliance on cash savings might not be the most efficient use of funds. The interest rates offered by banks are often relatively low; thus, the value of money merely kept in savings accounts could diminish due to inflation over time. On the other hand, investing allows capital to grow at potentially higher returns than traditional saving methods. However, it should be noted that all investments come with their own set of risks which should be thoroughly assessed before committing any funds.

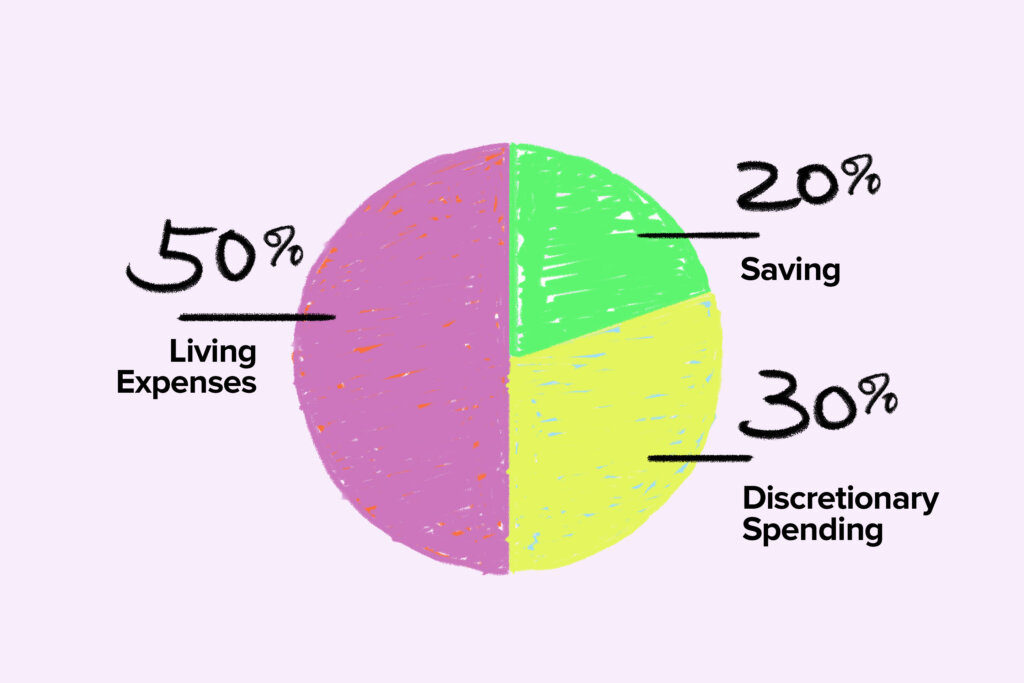

Striking an optimal balance between savings and investments requires careful consideration of personal financial circumstances and objectives. One must take into account their income stability, spending habits, short- and long-term financial goals when deciding how much money to allocate towards each avenue. A well-balanced approach provides both security from having readily available funds in savings and opportunity for wealth accumulation through investment activities. This path eventually leads towards achieving strategic financial planning – a comprehensive process that takes into consideration all aspects of one’s finances in order to optimize wealth management.

Strategic Financial Planning

Strategic financial planning is a comprehensive, long-term approach that incorporates various aspects of one’s financial life, such as savings and investments, to optimize wealth management. This process begins by identifying tangible financial goals which serve as the roadmap for determining how much money should be allocated towards savings and how much should be put into investments. It requires careful consideration of multiple factors including income levels, risk tolerance, time horizons, and future needs like retirement or education expenses. The role of cash in strategic financial planning cannot be overemphasized as it serves as a safety net for emergencies and provides liquidity.

A key element in strategic financial planning is diversification – spreading resources across multiple investment vehicles to mitigate risk. While maintaining a significant cash reserve may provide comfort and security, having an excessive amount sitting idle could mean missing out on potential returns from other asset classes like stocks or bonds. On the other hand, investing all available funds without keeping sufficient cash reserves can expose individuals to unnecessary risks if sudden unforeseen expenses arise.

The optimal mix of cash savings and investments within a strategic financial plan varies between individuals based on their specific circumstances and objectives. Hence, there isn’t necessarily an exact figure that denotes ‘too much’ cash in savings; rather it depends on the individual’s unique context defined by their goals, lifestyle choices, career stage among others. Therefore the importance lies not just in amassing wealth but managing it strategically with a balanced approach that considers both present requirements and future aspirations while mitigating potential risks along the way.

Frequently Asked Questions

What are some common mistakes people make when saving cash?

Common errors in cash savings include not diversifying investments, neglecting inflation impact, and avoiding risk entirely. These mistakes can result in diminished returns and potential erosion of the value of saved funds over time.

How does inflation affect the value of cash savings?

Inflation erodes the purchasing power of cash savings over time. As general price levels rise, each unit of currency buys fewer goods and services, diminishing the real value of money held in savings accounts.

Are there any tax implications to consider when saving large amounts of cash?

Significant cash savings may indeed have tax implications. Interest earned on such savings is typically taxable, potentially increasing one’s overall tax liability. Therefore, careful financial planning and understanding of tax laws are crucial.

How does the economy impact the value of cash saved?

Economic fluctuations significantly impact the value of cash savings. Inflation erodes purchasing power, diminishing the real value of saved money over time. Conversely, deflation increases its worth as goods and services become cheaper.

Can the amount of cash saved influence one’s credit score?

The amount of cash saved does not directly impact one’s credit score. Credit scores are primarily influenced by payment history, outstanding debt, length of credit history, and types of credit utilised.

Other Articles You Might Enjoy

How Much Less Can You Offer On A House With Cash