Making an offer on a home can be a complex process, particularly for those venturing into the real estate market for the first time. It is essential to understand the rule of thumb when it comes to making an offer in order to navigate this endeavor successfully. This article aims to provide valuable insights and guidance on how to make a competitive offer on a home, taking into account various factors that must be considered.

When making an offer on a home, several key factors should be taken into consideration. Firstly, understanding the current market conditions is crucial. Awareness of whether it is a buyer’s or seller’s market can greatly influence the negotiation process and determine how competitive your offer needs to be. Additionally, your financial readiness plays an important role in making an effective offer. Evaluating your budget, credit score, and pre-approval status will help you determine your purchasing power and set realistic expectations.

Another significant factor in making an offer is considering comparable sales in the area. Analyzing recent sales data of similar properties will provide insight into property values and enable you to make a more informed decision regarding your offering price. Moreover, having well-thought-out negotiation strategies can enhance your chances of securing the home at a favorable price point. Understanding contingencies and terms related to inspections, repairs, or financing can give you leverage during negotiations.

Lastly, timing and deadlines are crucial aspects of making an offer on a home. Being proactive with submitting offers promptly within specified timelines can demonstrate seriousness as a buyer while also allowing sufficient time for due diligence activities such as inspections or loan approvals.

By understanding these key factors and following the rule of thumb when making an offer on a home, prospective buyers can increase their chances of success in this competitive real estate market. With careful consideration of market conditions, financial readiness assessment, analysis of comparable sales data, strategic negotiation approaches, and adherence to timing constraints; buyers can navigate through this process with confidence towards achieving their goal of homeownership.

Factors to Consider

When considering factors to make an offer on a home, it is important to take into account various aspects such as the condition of the property, location, market trends, and comparable sales in order to determine a fair and competitive offer price. First and foremost, the condition of the property plays a significant role in determining its value. Buyers should carefully evaluate any potential repairs or renovations that may be required and factor those costs into their offer. Additionally, considering the location of the home is crucial. The proximity to schools, amenities, transportation options, and neighborhood safety can all influence its value.

Market trends also play a vital role when making an offer on a home. Understanding whether it is currently a buyer’s or seller’s market can help buyers gauge how strong their offer needs to be. In a seller’s market where demand exceeds supply, there may be multiple offers on properties. In such cases, buyers need to consider offering at or above asking price to increase their chances of securing the property.

Lastly, looking at comparable sales in the area can provide valuable Sell My House Fast Fort Worth insights into what other similar homes have recently sold for. These comparables serve as benchmarks for determining a fair offer price. By analyzing recent sales data and adjusting for any unique features or differences between properties, buyers can arrive at an appropriate offer amount that aligns with current market conditions.

Considering these factors will enable buyers to develop effective home offer techniques that not only position them competitively but also expedite the home selling process by aligning with sellers’ expectations. With an understanding of quick home sale strategies and best offer tactics in place based on comprehensive evaluation of factors like property condition, location analysis backed by market trends research along with comparative analysis; prospective homeowners are well-equipped to make informed decisions while making offers on homes.

Market Conditions

In considering market conditions, it is important to carefully assess the current state of the housing market before proceeding with any purchasing decisions. This step is crucial in order to make a successful home offer and expedite the home selling process. Market conditions can greatly impact the success of an offer negotiation for a quick sale, and being aware of these conditions can help buyers strategize their approach.

One key factor to consider when assessing market conditions is the level of competition among buyers. In a seller’s market where there are more buyers than available homes, it may be necessary to make a strong offer in order to stand out from other potential buyers. This could include offering above asking price or including additional incentives such as a quick closing or waiving certain contingencies. On the other hand, in a buyer’s market where there are more homes available than buyers, sellers may be more willing to negotiate and accept lower offers.

Another aspect of market conditions to evaluate is the average time homes are staying on the market before being sold. If homes are selling quickly, it may indicate high demand and competitive bidding situations. In this case, acting swiftly and making an attractive offer can increase your chances of success. Conversely, if homes are sitting on the market for extended periods of time, sellers may be more motivated to accept lower offers or negotiate favorable terms.

