Navigating the property tax landscape in Fort Worth, Texas, is a critical aspect of property investment. Property taxes, a substantial component of homeownership, encompass local municipal, county, and school district taxes. These taxes are typically calculated based on the appraised value of the property, and the total due is determined by the tax rate set by various tax authorities, including the city, county, and school districts. A comprehensive understanding of these elements can empower prospective homeowners and investors to make well-informed decisions. This article will explore the entities responsible for setting the tax rate, the factors that influence the tax rate, and how Fort Worth’s property tax rate compares to other major cities in Texas. Additionally, we’ll shed light on available tax exemptions and reductions, and how these rates impact housing affordability.

Entities Setting the Tax Rate and Calculation Process

Fort Worth property tax rate is set and determined by several taxing entities, each with a unique role in the process. The main players include the City of Fort Worth, Tarrant County, and local school districts, such as the Fort Worth Independent School District and others, depending on the property’s location.Each of these entities establishes its own tax rate, usually calculated per $100 of assessed property value. For example, if the tax rate is $0.75 per $100, and a house is appraised at $200,000, the property tax would be $1,500.

Let’s break down the process of setting the property tax rate:

- Appraisal: The Tarrant Appraisal District (TAD) annually assesses the value of all properties in the county. They take into account factors such as property size, construction quality, location, and market trends.

- Tax rate proposal: Each tax entity, including the city, county, and school districts, proposes their tax rates based on their budget needs for the upcoming year. This typically occurs around August or September.

- Public hearings: Tax entities hold public hearings to gather feedback on their proposed rates. These meetings provide residents with an opportunity to express concerns or seek clarifications about property tax rates.

- Approval: After considering public input, each entity finalizes and adopts their tax rates for the year.

- Tax imposition: Once the rates are approved and adopted, the tax entities levy the taxes based on property values from TAD’s assessment. Tax bills are usually sent to homeowners in October or November, with payment due by January 31 of the following year.

By understanding this process, property owners in Fort Worth can better anticipate and budget for their annual property tax obligations.

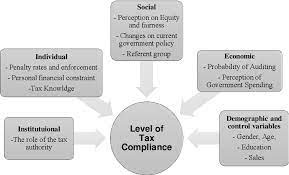

Factors Influencing the Tax Rate

A multitude of elements come into play when setting the property tax rate in sell my house fast Fort Worth. Gaining a grasp on these elements allows property owners to predict potential shifts in their annual tax obligations. Here are the primary factors to consider:

- City Budget: The annual budget of Fort Worth has a significant impact on the local tax rate. If the city foresees an increase in expenditures in sectors such as public safety, education, or infrastructure, it may need to adjust the tax rate upwards to meet these costs.

- Property Value: The Tarrant Appraisal District conducts yearly assessments of all properties within the county. If your property’s assessed value rises, you may see an increase in your property tax, even if the tax rate remains unchanged. On the other hand, if property values across the city decline, the city may increase the tax rate to compensate for this loss.

- School District Budgets: The budgets of local school districts also weigh heavily on the property tax rate. If a district anticipates higher expenses, perhaps for new facilities or educational programs, it may raise its portion of the tax rate.

- Voter Approved Tax Rates: Occasionally, voters may greenlight increases to the property tax rate through special tax referendums or bond proposals. These typically fund specific initiatives or projects.

- County and State Guidelines: Guidelines from Tarrant County and the State of Texas can also sway the tax rate. If these higher authorities modify their tax directives or expectations, Fort Worth may adjust its rate to remain in compliance.

By staying informed about these factors and the decisions made by local taxing entities, property owners can better predict changes in their property tax bills and plan their budgets accordingly.

Comparing Fort Worth Property Tax Rate to Other Major Cities in Texas

In assessing the expenses associated with property ownership in Texas, it’s crucial to juxtapose the property tax rates of various cities. This comparison can significantly influence the total cost of property ownership. Let’s examine how Fort Worth’s property tax rate stacks up against three other major Texas cities: Dallas, San Antonio, and Houston.

Given the factors that influence the tax rate, it’s important to remember that discrepancies between cities can arise from differences in budget requirements, property values, and voter-approved tax rates, among other things. So, how does Fort Worth and sell my house fast Texas fare when compared to these cities? We’ll explore this in more detail in the following subsection.

Comparisons with Dallas, San Antonio, and Houston

The property tax rates in Fort Worth, Dallas, San Antonio, and Houston are as diverse as the cities themselves, each reflecting their unique economic climates, residential values, and operational demands.

- Dallas: Nestled to the east of Fort Worth, Dallas often carries a marginally higher property tax rate. This can be traced back to the city’s expansive services, infrastructure demands, and elevated property valuations.

- San Antonio: Contrarily, San Antonio’s property tax rate generally falls below that of Fort Worth. This is influenced by the city’s distinct community services, fluctuating property values, and budgetary allocations.

- Houston: Houston’s property tax rate typically surpasses that of Fort Worth. The sprawling city’s extensive budget for maintaining its wide range of services and its high property values are key contributors to this elevated rate.

It’s important to note that these comparisons are subject to annual changes due to the evolving budgetary requirements and expenditure projections of each city. Therefore, this comparison should be viewed as a snapshot of the varied property tax landscape in Texas. For the most accurate and up-to-date rates, it is recommended to consult with a specialist or conduct thorough research before making property investment decisions in these cities.

Navigating Fort Worth Property Tax Exemptions and Reductions

The property tax rate in Fort Worth can significantly influence the cost of property ownership. However, a variety of property tax exemptions and reductions are available that can help alleviate these costs. These exemptions, each with its own specific criteria and applicable property types, can play a pivotal role in enhancing real estate affordability. A deep understanding of these exemptions can lead to substantial savings in property tax payments. The following section will delve into the details of specific exemptions such as Residential Homestead, Senior Citizen, Disability exceptions, and other potential reductions.

