In the realm of personal finance, one question often looms large in the minds of individuals with an annual income of $100,000: “What house can I afford?”This query encapsulates a yearning for stability and security, as well as a subconscious desire to conquer the complex world of real estate. Buying a house is not just a financial decision; it is a journey towards mastery over one’s financial future. With this in mind, it becomes imperative to delve into the factors that determine what type of house someone with a $100,000 annual income can comfortably afford.

To embark on this journey towards homeownership, several key factors must be considered. These include savings and expenses, mortgage options, debt-to-income ratio, credit score, home affordability calculators, and consulting with a financial advisor. By carefully examining each aspect and understanding their interplay within the context of an individual’s specific circumstances and goals, one can navigate the intricate path towards finding their ideal home. Through this exploration, we aim to empower individuals on their quest for homeownership by equipping them with knowledge and strategies necessary to make informed decisions about what house they can truly afford on an annual income of $100,000.

Factors to Consider

Ironically, when considering what house one can afford on a 100K annual income, it becomes imperative to take various factors into account. While a six-figure salary may seem substantial, there are other crucial elements that determine the affordability of a home. One such factor is the location and cost of housing in the desired area. Affordable housing options vary greatly depending on geographical location, so it is essential to research the real estate market and identify areas where homes align with your budget. To determine how much house you can afford on a 100K salary, utilizing a home affordability calculator can be immensely helpful.

These online tools consider your income, expenses, and debt-to-income ratio to estimate an affordable price range for purchasing a home. By entering relevant financial information into these calculators, you can gain insight into what percentage of your income should be allocated towards mortgage payments and related costs. This allows for better real estate budgeting and helps ensure that you do not overextend yourself financially.

Income-based home buying is another consideration when contemplating what kind of Sell My House Fast Fort Worth house one can afford on 100K annually. Various programs exist that cater to individuals or families with moderate incomes who aspire to become homeowners. These programs often offer assistance with down payments or provide reduced interest rates on mortgages based on income qualifications. Researching and exploring these options may help increase the range of properties available within your budget.

While affordability is important when buying a house on a 100K salary, it does not mean sacrificing quality or comfort entirely. There are several tips for buying a house on a budget that can help maximize your purchasing power while still finding a suitable home. Some strategies include exploring up-and-coming neighborhoods where property prices may be lower but have potential for growth, considering fixer-upper homes that allow for customization within budget constraints, or focusing on smaller-sized houses that require less maintenance and are more cost-effective.

Considering these factors will enable individuals with an annual income of 100K to make informed decisions regarding home affordability. However, it is crucial to remember that purchasing a house involves not only the initial cost but also ongoing expenses such as property taxes, insurance, maintenance, and utilities. Therefore, saving diligently and being aware of your overall financial situation is essential when determining what house you can afford on a 100K salary. Transitioning into the next section about savings and expenses, it is prudent to delve deeper into these aspects to ensure a comprehensive understanding of the financial considerations involved in buying a home.

Savings and Expenses

Notably, it is crucial to consider the implications of one’s savings and expenditures in order to assess the feasibility of acquiring a suitable residential property. When contemplating income-based home buying, individuals should first evaluate their financial standing by taking into account their annual salary of $100,000. It is important to determine whether this income level allows for sufficient savings and disposable income after accounting for necessary expenses such as housing, utilities, transportation, groceries, and other debts or obligations.

Financial planning for a home purchase involves analyzing current savings and determining how much of these funds can be allocated towards a down payment. The size of the down payment affects the mortgage options available as well as the monthly mortgage payments. Generally speaking, a larger down payment will result in lower monthly payments and potentially more favorable loan terms. Therefore, individuals with substantial savings may have access to better mortgage rates and more affordable financing options.

Furthermore, prospective buyers need to assess their overall debt-to-income ratio (DTI) when considering purchasing a house on an annual income of $100k. Lenders typically have guidelines regarding the percentage of one’s income that can go toward housing expenses. Ideally, most lenders prefer that no more than 28% – 30% of an individual’s gross monthly income goes towards housing costs including mortgage payments, property taxes, insurance fees etc. Analyzing this ratio will help potential buyers understand their affordability range based on their specific financial circumstances.

In addition to examining personal finances and assessing affordability limits through calculating DTI ratios, it is also important to conduct an analysis of the local Sell My House Fast Texas real estate market. Different regions have varying levels of affordability when it comes to housing prices. Conducting thorough research on cost-effective home buying strategies within affordable real estate markets can provide valuable insights into finding properties that align with one’s budgetary constraints while still meeting desired criteria such as location preferences or property features.