Considering market conditions plays a crucial role in making an informed decision when submitting an offer on a home. By understanding factors such as competition among buyers and average time on the Sell My House Fast Texas market, you can tailor your approach accordingly and increase your chances of success. With this insight into current market conditions established, it is now important to assess one’s financial readiness before moving forward with any purchasing decisions.

Financial Readiness

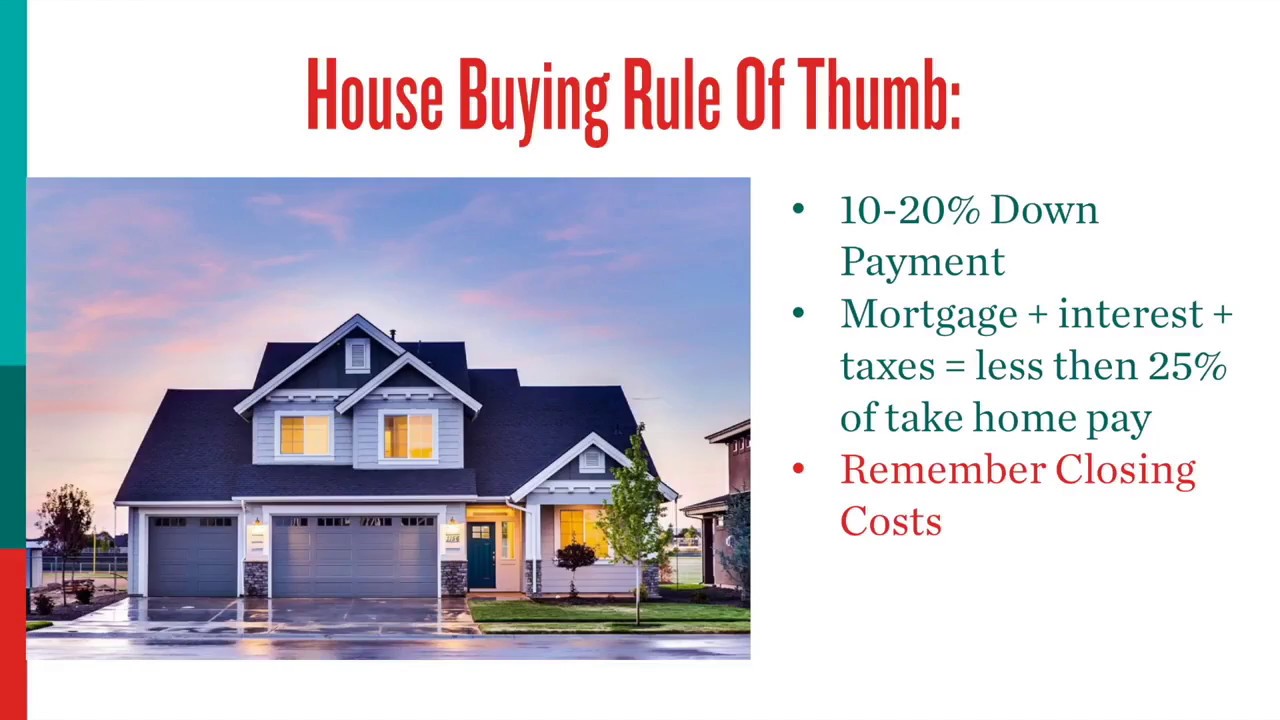

Assessing one’s financial readiness is imperative before proceeding with any purchasing decisions in order to make an informed and calculated choice. When it comes to making an offer on a home, being financially prepared can greatly increase the chances of a successful transaction. Home purchase acceleration often requires quick decision-making in home offers, as swift negotiation is crucial in boosting home sale speed. By assessing one’s financial situation beforehand, potential buyers can determine their budgetary limits and avoid wasting time on homes that are beyond their means.

To evaluate financial readiness for making an offer on a home, individuals should consider various factors such as income stability, credit score, and available savings. Income stability plays a vital role in determining the ability to afford mortgage payments over the long term. A steady source of income provides confidence to lenders and demonstrates the buyer’s capability to meet monthly obligations without defaulting. Additionally, having a good credit score is essential for securing favorable mortgage terms. Lenders typically assess creditworthiness using this metric, so maintaining a high score through responsible financial management is key.

