Probate, the legal process through which a deceased person’s assets are distributed, often raises questions about who exactly owns a house during this period. Understanding the ownership of a house during probate is crucial for beneficiaries, executors, and individuals involved in estate administration. This article aims to provide clarity on this matter by exploring various scenarios that can arise and shedding light on who ultimately holds ownership rights to a house during the probate process.

During probate, it becomes essential to determine who has legal ownership of a house. This process involves distributing the deceased person’s assets according to their will or state laws. The executor plays a significant role in probate by ensuring that the deceased person’s wishes are carried out and overseeing the distribution of assets, including the house. However, several factors come into play when determining ownership rights to a house during probate, such as debts and taxes owed by the estate or potential disputes among beneficiaries. By understanding these complexities and navigating them effectively, beneficiaries and those involved in estate administration can attain mastery over the process of determining house ownership during probate.

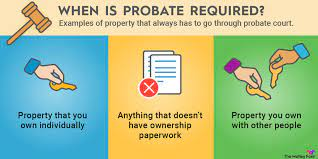

What is Probate?

Probate is a legal process that determines the validity of a deceased person’s will and ensures the proper distribution of their assets, including ownership of a house. When someone passes away, their estate goes through probate to settle any outstanding debts and distribute their property to beneficiaries. In the case of a house, probate determines who becomes the rightful owner. Selling a house in probate quickly can be challenging due to various legal requirements and potential complications. The executor, who is responsible for administering the deceased person’s estate, has certain responsibilities when it comes to selling a house in probate.

They must obtain appraisals, market the property appropriately, and ensure that all necessary paperwork is completed correctly.

The timeline for selling a house during probate can vary depending on several factors such as the complexity of the estate, disputes among beneficiaries or creditors, and local regulations. It is important to note that any property sales involving probate must go through probate court for approval. The court oversees the entire process to ensure fairness and accuracy in distributing assets according to the deceased person’s wishes.

With an understanding of what probate entails regarding Sell My House Fast Fort Worth real estate ownership and sales, it is essential to explore further into the intricacies of the probate process itself without missing any crucial steps or details.

Probate Process

The legal process that occurs upon an individual’s death involves the distribution of their assets, including immovable property. When it comes to the probate process, one aspect that often arises is the sale of inherited property. The inherited property sale process can be complex and time-consuming, as it requires adhering to specific legal requirements and addressing any potential challenges that may arise. One important consideration in this process is understanding the probate real estate market trends. This knowledge can help determine the best approach for selling the house in probate.

One crucial step in selling a house during probate is conducting a probate property valuation. This evaluation helps determine the fair market value of the property, taking into account various factors such as location, condition, and recent comparable sales in the area. By obtaining an accurate valuation, it becomes easier to set a reasonable asking price for potential buyers.

Once a fair market value has been established, it is essential to identify potential probate property buyers. These buyers specialize in purchasing properties during the probate process and are familiar with its intricacies. Working with experienced probate property buyers can help streamline the sales process and ensure a smooth transaction.

Understanding strategies to sell a house in probate is also vital for Sell My House Fast Texas success. Some common strategies include listing the property on multiple platforms to attract more potential buyers or setting up an auction to expedite the sale. Implementing effective marketing techniques and working closely with professionals who specialize in handling transactions involving houses in probate can significantly increase chances of success.

Transitioning into discussing ‘executor’s role,’ it is important for them to navigate through these processes while fulfilling their duty according to applicable laws and regulations.

Executor’s Role

One crucial aspect to consider in the legal process following an individual’s death is the executor’s role in managing and administering the deceased person’s estate. The executor, also known as the personal representative, is appointed either by the deceased person’s will or by a court if there is no will. The main responsibility of the executor is to ensure that all debts and taxes are paid from the estate before distributing any remaining assets to beneficiaries. In relation to a house owned by the deceased, here are five important points regarding the executor’s role:

- Valuation: The executor may need to hire a professional appraiser to determine the value of the house at the time of death. This valuation is essential for calculating estate taxes and deciding on how best to distribute assets.

