Selling a house can often be a cumbersome and time-consuming process, with the involvement of real estate agents and traditional buyers. However, an alternative method that has gained popularity in recent years is selling your house to an iBuyer.

This article aims to provide an objective and informative overview of the concept of selling your house to an iBuyer, as well as the pros and cons associated with this approach.

An iBuyer refers to a company or platform that uses technology and data analysis to make quick cash offers on houses. The process typically involves submitting information about your property online, which is then evaluated by the iBuyer using algorithms and market data. If interested, they may present you with a cash offer within days, allowing for a swift sale without the need for extensive negotiations or marketing efforts.

By understanding how selling your house to an iBuyer works and weighing the advantages against potential drawbacks, homeowners can make informed decisions regarding their property sale.

This article will delve into various aspects such as considerations before choosing this method over traditional sales, comparing it with conventional approaches, preparing the house for sale, negotiating offers effectively, and ultimately closing the deal successfully.

With this knowledge at hand, readers will be equipped to navigate through the process confidently while maximizing their benefits from selling their home through an iBuyer platform.

How It Works

When selling your house to an iBuyer, it is crucial to understand the intricacies of how the process works in order to make informed decisions and maximize the potential benefits.Firstly, a cost analysis should be conducted to determine if selling to an iBuyer is financially advantageous. While iBuyers may offer convenience and speed, they typically charge higher fees compared to traditional real estate agents. It is important to weigh these fees against potential savings in repairs, staging, and holding costs that would be incurred when selling through other methods.

Secondly, understanding the timeline expectations is essential when selling your house to an iBuyer. One of the main advantages of working with an iBuyer is the expedited sale process. Typically, after submitting information about your property online, you can expect a preliminary offer within 24-48 hours. If you decide to proceed with the sale, a home inspection will be conducted by the iBuyer’s representative. This step ensures that any necessary repairs or adjustments are factored into their final offer. Once both parties agree on a price, closing can occur within days or weeks rather than months as in traditional sales.

Lastly, it is important to gather all required documentation before engaging with an iBuyer. This includes necessary paperwork such as proof of ownership, property tax records, utility bills, mortgage details (if applicable), and any relevant sell my house fast Fort Worth permits or certificates of compliance. Having these documents readily available will help streamline the process and avoid unnecessary delays.

Understanding these aspects of selling your house to an iBuyer sets a solid foundation for making informed decisions throughout the process. Now that we have explored how it works in terms of cost analysis, timeline expectations, and required documentation; let’s delve into examining its pros and cons more closely without losing sight of our subconscious desire for mastery in this area.

Pros and Cons

One of the advantages and disadvantages of opting for this alternative method of property transaction is that it can be likened to a double-edged sword, as it offers both benefits and drawbacks. When considering selling your house to an iBuyer, it is important to consider the current market trends. iBuyers typically operate in specific markets where they have identified sufficient demand and profitability. Therefore, if your property is located in an area where iBuyers are active, you may benefit from their ability to quickly purchase properties. On the other hand, if there is limited iBuyer activity in your area, you may find it more challenging to sell your house using this method.

Financial implications also play a significant role when deciding whether or not to sell your house to an iBuyer. While iBuyers offer convenience and speed, they often charge fees higher than traditional real estate agents. Additionally, since these companies aim to make a profit from reselling your property, their initial cash offer may be lower than what you could potentially achieve on the open market. It is crucial to carefully evaluate these financial aspects before making a decision.

Another factor to consider is the timeframe expectations associated with selling through an iBuyer. If you need to sell your house quickly due to personal circumstances or time constraints, selling to an iBuyer can provide a speedy solution. However, if timing is not critical and maximizing profits takes precedence over speed, working with a traditional real estate agent might be more suitable.

Considering the potential risks involved in selling your house through an iBuyer platform is essential as well. Some risks include receiving lowball offers that undervalue your property or encountering hidden fees during the transaction process. It’s important to conduct thorough research on different iBuyers and read reviews from previous sellers who have used their services.

Real estate agent involvement is another aspect worth mentioning when discussing sell my house fast Texas through an iBuyer platform. Unlike traditional transactions, selling to an iBuyer typically eliminates the need for a real estate agent. While this can save you money on commissions, it also means that you will be responsible for handling all aspects of the sales process yourself.

Transition into the subsequent section about ‘considerations’: Taking into account these various factors and considerations when evaluating whether to sell your house to an iBuyer is crucial in making an informed decision about the best approach for your specific circumstances.

Considerations

Taking into account various factors and considerations is essential when deciding whether to opt for the alternative method of selling a property through an iBuyer platform.

One important consideration is the market value of the house. While iBuyers typically offer a quick and convenient sale, they may not pay the full market value for the property. It is crucial for homeowners to compare iBuyer offers with traditional sale options to ensure they are getting a fair price.

Another factor to consider is the inspection process. In a traditional sale, potential buyers often request inspections before finalizing the purchase. However, with an iBuyer transaction, there may be a more streamlined or limited inspection process. Homeowners should be aware that this could potentially lead to lower offers or unexpected repair costs if issues are discovered later on.

