Estate planning plays a crucial role in ensuring the smooth transfer of assets to beneficiaries, and trusts are often utilized as a means to bypass the probate process. However, it is important to recognize that even with the use of a trust, there are circumstances where it may still be subject to probate. Understanding why a trust might go to probate can help individuals navigate potential pitfalls and complications in their estate planning endeavors.

One of the primary reasons for a trust to go through probate is when legal requirements are not adequately met. Trusts must comply with specific laws and regulations, and any failure to do so can result in the need for court intervention. Additionally, complex trust structures can contribute to the involvement of probate. Sophisticated arrangements that involve multiple parties or intricate instructions may require judicial oversight to ensure proper execution. By comprehending these factors that may lead a trust into probate, individuals can take proactive measures in their estate planning journey and strive for mastery over this aspect of their financial future.

Reasons for Probate

One of the reasons why a trust would go to probate is due to disputes among beneficiaries regarding the distribution of assets, which can result in emotional turmoil and strained familial relationships. When a loved one passes away and leaves behind a trust, conflicts may arise between beneficiaries who have different expectations or interpretations of how the assets should be distributed. This can lead to lengthy legal battles and the need for court intervention through the probate process for real estate. Avoiding probate delays is often a priority for trustees, especially when it comes to selling real estate held in trust.

In some cases, beneficiaries may want to sell a house in trust quickly to access funds or divide the proceeds among themselves. However, if there are disagreements or conflicts about the sale, the property may need to go through probate before it can be sold. Fast house sale probate tips and strategies become crucial in such situations.

To navigate these challenges effectively, it is important for trustees and beneficiaries to consider various probate real estate selling strategies. For instance, they may choose to negotiate and resolve disputes outside of court through mediation or alternative dispute resolution methods. Additionally, seeking professional advice from an experienced attorney specializing in trusts and estates can help ensure that legal requirements are met during this process.

Transition: Understanding the sell my house fast Fort Worth legal requirements involved in probating a trust is essential for successfully navigating any disputes among beneficiaries and facilitating asset distribution without unnecessary delays.

Legal Requirements

To determine the validity and enforceability of a trust, it is essential to fulfill the legal requirements established by the governing jurisdiction. These legal requirements serve as safeguards to ensure that the trust reflects the intentions of its creator and protects the interests of beneficiaries. Failure to meet these requirements may result in the trust being deemed invalid or unenforceable, which could subsequently lead to the need for probate.

One of the primary legal requirements for a trust is proper documentation. This includes drafting a comprehensive trust agreement that clearly outlines the terms and conditions of the trust, such as identifying the trustee, beneficiaries, and assets included in the trust. Additionally, there should be clear language expressing that this document is intended to create a valid trust arrangement. Without proper documentation, it becomes difficult to establish whether a valid trust was created in accordance with applicable laws.

Another important legal requirement relates to asset ownership. In order for a trust to be valid, there must be a transfer of assets from the owner (also known as settlor) into the ownership of the trust itself. This transfer typically occurs through formalities such as executing deeds or changing titles on financial accounts. If these steps are not taken or if they are not properly executed, it can raise doubts about whether assets were truly placed within the control of the trust.

Meeting certain legal requirements is crucial for establishing a valid and enforceable sell my house fast Texas trust. Proper documentation and asset ownership transfers are key aspects that must be fulfilled in order for a trust to avoid probate proceedings. By adhering to these legal requirements, individuals can ensure their trusts will effectively carry out their wishes upon death without going through potentially costly and time-consuming probate processes.

Transitioning into discussing complex trusts structures: Understanding and fulfilling these legal requirements becomes even more critical when dealing with complex trust structures involving intricate estate planning strategies.”

Complex Trust Structure

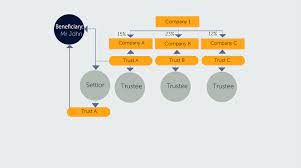

Complex trust structures present intricate estate planning strategies that require a thorough understanding of legal requirements for their validity and enforceability. These trusts often involve multiple layers, entities, and beneficiaries, making them more challenging to administer. Trust administration for quick sales, also known as probate real estate investors or executors guide to fast house sale, necessitates a deep knowledge of these complex structures.