- Maintenance: Until the probate process is complete, it falls under the executor’s responsibility to maintain and secure any properties owned by the deceased, including their house. This includes tasks such as cleaning, repairs, and insurance coverage.

- Selling: Depending on various factors like debt obligations or preferences of beneficiaries, selling an inherited property may be necessary. The executor can explore different options for selling inherited property, such as traditional sales through realtors or fast cash sales specifically designed for probate homes.

- Realtor Services: If choosing a traditional sale route, engaging with a probate realtor who specializes in handling these types of transactions can be beneficial. They have expertise in navigating probate laws and regulations related to selling inherited properties.

- Estate Sale vs Traditional Sale: Another consideration for executors is whether they should opt for an estate sale instead of a traditional sale. An estate sale involves liquidating multiple items within a property (including furniture and personal belongings) alongside selling the house itself.

With these considerations in mind regarding an executor’s role in managing a deceased person’s house during probate, it becomes evident that their responsibilities extend beyond mere administration. After attending to matters like valuation, maintenance, and potential property sales, the executor can then proceed to the next step of distributing assets among the beneficiaries.

Distribution of Assets

The distribution of assets following the completion of the executor’s responsibilities is a crucial step in the legal process after an individual’s death. Once all debts, taxes, and expenses have been paid off, the remaining assets are distributed among the beneficiaries according to the deceased person’s will or state law if there is no will. This process ensures that the estate is divided fairly and in accordance with the wishes or laws governing probate.

During probate, it is essential to identify all of the deceased person’s assets, including real estate properties such as houses. The executor must determine their value and make arrangements for their distribution. If there are multiple beneficiaries involved, each may receive a specific share of the property based on what is outlined in the will or determined by state law.

Distribution can take various forms depending on the circumstances and preferences of those involved. In some cases, beneficiaries may choose to sell their share of a house during probate if they do not wish to own it jointly with others. Alternatively, they may decide to keep the property and become co-owners with other beneficiaries. Ultimately, how ownership of a house is structured during probate depends on individual choices within legal boundaries.

Moving forward into consideration of debts and taxes, it is important to address any outstanding obligations before finalizing asset distribution. Debts owed by the deceased person must be paid off using available funds from their estate before beneficiaries can receive their inheritance fully. Likewise, any applicable taxes need to be settled before assets are transferred to ensure compliance with tax laws. Therefore, settling debts and taxes plays a vital role alongside asset distribution in concluding probate proceedings smoothly and efficiently without further delay or complications.

Debts and Taxes

Settling obligations and ensuring compliance with tax laws are crucial steps in the legal process following an individual’s death, as debts and taxes must be addressed before asset distribution can occur. During probate, all outstanding debts of the deceased person, including mortgages, loans, credit card balances, and unpaid bills, need to be identified and paid off using the assets of the estate. The executor or personal representative is responsible for managing these financial matters and ensuring that all creditors are notified and given an opportunity to make a claim against the estate.

Additionally, taxes also play a significant role in probate proceedings. Income taxes owed by the deceased up until their date of death must be filed and paid from the estate’s assets. The executor may need to obtain a taxpayer identification number for the estate to handle these tax-related matters. Moreover, if applicable, estate taxes may also need to be addressed depending on the value of the deceased person’s assets.

Only after settling debts and meeting tax obligations can the remaining assets be distributed among beneficiaries as outlined in the will or determined by state intestacy laws if there is no will. It is essential to ensure that all debts are properly accounted for before distributing any property or funds from an estate. Failure to do so could result in legal complications or disputes among heirs who may have valid claims against specific assets.

Transitioning into disputes and challenges: Resolving potential conflicts over inheritances or disagreements about how assets should be divided can further complicate probate proceedings.

Disputes and Challenges

Resolving potential conflicts over inheritances or disagreements about the division of assets can present significant challenges during the probate process. Disputes and challenges can arise when beneficiaries feel they have been unfairly treated or when there is ambiguity in the will or estate plan. These disputes may involve various parties, including family members, creditors, or other interested parties. Resolving these disputes requires careful consideration of legal rights and obligations.