By taking into account savings habits and expenses alongside conducting a comprehensive analysis of the local real estate market, individuals can gain a deeper understanding of what type of house they can afford on an annual income of $100k. With this knowledge in hand, potential buyers can then proceed to explore suitable mortgage options that align with their financial circumstances and homeownership goals.

Mortgage Options

When considering purchasing a residential property, it is important to explore various mortgage options in order to make an informed decision. One interesting statistic reveals that adjustable-rate mortgages accounted for 9.2% of all mortgages originated in 2020, highlighting the popularity of these flexible loan options among homebuyers. These mortgages offer an initial fixed interest rate for a certain period of time, typically 5 or 7 years, before adjusting annually based on prevailing market rates. While they may initially provide lower interest rates compared to fixed-rate mortgages, there is always the risk that rates will increase during the adjustment period. Homebuyers who are confident in their ability to manage potential fluctuations in interest rates may find adjustable-rate mortgages appealing.

To further understand mortgage options and their impact on affordability, it is crucial to consider low down payment options available in the housing market for middle-income earners. Traditional mortgage loans often require a substantial down payment, which can be challenging for individuals with limited savings or lower incomes. However, there are alternative programs such as Federal Housing Administration (FHA) loans and conventional loans with low down payment requirements. FHA loans allow borrowers to put as little as 3.5% down and have more lenient credit score requirements compared to conventional loans.

In addition, exploring the best neighborhoods for budget-friendly homes can help maximize your home buying power within your income range. Some areas may offer more affordable housing options without compromising on quality or location amenities. Researching neighborhoods with lower median home prices and reasonable cost of living can lead you to hidden gems where you can find a house that suits your needs and budget.

Understanding different mortgage options is essential when determining what house you can afford on a $100k annual income. By exploring adjustable-rate mortgages, low down payment options like FHA loans or conventional loans with low requirements, and searching for budget-friendly neighborhoods, you can make informed decisions about financing your dream home while maximizing your purchasing power within your income range. This knowledge will lay the foundation for the next step, which is assessing your debt-to-income ratio to ensure you can comfortably manage your mortgage payments and other financial obligations.

Debt-to-Income Ratio

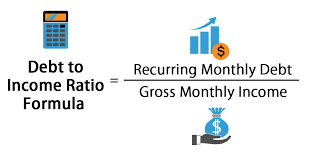

One crucial factor to consider when determining your eligibility for a mortgage is your debt-to-income ratio (DTI). Your DTI compares your monthly debt obligations to your gross monthly income. Lenders use this ratio to assess how much of your income is already allocated towards existing debts and whether you can afford additional financial obligations such as a mortgage. To calculate your DTI, add up all your monthly debt payments, including credit cards, student loans, car loans, and any other outstanding loans. Then divide that total by your gross monthly income. Multiply the result by 100 to get a percentage.

A lower DTI indicates that you have more disposable income available after paying off existing debts and signifies better financial stability. Lenders generally prefer borrowers with DTIs below 43%, although some may be more flexible depending on other factors such as credit score or down payment amount. It’s important to note that different lenders may have varying criteria for what they consider an acceptable DTI, so it’s advisable to shop around and compare offers from different institutions.

As a first-time homebuyer, understanding the significance of the debt-to-income ratio is critical in navigating the housing market successfully. By keeping your DTI low, you demonstrate responsible financial management and increase your chances of securing a mortgage at favorable rates. Additionally, being mindful of this ratio allows you to make informed decisions about the size of the house you can comfortably afford based on your current level of debt.

Moving forward into the next section about ‘credit score,’ it’s important to note that while the debt-to-income ratio plays a significant role in determining mortgage eligibility, it is not the sole factor lenders consider. Another essential aspect is one’s credit score, which reflects their past borrowing history and determines their creditworthiness.

Credit Score

The credit score is a crucial factor in determining mortgage eligibility and reflects an individual’s past borrowing history, with higher scores indicating greater creditworthiness. According to recent data from Experian, the average credit score in the United States is 711, highlighting the importance of maintaining good credit to secure favorable mortgage rates.

Credit scores are typically measured on a scale ranging from 300 to 850, with lenders considering scores above 700 as good and those above 800 as excellent. A high credit score indicates responsible financial behavior and demonstrates a lower risk of defaulting on loan payments. Lenders use this information to assess an individual’s ability to repay their mortgage debt.

