In the realm of real estate, foreclosure is a term that carries with it significant ramifications. This process signifies the legal seizure of a property by a lender due to the homeowner’s inability to meet mortgage obligations. Understanding the pre-foreclosure process, its length and intricacies, can prove invaluable for struggling homeowners and prospective buyers alike. Mastery of this knowledge can empower these individuals to make informed decisions, potentially mitigating financial distress.

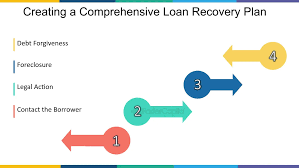

The stages involved in the pre-foreclosure process are manifold and complex. Beginning with an initial notice by the lender, this journey weaves through numerous phases including borrower response timeframes, lender’s legal proceedings, auction preparation, auction day and post-auction actions. Each stage bears its own unique timeline and procedures which need comprehensive exploration to gain a holistic understanding of this intricate process. This article aims to dissect each aspect meticulously while highlighting their respective durations within the overall pre-foreclosure timeline.

Understanding Foreclosure

Foreclosure, an intricate procedure that can vary in duration, typically ensues when a homeowner fails to meet mortgage obligations; understanding this process is vital, especially considering the pre-foreclosure phase can extend from several months up to a year. The pre foreclosure process requires an intricate understanding of both legal and financial aspects entailed. It begins when a borrower starts missing their monthly payments and ends just before the lender auctions off the property. Grasping this concept is crucial as it allows homeowners to strategize on ways they could potentially halt or slow down foreclosure proceedings.

One must also grasp the pre foreclosure timeline which demarcates sell my house fast Fort Worth significant steps in pre foreclosure that are time-bound. This timeline presents strategically important deadlines such as notices of default and potential auction dates. Knowledge about these schedules offers some power back to homeowners who might otherwise feel helpless during the overall foreclosure proceedings duration. Understanding each step not only demystifies what may seem like an overwhelming predicament but also provides avenues for intervention with potential solutions.

Understanding foreclosure is indeed more than just knowing how long it takes; it’s about comprehending its intricacies, grasping key timelines and milestones within its process; information that empowers those affected by it to make informed decisions regarding their properties rather than being passive victims of circumstance. With such comprehension comes the ability to plan ahead effectively and possibly mitigate any negative impact on one’s future financial stability or housing prospects. Becoming aware of one’s rights following receipt of an initial notice can serve as a stepping stone towards managing this complex scenario better.

Initial Notice

In the initial notice phase, homeowners are typically given a period of 30 to 120 days to rectify their default status, depending on the state’s laws. This stage is critical in the pre foreclosure process as it sets into motion a legal process that could potentially lead to the loss of one’s home. During this time frame, a Notice of Default (NOD) or lis pendens—a public announcement that conveys information about the mortgage being in arrears—is usually recorded.

- The pre foreclosure time frame varies from one jurisdiction to another and may be influenced by factors such as whether judicial or non-judicial foreclosure proceedings are followed.

- Homeowners have various pre foreclosure options at their disposal during this period. These include negotiation for a revised payment plan with lenders, application for loan modification programs, or selling the property through short sale.

- Pre foreclosure help can come in several forms such as counselling services from HUD-approved agencies, assistance from real estate professionals experienced in dealing with distressed properties, and legal advice from attorneys specializing in foreclosures.

- Navigating the pre foreclosure maze requires understanding of pertinent laws and regulations pertaining to foreclosures within one’s state or county. It also demands proactive steps towards addressing financial challenges.

- Becoming aware of rights as a homeowner during pre foreclosure is crucial. This can protect individuals from predatory practices by certain entities which exploit homeowners under financial stress.

The last part of this initial notice stage involves sending out an official notification detailing how much is owed (including any penalties), why it is considered due and instructions on how to cure the default within a specified timeframe—usually not less than 30 days after sending out mail notification—to avoid potential acceleration of debt or initiation of sell my house fast Texas foreclosure proceedings. This letter also includes information about potential consequences if failure to redeem occurs within stipulated timelines. Understanding these procedures provides insight into what comes next: mapping out an effective borrower response timeline without necessarily moving to the next phase of foreclosure.