- Mediation: One option to resolve disputes during probate is mediation. Mediation involves a neutral third party who helps facilitate communication between the parties involved in the dispute. The mediator does not make decisions but assists in finding common ground and reaching a mutually acceptable resolution. Mediation can be a cost-effective and efficient way to resolve disputes without resorting to litigation.

- Litigation: In some cases, disputes cannot be resolved through mediation, and litigation becomes necessary. This involves taking the matter to court for a judge to make a decision on the disputed issues. Litigation can be time-consuming, expensive, and emotionally draining for all parties involved. It is important to seek legal advice from an experienced attorney if litigation becomes necessary during probate.

- Alternative Dispute Resolution: Apart from mediation and litigation, there are other alternative dispute resolution methods available during probate. These include arbitration and collaborative law processes where neutral third parties help facilitate resolutions outside of traditional court settings. Each method has its advantages and disadvantages, depending on the specific circumstances of the dispute.

Resolving disputes during probate can be complex and emotionally challenging for everyone involved. However, it is crucial to address these issues promptly to ensure a fair distribution of assets according to the deceased’s wishes or applicable laws. Transitioning into finalizing probate involves completing any outstanding tasks related to resolving these disputes so that the distribution process can proceed smoothly without further contention among beneficiaries or interested parties.

Finalizing Probate

Concluding the probate process involves the finalization of outstanding tasks and ensuring a smooth distribution of assets in accordance with the deceased’s wishes or applicable laws. This stage is crucial as it marks the end of the legal proceedings and ensures that all obligations are discharged before transferring ownership of the house to its rightful beneficiaries. The finalizing of probate can be a complex and time-consuming process, often requiring meticulous attention to detail.

One important aspect of finalizing probate is addressing any outstanding debts or claims against the estate. Before distributing assets, it is necessary to settle any remaining financial obligations, such as taxes, funeral expenses, or outstanding bills. This ensures that creditors are paid and prevents any potential disputes over unpaid debts after the distribution of assets. By diligently resolving these matters, the executor or personal representative ensures that the estate’s liabilities are appropriately settled before transferring ownership.

Another crucial step in finalizing probate is preparing an accurate inventory and appraisal of all assets held by the deceased, including their house. This inventory provides a comprehensive list of assets and their corresponding values, which helps determine how they will be distributed among beneficiaries. The house may need to be appraised by a professional to establish its fair market value at the time of death accurately. It is essential to ensure transparency in this process so that all parties involved have confidence in its fairness.

Ultimately, concluding probate requires careful attention to detail and adherence to legal protocols. By settling outstanding debts and properly valuing assets like a house through an inventory and appraisal process, executors can fulfill their duty while providing for an orderly transfer of ownership according to the deceased’s wishes or applicable laws. Understanding these steps helps individuals navigate through probate with greater ease and efficiency while ensuring a smooth transition for all parties involved in this challenging process.

Frequently Asked Questions

Can a house be sold during the probate process?

Yes, a house can be sold during the probate process. The court-appointed executor or administrator of the estate has the authority to sell the property in order to settle debts or distribute assets to beneficiaries.

What happens to a house if there is no will?

If there is no will, the distribution of a house during probate depends on the laws of intestacy in the jurisdiction. In general, the house may be inherited by close relatives according to a predetermined order set by law.

Can beneficiaries of the estate live in the house during probate?

Beneficiaries of an estate may be able to live in a house during probate, depending on the circumstances. However, ownership is typically transferred after probate is complete and the property is distributed to the beneficiaries.

Are mortgage payments still required during the probate process?

Mortgage payments are generally still required during the probate process. The house is considered an asset of the estate, and its expenses, including mortgage payments, must be managed by the executor or administrator.

Can the executor of the estate make changes to the house, such as renovations, during probate?

During probate, the executor of the estate may have limited authority to make changes to the house, such as renovations. However, they must act in the best interest of the beneficiaries and obtain necessary approvals from the court or other relevant parties.