Probate property liquidation can be a complicated process when dealing with complex trust structures. Executors and probate real estate investors must navigate the intricate web of legal obligations and ensure compliance with all applicable laws. They need to understand the rights and responsibilities of various parties involved in the trust administration for quick sales.

Navigating probate for quick sales requires expertise in handling disputes and challenges that may arise during the process. With complex trust structures, there is an increased likelihood of disagreements among beneficiaries or other interested parties. Executors must be prepared to address these conflicts effectively while ensuring a timely resolution.

Transitioning into the next section about ‘disputes and challenges,’ it is crucial to have a comprehensive understanding of complex trust structures to resolve any issues that may impede the quick sale of properties held within these trusts.

Disputes and Challenges

Disputes and challenges often arise in the context of complex trust structures, requiring a comprehensive understanding of legal requirements and effective resolution strategies to ensure a smooth and timely probate property liquidation process. When a trust is involved in probate, beneficiaries may have differing opinions on how the assets should be distributed or sold. In some cases, there may be disagreements over the valuation of the assets, leading to disputes that can prolong the probate process.

One common challenge is when multiple beneficiaries inherit property and wish to sell it fast for various reasons. Some beneficiaries may need immediate access to funds or prefer not to manage real estate properties. In such situations, it becomes crucial to accelerate the trust property sale while still following legal procedures. Executors or trustees must navigate these disputes by considering all relevant factors such as market conditions, fair distribution among beneficiaries, and compliance with applicable laws.

To address these challenges effectively, strategies like seeking mediation or alternative dispute resolution methods can help resolve conflicts more efficiently. Additionally, engaging professionals who specialize in handling probate property sales can offer valuable insights into navigating complex trust structures. These experts understand the urgency of selling inherited houses without delay and can provide guidance on how to obtain fast cash for probate houses while adhering to legal obligations.

Transitioning smoothly into the subsequent section about ‘unfunded or invalid trusts,’ it is important to note that disputes arising from complex trust structures are not limited to disagreements between beneficiaries. Other issues might involve unfunded or invalid trusts where legal technicalities come into play during probate proceedings. Understanding these potential obstacles will enable executors and trustees to address them appropriately and ensure a successful resolution of any disputes before proceeding further in the probate process.

Unfunded or Invalid Trusts

Unfunded or invalid trusts can present significant challenges within the probate process, requiring careful consideration of legal technicalities and appropriate resolution strategies. When a trust is unfunded, it means that the assets intended to be transferred into the trust have not been properly titled or transferred. This can occur due to oversight, lack of understanding about how trusts work, or simply neglecting to follow through with the necessary steps. An unfunded trust may result in the need for probate because without proper funding, the assets remain in the individual’s name at the time of their death.

Invalid trusts, on the other hand, are those that do not meet the legal requirements for creating a valid trust. This could be due to issues such as lack of capacity when creating the trust document, undue influence by another party involved in creating or amending the trust, or failure to comply with formalities required by state law. When a trust is deemed invalid by a court, it may also require probate proceedings to distribute assets according to intestacy laws.

The realization that a loved one’s trust is either unfunded or invalid can evoke various emotions and frustrations among beneficiaries and family members. Some common emotional responses include:

- Frustration: Discovering that an intended plan for asset distribution cannot be implemented due to an unfunded or invalid trust can lead to feelings of frustration and disappointment.

- Confusion: Understanding complex legal technicalities surrounding trusts and probate processes can be overwhelming for individuals who are not well-versed in estate planning law.

- Anger: If there are suspicions of foul play or intentional actions leading to an invalid or unfunded status of a trust, anger towards those responsible may arise.

- Anxiety: The uncertainty regarding how assets will be distributed and potential delays caused by resolving these issues can create anxiety among beneficiaries.

- Desperation: In cases where financial stability depends on receiving assets from a trust, discovering its unfunded or invalid status can result in feelings of desperation and urgency to find a resolution.

Addressing the challenges posed by unfunded or invalid trusts requires expert legal guidance and meticulous attention to detail. The subsequent section will discuss another common issue that may lead a trust to go through probate: insufficient trustee administration.

