Inheriting a property can often lead to complex and emotionally charged situations, especially when multiple siblings are involved. When one sibling decides to reside in an inherited property and refuses to sell, it can give rise to tension and disagreements within the family. This article aims to explore the legal and emotional consequences that arise in such scenarios, providing insights into potential solutions and guidance for those navigating this challenging situation.

Understanding the legal rights and obligations of all parties involved is crucial when dealing with a situation where one sibling is living in an inherited property and refusing to sell. The article will delve into the intricacies of property inheritance laws, highlighting the various legal avenues available for resolving disputes. Additionally, effective communication techniques such as mediation will be discussed as a means of fostering dialogue between siblings. By exploring these topics, readers will gain a comprehensive understanding of their options and empower themselves with knowledge that can help them navigate this complex situation with confidence.

Legal Rights and Obligations

In the scenario where one sibling is residing in an inherited property and adamantly refuses to sell, it is crucial to understand the legal rights and obligations associated with such a situation. When a property is inherited by multiple siblings, they become co-owners of the property. Each sibling has certain legal rights as an heir in the property, including the right to possess, use, and enjoy their portion of the inheritance. However, these rights are not absolute and can be subject to limitations. Co-ownership challenges often arise in inheritance situations where one sibling wants to sell while another wants to continue living in the inherited property.

In such cases, it may be necessary for the siblings involved to negotiate a buyout agreement. This allows one sibling who wishes to remain in the property to compensate their co-owners for their share of ownership. A buyout agreement can help resolve conflicts by providing a fair financial arrangement that considers both parties’ interests.

Negotiating a buyout with siblings can be complex and emotionally charged. It requires open communication and willingness from all parties involved to find a mutually acceptable solution. Mediation services can be helpful in facilitating productive discussions among siblings and assisting them in reaching an agreement regarding the sale or buyout of a Sell My House Fast Fort Worth inherited property.

Understanding the legal options available is essential when dealing with a situation where one sibling refuses to sell an inherited property. In some jurisdictions, if negotiations or mediation fail, it may be possible for a co-owner seeking resolution to force a sale of the inherited property through legal means. However, going down this route should generally be considered as a last resort due to its potential for further straining familial relationships.

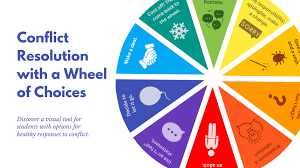

Transitioning into the subsequent section about ‘mediation and communication,’ it becomes evident that finding common ground among siblings is vital when facing disputes over inheriting properties. Effective communication skills coupled with professional mediation services can play key roles in resolving conflicts arising from disagreements on selling or buying out an inherited house.

Mediation and Communication

Through the process of mediation and open lines of communication, the involved parties can engage in a constructive dialogue to explore potential solutions and navigate the complexities that arise when one sibling occupies an inherited property without willingness to relinquish ownership. Mediation for sibling disputes can provide a neutral platform where all parties involved can express their concerns, share their perspectives, and work towards finding a resolution that is fair and satisfactory to everyone. This approach allows siblings to address any underlying conflicts or misunderstandings that may have contributed to the refusal to sell the inherited property.

To better understand how mediation and communication can help resolve inherited property disputes, let’s consider a hypothetical scenario involving two siblings, Alex and Sarah. Upon their parents’ passing, they inherit a house as co-owners. However, Alex decides to live in the property while Sarah wants to sell it. This creates tension between them as both have different desires for the inherited property.

| Challenges | Strategies |

|---|---|

| Emotional attachment: | Encourage open expression of emotions in a controlled environment during mediation sessions. |

| Financial considerations: | Explore options such as buying out the occupying sibling’s share or reaching an agreement on rental income if one sibling continues living there. |

| Decision-making: | Establish clear guidelines for decision-making processes regarding repairs, maintenance costs, and future plans for the property. |

| Legal framework: | Consult legal professionals who specialize in estate planning and inheritance laws to ensure compliance with regulations throughout the mediation process. |

By engaging in mediation sessions guided by trained professionals experienced in handling sibling conflicts over real estate disputes, Alex and Sarah can confront their emotions openly while seeking practical solutions based on their unique circumstances. Mediation provides an opportunity for both siblings to voice their concerns while actively listening to each other’s viewpoints.

Mediation offers valuable Sell My House Fast Texas strategies for smooth estate distribution by facilitating effective communication between siblings facing disagreements regarding inherited properties. By addressing emotional attachments, financial considerations, decision-making processes, and legal frameworks through mediation, siblings can work towards resolving conflicts and finding mutually beneficial solutions. Transitioning into the subsequent section about family dynamics and relationships, it is important to recognize that these disputes can often stem from deeper familial issues that extend beyond the property itself.