Incorporating the table below can provide further insight into assessing financial readiness:

| Financial Factors | Considerations |

|---|---|

| Income Stability | Evaluate job security and potential for future income growth |

| Credit Score | Aim for a high credit score by paying bills on time and reducing debt |

| Savings | Ensure sufficient savings for down payment, closing costs, and unexpected expenses |

Considering these factors will help individuals gauge their readiness when making an offer on a home. Once confident in their financial position, they can proceed with negotiations knowing they have done their due diligence and are well-prepared. Having established financial readiness enables potential buyers to proceed seamlessly into the subsequent section about ‘comparable sales’, where they can analyze market trends before finalizing their offer.

Assessing one’s financial readiness is crucial when making an offer on a home. It involves evaluating factors such as income stability, credit score, and savings to ensure individuals are well-prepared for the financial obligations that come with homeownership. By taking the time to assess their financial situation, potential buyers can make informed decisions and avoid unnecessary delays or disappointments in the home buying process. With financial readiness established, individuals can confidently move on to analyzing comparable sales and determining a fair offer for their desired property.

Comparable Sales

To gain a clearer understanding of the current market trends and property values, it is essential to analyze comparable sales. Comparable sales, also known as “comps,”refer to recently sold properties that are similar in size, location, and condition to the home you are interested in purchasing. By examining these comps, potential buyers can determine a fair price range for the property they wish to offer on. Analyzing comparable sales allows individuals to make informed decisions about their home buying process efficiency and increases their chances of making winning home offers.

Studying comparable sales provides valuable insights into the local real estate market. It helps buyers understand how quickly homes are selling in a particular area and at what price point. By comparing recent sales data with the target property’s features and condition, buyers can gauge its value accurately. This knowledge empowers them during negotiations by providing evidence-backed arguments when proposing an offer amount.

Moreover, analyzing comparable sales can accelerate home selling or boost home sale speed for sellers as well. Sellers can use comps as a benchmark for pricing their own property competitively in order to attract potential buyers quickly. By setting a realistic asking price based on recent sales data of similar homes nearby, sellers increase the likelihood of receiving multiple offers and driving up demand for their property.

Understanding the importance of analyzing comparable sales enables both buyers and sellers to navigate the real estate market more effectively. With this knowledge in hand, individuals have a better chance of making successful transactions that align with their financial goals. Having explored how studying comparable sales contributes to decision-making during the home buying process, let us now delve into negotiation strategies that can further optimize this process without compromising on outcomes or satisfaction levels.

Negotiation Strategies

Negotiation strategies play a crucial role in the home buying process, enabling individuals to navigate the real estate market effectively and optimize outcomes to align with their financial goals. When it comes to making an offer on a home, there are several tips and techniques that can help expedite the process and ensure a fast sale. By implementing these rapid home sale guidelines, sellers can increase their chances of attracting potential buyers and closing the deal quickly.

One effective strategy for boosting home sale speed is to set a competitive asking price. Conducting thorough research on comparable sales in the area can provide valuable insights into the market value of similar homes. Pricing your house competitively can attract more buyers and generate greater interest, leading to faster offers. Additionally, being flexible with negotiation terms such as closing dates or contingencies can make your property more appealing to potential buyers who may be looking for a quick closing on a home.

In addition to setting an attractive asking price, sellers can utilize various marketing techniques to sell their house quickly. Utilizing professional photography services, creating virtual tours or videos of the property, and highlighting its unique features can capture potential buyers’ attention and entice them to schedule viewings promptly. Moreover, leveraging online platforms such as social media channels and real estate websites can broaden exposure for your listing and reach a larger pool of interested buyers.

Transition Sentence: Moving forward into the next section about ‘contingencies and terms,’ it’s important for both buyers and sellers to understand how these factors impact negotiations in the home buying process.

Contingencies and Terms

Contingencies and terms play a crucial role in the negotiation process of buying or selling a home, as they can significantly impact the final outcome and agreement between both parties involved. Contingencies are conditions that must be met for the sale to proceed, while terms refer to the specific details and requirements outlined in the purchase agreement. These factors can vary depending on the local real estate market, financing options, and individual preferences of the buyer and seller.