Insufficient Trustee Administration

In the previous subtopic, we discussed unfunded or invalid trusts and how they can lead to a trust going through probate. Another reason why a trust may end up in probate is due to insufficient trustee administration. The role of the trustee is crucial in ensuring that the terms and provisions of the trust are properly executed. However, if the trustee fails to fulfill their duties adequately, it can result in legal complications and ultimately lead to probate.

When a trust is created, it is essential for the trustee to understand their responsibilities and obligations. This includes managing and protecting the assets held within the trust, distributing income or principal as specified by the trust document, keeping accurate records, filing tax returns on behalf of the trust, and providing regular accounting to beneficiaries. If a trustee neglects these duties or acts negligently in carrying them out, it can give rise to disputes among beneficiaries or other interested parties.

Insufficient trustee administration can take various forms. For example, if a trustee fails to keep proper records or account for all transactions related to the trust’s assets, beneficiaries may question their actions and seek court intervention. Similarly, if a trustee does not distribute income or principal in accordance with the terms of the trust or unfairly favors certain beneficiaries over others, it can result in legal challenges that may require probate proceedings.

Insufficient trustee administration is another factor that can cause a trust to go through probate. It highlights the importance of selecting a competent and responsible individual as a trustee who understands their fiduciary duties and carries them out diligently. By doing so, potential conflicts and legal issues arising from inadequate administration could be minimized or avoided altogether. Transitioning into our next section about ‘distribution issues,’ let us now delve into how disputes over distributions can also contribute to trusts going through probate without step mentioned explicitly , resulting in delays and increased expenses for beneficiaries and the trust administration process.

Distribution Issues

Distribution issues within a trust can significantly impact the administration process, potentially leading to delays and increased expenses for beneficiaries. When a trust is created, the settlor specifies how the assets should be distributed among the beneficiaries. However, if there are ambiguities or conflicts in the trust document regarding distribution instructions, it can create confusion and disputes among the parties involved. This often leads to legal challenges and court intervention, ultimately resulting in probate.

One common distribution issue arises when there is no clear guidance on how to distribute specific assets or when their valuation becomes contentious. For example, if a trust includes real estate properties that need to be divided among multiple beneficiaries, determining their fair market value can be challenging. Disagreements may arise between beneficiaries who have different perceptions of what constitutes an equitable distribution. In such cases, probate court may need to step in to resolve these disputes and make final decisions on asset allocation.

Another distribution issue involves situations where there are unequal distributions or perceived inequities among beneficiaries. If some beneficiaries believe they were unjustly treated due to favoritism or unfair treatment by the trustee during asset distribution, they may contest the trust’s validity or file lawsuits against the trustee. Such disputes prolong the administration process and increase costs as legal fees accumulate.

Distribution issues within a trust can lead to probate when there are ambiguities or conflicts regarding asset allocation instructions or disagreements over perceived inequitable distributions. These issues not only cause delays but also result in increased expenses for beneficiaries who must engage in costly litigation processes to resolve disputes. It is crucial for trustees and settlors to ensure that trusts are drafted with clarity and specificity regarding distribution instructions to minimize potential conflicts that could trigger probate proceedings.

Frequently Asked Questions

What are the consequences of not going through probate for a trust?

Failing to go through probate for a trust can have serious consequences. Without court oversight, there is a risk of mismanagement or misuse of assets. Beneficiaries may not receive their rightful inheritance and legal disputes may arise.

Can a trust go to probate if the trustee is still alive?

A trust can go to probate even if the trustee is still alive if there are disputes or issues with the trust that need to be resolved by a court. Probate ensures proper administration and distribution of assets according to the terms of the trust.

Is it possible to contest a trust that has already gone through probate?

Yes, it is possible to contest a trust that has already gone through probate. This can be done by filing a lawsuit challenging the validity or terms of the trust document in court.

Are there any alternatives to probate for a trust?

There are alternative methods to probate for trusts, such as using revocable living trusts or joint tenancy with right of survivorship. These options allow assets to pass directly to beneficiaries without the need for court involvement.

How long does the probate process typically take for a trust?

The probate process for a trust typically takes several months to a year, depending on various factors such as the complexity of the trust, any disputes among beneficiaries, and court schedules.

Other Articles You Might Enjoy

Why You Should Declutter Your Home Before Selling