Family Dynamics and Relationships

Family dynamics and relationships play a crucial role in shaping the outcomes of disputes arising from the occupation of an inherited property by one sibling without a willingness to sell. In such cases, it is important to understand and navigate the complex emotions and interpersonal dynamics that can arise within families. Here are some key points to consider:

- Arbitration in inherited property cases: When siblings find themselves at odds over the sale of an inherited property, arbitration can be a useful tool for resolving conflicts. This involves bringing in a neutral third party who can help facilitate communication and negotiation between the siblings. Arbitration allows for a structured process where each party has an opportunity to present their arguments and concerns, leading to a fair resolution.

- Partition actions in real estate: If mediation fails or is not feasible, another option is pursuing a partition action in court. A partition action involves legally dividing the property among co-owners or selling it off and distributing the proceeds accordingly. This can be an effective way to resolve conflicts when one sibling refuses to sell but others want their share of inheritance.

- Fair market value in property disputes: Determining the fair market value of the inherited property becomes crucial when disagreements arise regarding its sale or division. It is essential for all parties involved to obtain professional appraisals or seek expert advice on determining the accurate value of the property. This ensures that any potential financial discrepancies are addressed fairly during negotiations or legal proceedings.

- Estate planning to prevent conflicts: To avoid such disputes altogether, proactive estate planning can play an important role. Clear instructions regarding how jointly owned properties should be managed after someone’s passing can prevent misunderstandings and conflicts among siblings later on. Estate planning tools like wills, trusts, or family agreements can establish guidelines for decision-making processes concerning inherited properties.

Understanding these aspects of family dynamics and relationships helps navigate through challenging situations involving one sibling refusing to sell an inherited property effectively. By considering options such as arbitration and partition actions, addressing fair market value, and implementing proactive estate planning measures, families can work towards resolving conflicts and ensuring a fair outcome for all parties involved. This sets the stage for exploring the subsequent section on the financial implications of such disputes.

Financial Implications

The financial implications of a sibling’s unwillingness to sell an inherited property can have significant ramifications for all parties involved, potentially affecting their wealth, investment opportunities, and overall financial stability. One key concern is the division of assets. If one sibling refuses to sell, it can lead to an imbalance in the distribution of inheritance among family members. This can result in resentment and strained relationships, as other beneficiaries may feel cheated or disadvantaged.

Another financial implication is the opportunity cost of holding onto the property. Inherited properties often require ongoing expenses such as maintenance fees, property taxes, and insurance. If one sibling refuses to sell and insists on living in the property, these costs would need to be shared by all beneficiaries or solely borne by the refusing sibling. This can create a burden on their finances and limit their ability to invest or save for other purposes.

Furthermore, the refusal to sell can also impact each beneficiary’s overall financial stability. The value of a property is not static and can fluctuate over time due to market conditions or changes in the neighborhood. By refusing to sell, siblings may miss out on potential gains from selling at a favorable price or risk losing value if market conditions decline.

In addition, unresolved disputes regarding the inherited property may also lead to legal expenses. Siblings who are unable to reach an agreement may resort to litigation which can be costly and further deplete their shared inheritance.

As we have seen, there are various financial implications when one sibling refuses to sell an inherited property. These implications include imbalanced asset division among family members causing strained relationships; opportunity costs related to ongoing expenses for maintaining the property; limited investment opportunities due to financial burden; potential gain loss from fluctuations in market value; and even added legal expenses incurred during disputes resolution process. Considering these factors makes it important for siblings facing such challenges seek options for resolution without delay.

Options for Resolution

Potential pathways for resolving the disagreement surrounding the inherited property include seeking mediation or arbitration, exploring the option of a buyout agreement, or considering legal action as a last resort. Mediation or arbitration can provide a neutral platform for siblings to discuss their concerns and reach a mutually agreeable solution. A trained mediator or arbitrator can help facilitate communication and guide the parties towards finding common ground. This approach allows siblings to maintain control over the outcome while minimizing the financial and emotional costs associated with litigation.

Another potential option is to explore a buyout agreement. In this scenario, one sibling who wishes to keep the inherited property may offer to compensate their co-owners for their share. This can be achieved through negotiation and valuation of the property’s worth. The sibling interested in purchasing the property would need to secure financing or liquidate other assets in order to fund the buyout. It is essential that both parties seek legal advice during this process to ensure fairness and protect their interests.

If all attempts at mediation, arbitration, or buyout agreements fail, legal action may be necessary as a last resort. Engaging in litigation can be expensive, time-consuming, and emotionally draining for all involved parties. However, it provides a formal legal process where a judge will make binding decisions regarding ownership rights and potential sale of the inherited property. It is important for individuals considering this route to consult with an experienced attorney who specializes in real estate law.