Borrower Response Timeline

Crafting a strategic borrower response timeline is vital for homeowners who have received an initial notice of default, as it may significantly influence the course and duration of potential foreclosure proceedings. The pre foreclosure process typically commences with a notice from the lender upon a homeowner’s failure to meet contractual obligations such as mortgage payments. It is during this period that borrowers should begin mastering the pre foreclosure timeline by comprehending their legal rights, examining available options and potentially initiating negotiations with lenders to forestall foreclosure.

The borrower response timeline involves several critical steps which can be instrumental in determining the outcome of the pre foreclosure sale process. It is essential for homeowners to take immediate action upon receiving a notice of default, since every day counts in mitigating possible adverse outcomes. A timely response will allow borrowers enough room to explore alternative solutions like loan modification or short sale. Additionally, entering into pre-foreclosure negotiation with lenders might provide opportunities for mortgage repayment restructuring or other feasible arrangements that could halt the progression towards foreclosure.

Moreover, understanding and adhering to the borrower response timeline could facilitate better control over one’s financial circumstances while navigating through this phase of uncertainty. Proactive engagement in managing these challenges not only helps restore financial stability but also cultivates resilience against future potential threats. As part of this process, it becomes crucial for homeowners to seek professional advice where necessary, engage positively with their lenders, and stay informed about any changes in legislation or policy that might affect their situation. This engagement segues into the subsequent section which delves deeper into exploring lender’s legal procedures without explicitly stating them as ‘steps’.

Lender’s Legal Steps

Navigating through the intricate pathways of a lender’s legal procedures requires an insightful understanding of the various steps involved, offering homeowners a better chance to manage their financial predicament. The initiation of these proceedings forms part of the pre foreclosure process, where lenders, often banks or other financial institutions, begin by issuing a notice default (NOD) to the borrower. This document is essentially a declaration that the homeowner has defaulted on their mortgage agreement due to unpaid debts. During this phase, it is critical for homeowners to consider swift solutions selling your house fast; this strategy can prevent further progression into foreclosure while also maintaining some control over one’s financial destiny.

The art of quick home sales becomes an essential tool in this scenario. As real estate market trends continually evolve, it’s important for homeowners navigating these precarious waters to understand how they can leverage such trends towards their advantage. For instance, in a seller’s market where demand outweighs supply, homeowners might find themselves with multiple offers and competitive bids which could expedite the sale and potentially cover their outstanding debts. Indeed, selling your house: a fast-paced guide would be an invaluable resource during these challenging times as it offers strategies that could expedite transactions and mitigate losses.

In tandem with considering potential buyers in the open market are necessary legal actions taken by lenders who may continue with foreclosure procedures if payments remain unfulfilled after NOD issuance. It is at this point that auction preparation ensues; marking another milestone within lender’s legal steps towards recovering owed funds. A comprehensive understanding of these processes ensures proactive measures can be implemented before reaching such stages – thereby increasing chances for successful negotiations with lenders or even successful quick house sales before any formal auction proceedings commence.

Auction Preparation

The preparation for auction marks a pivotal stage within the lender’s legal steps, as it signifies that the property is imminent to being sold off in an effort to recoup unpaid mortgage debts. At this juncture, homeowners who desire an accelerated property sale may seek real estate negotiation tips or strategies like “sell my house quickly”or “sell property fast”. The urgency of this phase emphasizes the need for swift action, particularly for those who wish to evade the impending foreclosure and auction process.

- Notice of Sale: A public notice is issued announcing a forthcoming auction. This notification provides crucial information such as the date, time and location of the auction.

- Property Exhibition: Potential buyers are given access to view or inspect the property before placing their bids. This helps ensure transparency and informs bidders about what they are investing in.

- Starting Bid Determination: The lender sets an initial bid amount which usually covers their outstanding mortgage debt plus any additional fees incurred during the pre-foreclosure process.

- Bidder Registration: Interested parties must formally register in order to participate in bidding at the auction.

These four stages characteristically define how lenders prepare for auctions during pre-foreclosure processes. They represent critical points where homeowners can intercede with fast house sale strategies to prevent their properties from reaching auction blocks.