One common contingency is a home inspection contingency, which allows buyers to have a professional inspector evaluate the property before finalizing the purchase. This contingency gives buyers an opportunity to identify any potential issues or defects with the property and negotiate repairs or price reductions if necessary. Another important contingency is financing contingency, which states that the sale is dependent on obtaining satisfactory financing from a lender. If buyers are unable to secure a mortgage within a specified period, they can back out of the deal without penalty.

In addition to contingencies, terms also play a significant role in negotiations. These include factors such as closing date, earnest money deposit amount, inclusion or exclusion of certain appliances or fixtures, and any additional requests made by either party. Both buyers and sellers should carefully consider these terms and ensure they align with their needs and priorities. By understanding contingencies and negotiating favorable terms, both parties can increase their chances of reaching an agreement that satisfies their objectives.

Transitioning into timing and deadlines: As important as contingencies and terms are in negotiating an offer on a home, timing and deadlines are equally significant considerations in this process.

Timing and Deadlines

Timing and deadlines play a crucial role in the negotiation process of buying or selling a home, as they require careful consideration to ensure all parties involved can meet their respective obligations within the specified timeframes. When making an offer on a home, it is important to be aware of key timing factors that can significantly impact the outcome of the transaction. One such factor is the expiration date and time of the offer. Sellers often set a deadline for accepting offers, which creates a sense of urgency for buyers. It is essential for prospective buyers to submit their offer before this deadline to increase their chances of being considered.

Moreover, understanding the timeline for contingencies is vital during an offer negotiation. Contingencies are conditions that must be met in order for the sale to proceed smoothly. These may include obtaining financing, conducting inspections, or reviewing documents related to the property. Buyers typically have a specific timeframe within which they need to complete these contingencies. Failing to meet these deadlines can result in potential consequences such as losing earnest money deposits or even termination of the agreement altogether. Therefore, it is crucial for buyers to carefully review and adhere to these timelines.

Another aspect related to timing and deadlines when making an offer on a home is considering any external factors that might affect the transaction process. This could include holidays, weekends, or other events that may cause delays in communication or paperwork processing. Additionally, it is important to take into account any anticipated changes in interest rates or market conditions when deciding on an appropriate deadline for acceptance or completion of contingencies. By being mindful of these factors and setting realistic timelines from both parties’ perspectives, buyers can position themselves favorably while ensuring smooth negotiations and timely closing processes.

Timing and deadlines should not be overlooked when making an offer on a home. Understanding and adhering to specific timeframes set by sellers can significantly increase one’s chances of success during negotiations. Additionally, paying close attention to contingency timelines and external factors can help avoid unnecessary complications and ensure a smooth transaction process. By considering these aspects, prospective buyers can navigate the negotiation process with confidence and increase their chances of securing their dream home.

Frequently Asked Questions

How do I determine the appropriate amount to offer on a home?

Determining the appropriate amount to offer on a home requires careful consideration of various factors, such as market conditions, comparable sales, and the property’s condition. It is essential to conduct thorough research and seek expert advice to make an informed decision.

What are some common contingencies that can be included in an offer?

Common contingencies that can be included in an offer on a home include financing, appraisal, and inspection. These contingencies protect the buyer by allowing them to back out of the deal if certain conditions are not met.

Are there any specific terms or conditions that I should be aware of when making an offer?

When making an offer on a home, it is important to be aware of specific terms and conditions. These may include the purchase price, financing arrangements, inspection contingencies, closing date, and any additional requirements specified by the seller.

How do I know if the home’s listing price is fair and reasonable?

To determine if a home’s listing price is fair and reasonable, potential buyers should conduct research on comparable sales in the area, assess the condition of the property, consider market conditions, and seek guidance from a real estate agent.

Can I negotiate the closing date or other deadlines in my offer?

Yes, you can negotiate the closing date and other deadlines in your offer. This allows for flexibility and ensures that both parties are able to meet their respective needs and obligations.

Other Articles You Might Enjoy

What Is The Secret To A Fast Sale Of A Property