Timeframe expectations are also important to consider when selling through an iBuyer platform. While these platforms offer quick sales, it’s essential to understand that there might still be some waiting time involved. The timeframe can vary depending on factors such as location and demand in the housing market.

In addition to these factors, sellers should also evaluate potential repair costs and selling fees associated with using an iBuyer platform. Some iBuyers may require sellers to make repairs or deduct repair costs from their offer price. Additionally, sellers should be aware of any fees charged by the iBuyer for their services.

Considering all these factors allows homeowners to make an informed decision about whether selling through an iBuyer platform aligns with their needs and goals. By comparing different options and understanding both pros and cons, homeowners can determine whether they prefer this alternative method or would rather pursue a traditional sale approach.

Comparison with Traditional Sale

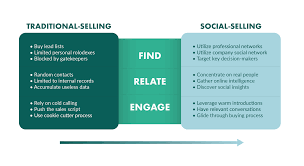

A critical aspect to consider when evaluating the alternative method of selling a property through an iBuyer platform is how it compares to the traditional sale process.

One key difference lies in pricing. With traditional sales, sellers often have more control over setting the listing price and negotiating with potential buyers. However, iBuyers typically provide sellers with an instant cash offer based on automated valuation models, which may not always take into account unique features or market conditions that could affect the property’s value.

Another important consideration is the timeframe for selling a house. Traditional sales can sometimes be a lengthy process, involving multiple showings, negotiations, and potential delays in finding a suitable buyer. In contrast, iBuyers offer a quicker turnaround time by providing sellers with immediate offers and closing deals within days or weeks. This expedited timeline can be advantageous for sellers who need to sell their home quickly or want to avoid the uncertainties of a prolonged selling process.

The inspection process also differs between selling to an iBuyer and going through traditional channels. When working with an iBuyer, there is usually less emphasis on inspections as they generally purchase properties ‘as-is.’ This means that sellers do not have to invest time and money in making repairs or upgrades before selling their house. In contrast, traditional sales often involve thorough inspections by potential buyers, which may uncover issues that require addressing before finalizing the sale.

In comparison to traditional sales, financing options are another factor worth considering when selling your house to an iBuyer. While traditional buyers may rely on mortgage loans for purchasing a property, iBuyers typically use their own funds or partnerships with investors to make cash offers. This eliminates the risk of deals falling through due to financing issues and provides certainty for sellers regarding payment.

Considering these differences in pricing, timeframe, inspection processes, financing options, and flexibility for sellers between selling your house to an iBuyer versus through traditional methods highlights the unique advantages each approach offers. To ensure a successful transaction, it is essential to also prepare your house adequately for the selling process, which will be discussed in the subsequent section.

Preparing Your House

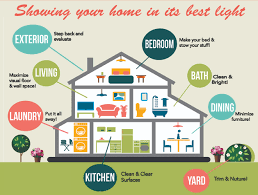

To ensure a smooth and successful transaction, it is crucial to thoroughly prepare the property before initiating the selling process. One important aspect of preparing your house for sale is staging.

Staging involves arranging furniture and decor in a way that showcases the potential of each room and creates an inviting atmosphere for potential buyers. This can include rearranging furniture to maximize space, adding fresh flowers or plants, and removing personal items to create a neutral canvas that allows buyers to envision themselves living in the space.

Another key element of preparing your house for sale is enhancing its curb appeal. First impressions matter, and potential buyers will often form an opinion about your property before even stepping foot inside. Simple tasks such as mowing the lawn, trimming hedges, and planting colorful flowers can greatly enhance the exterior appearance of your home. Additionally, making sure that the front door is clean and freshly painted can make a significant difference in creating an inviting entrance.

In addition to staging tips and improving curb appeal, it’s essential to address any necessary home repairs before listing your property with an iBuyer. Potential buyers may be deterred by visible issues such as leaky faucets, cracked tiles, or outdated fixtures. Taking care of these repairs ahead of time not only increases your chances of receiving competitive offers but also signals to buyers that you have maintained the property well.

By decluttering your home, you create a more spacious and organized environment that appeals to potential buyers. Remove any unnecessary items from countertops, shelves, and closets so that buyers can visualize their own belongings in the space. Consider renting a storage unit if needed to temporarily store larger items or excess furniture.

Setting an appropriate pricing strategy is crucial when selling your house to an iBuyer. Research comparable properties in your area and consult with real estate professionals who have experience working with iBuyers in order to determine a fair asking price for your home. A well-priced property will attract more attention from potential buyers and increase the likelihood of receiving competitive offers.

In the subsequent section about negotiating the offer, it is important to carefully consider the terms presented by the iBuyer. Transitioning into this topic, understanding how to properly evaluate and negotiate an offer can help ensure a successful transaction with an iBuyer.

Negotiating the Offer

When engaging in a transaction with an iBuyer, skillfully navigating the negotiation process is crucial to ensure a mutually beneficial outcome for both parties involved. One important aspect of negotiating the offer is employing effective counteroffer strategies. This involves carefully considering the initial offer and identifying areas where adjustments can be made to better align with your expectations. By presenting a well-reasoned counteroffer, you increase the likelihood of reaching a favorable agreement.