Details of Residential Homestead, Senior Citizen, Disability Exemptions, and Other Reductions

In the realm of property taxes, exemptions can be a game-changer for homeowners in Fort Worth. Let’s delve into some of the most prevalent exemptions and the tax relief they offer.

Firstly, the Residential Homestead Exemption subtracts a portion of your home’s value from taxation, effectively reducing your overall property tax obligation. This benefit is available to homeowners who claim the property as their primary residence as of January 1 of the tax year.

Secondly, the Senior Citizen Exemption provides additional tax relief for homeowners aged 65 or older. This exemption not only lessens the taxable property value but also places a cap on future property tax increases.

Thirdly, the Disability Exemption offers similar benefits to the Senior Citizen Exemption. Homeowners with a disability can enjoy an additional homestead exemption, which also includes a tax ceiling that restricts future property tax hikes.

Lastly, there are other reductions to consider. These may include exemptions for surviving spouses of disabled individuals or military service members who are at least 10% disabled, lost their lives in active duty, or survived a military conflict.

Remember, each exemption comes with its own set of eligibility criteria and application processes. It’s essential to navigate these correctly to fully benefit from these provisions. For advice tailored to your specific situation, it’s always wise to consult with a tax professional. This information serves as a basic guide to the property tax exemptions and reductions in Fort Worth.

The Impact of Fort Worth Property Tax Rate on Housing Affordability

The property tax rate is a pivotal element in assessing housing affordability in any city, Fort Worth included. Despite the availability of various property tax exemptions that can alleviate the tax burden, a higher property tax rate can still significantly influence housing affordability. The subsequent sections will delve deeper into the correlation between property tax and housing costs, as well as tax considerations for prospective home buyers in Fort Worth. Understanding these factors is crucial in grasping the true cost of homeownership and making well-informed financial decisions.

Understanding the Relationship Between Property Tax and Housing Costs

Property tax, an annual financial obligation, plays a pivotal role in determining housing affordability. The correlation between property tax and housing costs is straightforward – as property taxes rise, the overall cost of homeownership escalates, thereby diminishing affordability, and the opposite holds true.

The crux of this relationship lies in the tax rate. A lofty property tax rate amplifies the annual property taxes, rendering housing less affordable, even if the property’s initial price tag is modest. This often overlooked expense can significantly inflate the monthly outlay for mortgage holders or the direct costs for outright property owners.

Equally significant is the property’s assessed value. The property tax rate is multiplied by the property’s appraised value to compute the total tax. Consequently, a surge in the property’s assessed value will inevitably result in an uptick in the property tax, even if the tax rate remains static.

Conversely, tax exemptions and reductions can mitigate the effective tax rates. For example, a homestead exemption can diminish the taxable value of a home, resulting in lower property taxes and enhancing the home’s affordability.

In essence, grasping this relationship is vital for prospective homebuyers as it provides a comprehensive understanding of the true cost of homeownership beyond the asking price. It’s imperative to incorporate potential property taxes when assessing the affordability of a home.

Tax Considerations for Potential Home Buyers in Fort Worth

For those considering a home purchase in Fort Worth, it’s essential to grasp the tax implications to make an informed decision. Here are some pivotal considerations:

- Tax Rates: Scrutinize not only the prevailing tax rate but also historical trends. This will offer a glimpse into potential future tax variations. Bear in mind, a seemingly attractive purchase price can lose its allure if it’s offset by hefty property taxes.

- Assessed Value: Property tax is derived from the property’s assessed value, not the purchase price. Be cognizant of this and inquire about the assessed value when considering a property.

- Exemptions: If you qualify, contemplate applying for various property tax exemptions, such as the Residential Homestead Exemption. These exemptions can significantly reduce annual tax bills and enhance the affordability of your home.

- Area Development: Are there impending development plans for the area? Enhanced amenities often elevate property values, which could result in increased taxes in the future.

- Escrow: If you’re financing your property with a mortgage, your mortgage company may incorporate property taxes into your monthly payment and hold the funds in an escrow account. Be sure to factor this into your budget calculations.

In conclusion, taking these property tax factors into account will enable you to accurately gauge the total cost of owning a home in Fort Worth and sidestep potential financial hurdles. Seeking advice from a Fort Worth real estate professional or tax advisor can also offer additional local insight and guidance.

Frequently Asked Questions

1. What is the current Fort Worth property tax rate?

The Fort Worth property tax rate for the year 2022 is $0.746 per $100 of assessed value (City of Fort Worth, 2022).

2. How often is the Fort Worth property tax rate updated?

The Fort Worth property tax rate is determined and updated annually, typically during the budget setting process of the City Council (City of Fort Worth, 2022).

3. How does Fort Worth’s property tax rate compare to other Texas cities?

Fort Worth’s property tax rate is lower than many other major Texas cities such as Austin and Dallas, but higher than cities like Houston (Texas Comptroller of Public Accounts, 2022).

4. Where do the funds from Fort Worth’s property tax go?

Funds from Fort Worth’s property tax predominantly fund services such as public safety, parks, libraries, and infrastructure maintenance (City of Fort Worth, 2022).

5. How is the Fort Worth property tax rate calculated?

The Fort Worth property tax rate gets multiplied by the assessed value of the property and divided by 100. This calculation determines the amount payable (Tarrant County, 2022).

6. How can a homeowner in Fort Worth contest their property tax assessment?

Homeowners in Fort Worth can contest their property tax assessment by filing a protest with the Tarrant County Appraisal District during the specified protest period (Tarrant County, 2022).