Transitioning into the subsequent section about ‘legal action and litigation,’ it should be noted that while legal action offers an avenue for resolution when other options have been exhausted, it should generally be considered as a final step due to its potential drawbacks and consequences on familial relationships.

Legal Action and Litigation

Litigation can be a contentious and emotionally charged process, akin to a long and arduous legal battle that leaves deep scars on familial relationships. When one sibling refuses to sell an inherited property, legal action may become necessary to resolve the dispute. In these cases, the aggrieved siblings have the option to file a lawsuit against the sibling occupying the property and seek a court order for its sale.

To initiate legal action, the aggrieved siblings must consult with an attorney experienced in real estate law or inheritance disputes. The attorney will help them understand their rights and guide them through the legal process. The first step typically involves sending a demand letter to the sibling living in the inherited property, stating their intention to take legal action if an agreement cannot be reached.

If negotiations fail, the next course of action is filing a lawsuit against the occupant sibling. The court will analyze various factors such as ownership rights, financial contributions towards maintenance costs, and any existing agreements between siblings regarding inheritance distribution. Ultimately, it will determine whether it is equitable for one party to continue residing in the inherited property while refusing to sell.

Litigation becomes an option when one sibling refuses to sell an inherited property. It is important for all parties involved to seek legal counsel before proceeding with this course of action due to its potential emotional toll and impact on familial relationships. This leads us into exploring further how this process affects individuals’ emotional and psychological well-being during such challenging times without compromising their desire for mastery over resolving conflicts amicably.

Emotional and Psychological Impact

Emotional and psychological well-being can be significantly affected when siblings are involved in disputes over the disposition of an inherited property. The intense emotions that arise from such situations can have a lasting impact on individuals, straining family relationships and causing distress. It is important to acknowledge the potential consequences on mental health that can result from these conflicts, as they may require professional intervention or support.

- Emotional Turmoil: Siblings who find themselves at odds over the sale of an inherited property often experience a range of negative emotions. These may include anger, resentment, jealousy, and betrayal. The deep-rooted attachment to the property coupled with differing opinions on its future use can create a hostile environment where emotional turmoil prevails. Such prolonged conflict can lead to increased stress levels, anxiety, and depression for all parties involved.

- Strained Relationships: Disputes over inherited properties have the potential to strain even the strongest sibling bonds. The division created by conflicting interests can fracture relationships built on trust and shared experiences. Siblings may find themselves pitted against each other, leading to communication breakdowns and estrangement. This strained dynamic not only impacts their individual well-being but also has ripple effects on wider family dynamics.

- Loss of Control: Inherited properties often carry sentimental value for siblings due to childhood memories or familial connections associated with them. When one sibling refuses to sell or make decisions aligned with others’ wishes, it can engender feelings of powerlessness and loss of control among those seeking resolution through consensus. This lack of control over an important aspect of their lives further exacerbates emotional distress and diminishes overall well-being.

Navigating conflicts related to inherited properties requires careful consideration not only for legal aspects but also for the emotional toll it takes on individuals involved in such disputes. Acknowledging the potentially devastating impact on mental health allows space for compassionate understanding amidst differing perspectives. Seeking professional mediation or counseling services might prove beneficial in facilitating effective communication, fostering empathy, and moving toward a resolution that prioritizes emotional well-being. Ultimately, recognizing the emotional and psychological implications of these disputes is essential in fostering healthier relationships within families facing such challenges.

Frequently Asked Questions

Can the sibling living in the inherited property be forced to sell against their will?

It is possible for a sibling living in an inherited property to be forced to sell against their will, depending on the laws in the jurisdiction where the property is located and the specific circumstances surrounding the situation.

What are the potential consequences for the sibling living in the inherited property if they refuse to sell?

The potential consequences for a sibling who refuses to sell an inherited property include legal action, strained relationships with other family members, financial penalties, and the possibility of being forced to sell through court orders.

Are there any tax implications for the sibling living in the inherited property who refuses to sell?

There may be tax implications for the sibling living in the inherited property if they refuse to sell. These can include potential capital gains taxes and income taxes on rental income generated from the property.

How long can a sibling legally stay in an inherited property without selling?

The duration a sibling can legally reside in an inherited property without selling depends on various factors, such as applicable laws and the agreement among co-owners. The specific timeframe can vary significantly and should be determined through legal consultation.

What are some alternative options for resolution if the sibling living in the inherited property refuses to sell?

Some alternative options for resolution if a sibling living in an inherited property refuses to sell include negotiation, mediation, legal action such as filing a partition lawsuit, or exploring creative solutions like renting out the property.

Other Articles You Might Enjoy

What House Can I Afford On 100K A Year