In addition to counteroffers, evaluating competing offers is another essential step in negotiating with an iBuyer. It’s important to carefully review each offer, taking into account not only the price but also any additional terms or contingencies that may impact the overall value of the offer. By comparing and contrasting these offers, you can make an informed decision about which one best meets your needs.

Another factor to consider during negotiations is dealing with inspection issues. An iBuyer will typically conduct a thorough inspection of your property before finalizing their offer. It’s important to be prepared for potential issues that may arise during this process and have a plan in place for addressing them. Whether it’s negotiating repairs or credits, being proactive and open to finding solutions can help facilitate a smoother negotiation process.

Understanding the iBuyer’s pricing algorithm is also crucial when negotiating with these companies. Each iBuyer has its own unique algorithm that determines how they arrive at their offer price. Educating yourself about how this algorithm works can give you valuable insights into what factors are considered and how they may impact the final offer price.

By skillfully navigating through these aspects of negotiation, you are better positioned to reach a mutually satisfactory agreement with an iBuyer. Once negotiations are successfully completed, it’s time to move on to closing the deal without delay.

Transition: Now that we have explored effective negotiation strategies when working with an iBuyer, let us delve into the next step – closing the deal

Closing the Deal

The final step in the process of selling your house to an iBuyer is closing the deal, which involves completing the transaction by finalizing all necessary paperwork and ensuring that both parties fulfill their obligations.

This stage typically includes finalizing the agreement between the seller and the iBuyer, preparing and signing legal documentation, facilitating the payment process, addressing any post-sale obligations, and ultimately handing over the keys.

During this phase, it is crucial for both parties to carefully review and finalize all aspects of the agreement. This includes confirming important details such as the purchase price, any contingencies or conditions, and specific timelines for completion.

Once all parties are satisfied with these terms, legal documentation will need to be prepared. This may involve drafting a purchase agreement or other relevant forms that outline the terms of sale and protect both buyer and seller.

Another critical aspect of closing a deal with an iBuyer is ensuring a smooth payment process. Typically, iBuyers offer fast cash transactions that can often be completed within days or weeks. However, it is essential for sellers to understand how they will receive their funds and when they can expect payment. Clear communication regarding payment methods and timing should be established upfront to avoid any confusion or delays.

Once all financial matters have been settled, there may be some post-sale obligations that need attention. For instance, if repairs were agreed upon during negotiations or if certain items were included in the sale but still need to be removed from the property before transfer of ownership occurs. Both parties must ensure that these obligations are met promptly according to agreed-upon timelines.

Once all paperwork has been signed, payments have been made or received as agreed upon by both parties; it’s time for you as a seller to hand over the keys to your property officially. At this stage in closing a deal with an iBuyer service provider like Opendoor.com or Offerpad.com etc., you will relinquish physical possession of your property and transfer ownership rights to the iBuyer. This symbolic gesture represents the completion of the transaction and marks the end of your relationship with the iBuyer as a seller.

In conclusion, closing a deal when selling your house to an iBuyer involves finalizing the agreement, completing legal documentation, facilitating the payment process, fulfilling any post-sale obligations, and ultimately handing over the keys. It is crucial for both parties to carefully review all aspects of the agreement and ensure that they are satisfied with its terms. Clear communication regarding payment methods and timing should be established upfront, and any post-sale obligations should be promptly addressed. With proper attention to detail and effective communication, closing a deal with an iBuyer can be a smooth and efficient process.

Frequently Asked Questions

What happens if the iBuyer finds major repairs or issues during the inspection?

When an iBuyer discovers major repairs or issues during the inspection, they may negotiate a lower offer or ask the seller to make the necessary repairs. This can lead to changing decisions and unexpected expenses for the seller.

Can I negotiate the offer presented by the iBuyer?

Negotiation options are available when considering an offer presented by an ibuyer. These options may involve accepting the offer, negotiating repairs based on inspection findings, or requesting a revised offer within a specific time frame. It is important to avoid buyer’s remorse by carefully weighing the pros and cons of each negotiation option.

How long does the entire process typically take when selling to an iBuyer?

The selling timeline when dealing with an ibuyer can resemble a well-orchestrated symphony, with each step meticulously planned and executed. On average, the typical process takes around two to three weeks, providing sellers with a relatively quick and efficient duration estimate for the transaction.

What happens if I change my mind after accepting an offer from an iBuyer?

If you change your mind after accepting an offer from an iBuyer, it is possible to back out. However, there may be consequences such as losing any fees paid or damaging your reputation with the iBuyer company.

Are there any additional fees or hidden costs associated with selling to an iBuyer?

When selling to an iBuyer, there may be additional fees or hidden costs. Pros include convenience and speed, while cons include potentially lower offers. Compared to traditional sales, iBuyers use automated market value assessments with limited seller protection.

Other Articles You Might Enjoy

Difficulties Homeowners Are Facing Fort Worth