As these preparations culminate, all eyes then turn towards ‘auction day’. It presents both opportunities and risks – a chance for potential investors seeking profitable deals as well as a point of no return for homeowners still attempting last-minute efforts to prevent foreclosure sales of their homes.

Auction Day

Transitioning from the preparation phase, Auction Day marks a significant juncture in the pre foreclosure process. It is on this day that the culmination of all efforts to forestall foreclosure are put to the test. The primary objective for this stage is to maximize property value while ensuring a quick home sale.

Selling property tips can be particularly useful during auction day. One key strategy is pricing your home to sell – setting a realistic price that reflects market conditions and the property’s actual worth can be instrumental in attracting home buyers. However, it is also important not to undersell and lose potential earnings from the transaction. Another critical tip involves enhancing the aesthetic appeal of your home, which plays an essential role in attracting potential buyers and maximizing property value. Ensure necessary repairs are done, declutter your space, improve landscaping and consider staging your house professionally if possible.

While a successful auction concludes with securing a buyer willing to meet or surpass set selling price, it isn’t always guaranteed; thus contingency plans should be put in place. Various factors including market conditions or low turnout could affect expected outcomes on auction day prompting alternative solutions such as negotiating short sales or seeking deed-in-lieu agreements with lenders. This necessitates further exploration into post-auction actions aimed at handling any aftermaths of auction days that do not go as planned.

Post-Auction Actions

Exploring post-auction actions becomes crucial when the anticipated home sale does not materialize on auction day. At this point, several expedited home sale strategies can be employed to ensure a speedy resolution of the foreclosure process. It is important to note that these strategies are no different from those used in a traditional home selling scenario and require efficiency and precision in execution.

- Firstly, an immediate re-listing of the property may prove fruitful as it provides another opportunity for interested buyers who might have missed out on the initial auction. This rapid house selling strategy keeps the property visible in the market.

- Secondly, working with real estate agents or brokers knowledgeable in foreclosure properties proves beneficial. These professionals understand how to navigate such situations efficiently and can provide pro tips for a rapid home sale.

- Lastly, reaching out directly to potential buyers or investors can speed up the selling process. In many cases, investors are interested in purchasing foreclosed properties due to their potential high return on investment.

The post-auction phase doesn’t necessarily signify failure but offers an alternative route towards achieving a successful home sale. Embracing these suggestions could facilitate expedited transactions, leading to speedy home selling even after failed auctions. The emphasis here rests on being proactive and responsive – constantly seeking opportunities while also remaining flexible enough to adjust plans based on prevailing circumstances. Such practices will undoubtedly assist homeowners facing foreclosure by offering them effective options for quick sales, thereby potentially alleviating financial distresses associated with lengthy foreclosure processes.

Frequently Asked Questions

What are some strategies to prevent entering the pre-foreclosure process?”

Strategies to avert pre-foreclosure encompass maintaining regular mortgage payments, negotiating loan modification with the lender, refinancing the mortgage, or selling the property before foreclosure is initiated.

How does the pre-foreclosure process affect your credit score and for how long?”

The pre-foreclosure process can significantly impact one’s credit score, typically causing a reduction of 85-160 points. This negative effect may linger for seven years, hampering future borrowing and credit opportunities.

Can you sell your property while it’s in the pre-foreclosure process?”

Yes, it is feasible to sell a property during the pre-foreclosure process. This procedure, known as a short sale, allows homeowners to avoid foreclosure by selling their property for less than they owe on their mortgage.

What are the potential tax implications of going through the pre-foreclosure process?”

Potential tax implications of the pre-foreclosure process may include cancellation of debt income, which could be taxable. Additionally, any capital gains from a short sale or deed in lieu could also be subject to taxes.

Are there any specific laws or regulations about the pre-foreclosure process that vary by state or country?”

Yes, regulations for the pre-foreclosure process can differ significantly by state and country. These variations may include timeline, notice requirements, and rights of redemption, demonstrating the importance of local legal counsel.

Other Articles You Might Enjoy

How Long Should You Leave Your House On The Market If It Doesnt Sell