To further understand how different credit scores can impact mortgage eligibility and interest rates, let’s look at the following table:

| Credit Score Range | Mortgage Eligibility | Estimated Interest Rate |

|---|---|---|

| 760-850 | Highly eligible | Lowest rate |

| 700-759 | Very eligible | Low rate |

| 660-699 | Eligible | Moderate rate |

| Below 660 | Less eligible | Higher rate |

As shown in the table, individuals with higher credit scores have better chances of being approved for a mortgage and securing lower interest rates. This can significantly affect their ability to afford a house within their income range.

Maintaining a good credit score requires responsible financial habits such as making timely payments on loans and credit cards, keeping balances low compared to available limits, avoiding excessive new applications for credit, and regularly reviewing one’s credit report for errors or fraudulent activity.

Understanding the importance of having a good credit score is essential when determining what house you can afford on $100k per year. By improving your creditworthiness through responsible financial behavior, you increase your chances of qualifying for better loan terms and ultimately finding a home that fits within your budget.

Transition: Now that we have explored the role of credit scores in determining mortgage eligibility, let’s delve into another important aspect of determining home affordability – home affordability calculators.

Home Affordability Calculators

Credit Score is an important factor when it comes to determining the type of house one can afford on a $100,000 per year income. A credit score is a numerical representation of an individual’s creditworthiness and financial responsibility. Lenders use this score to assess the risk associated with lending money to potential homebuyers. Generally, individuals with higher credit scores are more likely to qualify for lower interest rates and better loan terms.

However, in addition to credit score, there are other factors that come into play when determining how much house one can afford on a $100,000 annual income. These factors include the size of the down payment, current debt obligations, monthly expenses such as utilities and insurance, as well as the prevailing interest rates. To get a more accurate estimate of what house you can afford based on your specific circumstances, it is advisable to utilize home affordability calculators.

Home affordability calculators take into account various financial aspects such as income, debts, monthly expenses, and desired down payment amount to determine how much house you can comfortably afford without stretching your finances too thin. These online tools provide an estimate of the maximum purchase price based on your inputs and prevailing market conditions.

While home affordability calculators offer a useful starting point in determining what house you may be able to afford on a $100k annual income, consulting a financial advisor would provide further guidance tailored specifically to your unique financial situation. A financial advisor will consider not only your current income but also future goals and potential changes in circumstances that could affect your ability to pay for housing costs over time. They can help you create a comprehensive budgeting plan that takes into account all relevant factors so that you make an informed decision about purchasing a house within your means.

Credit Score plays an important role when considering what type of house one can afford on a $100k annual income; however other factors like down payment amount and current debt obligations should also be taken into account. Home affordability calculators can provide a rough estimate based on your inputs, but consulting a financial advisor is recommended to get personalized advice and create a comprehensive budgeting plan. Transitioning into the next section, it is crucial to seek professional guidance when making such an important financial decision.

Consulting a Financial Advisor

Seeking guidance from a knowledgeable financial advisor can provide valuable insight and peace of mind when making important decisions regarding housing affordability. A financial advisor is an expert in personal finance who can assist individuals in creating a comprehensive financial plan, including budgeting for housing expenses. By consulting with a financial advisor, individuals can gain a better understanding of their current financial situation, set realistic goals, and receive tailored advice on how to achieve them.

One of the key advantages of consulting a financial advisor is their ability to assess an individual’s overall financial health and determine the amount of house they can afford based on their income, expenses, and other factors. They take into account not only the mortgage payment but also other costs associated with homeownership such as property taxes, insurance, maintenance fees, and utilities. By analyzing these variables along with an individual’s income level and debt obligations, a financial advisor can provide an accurate estimate of what house would be affordable within one’s budget.

In addition to helping determine housing affordability based on income, a financial advisor can also offer guidance on strategies to increase purchasing power or save for a down payment. They may recommend options such as reducing debt-to-income ratios by paying off existing debts or suggest investment vehicles that could generate additional income over time. Moreover, they can educate individuals about available government programs or grants that could assist in purchasing a home.

Consulting with a financial advisor offers numerous benefits beyond just calculating housing affordability. They serve as mentors who guide individuals towards achieving long-term financial goals while minimizing risks along the way. With their expertise in various aspects of personal finance like tax planning and investment management, they can help individuals make informed decisions that align with their aspirations for homeownership and overall wealth accumulation.

| Pros | Cons |

|---|---|

| Provides personalized advice | Costly services |

| Expertise in various aspects of personal finance | Limited availability |

| Helps create comprehensive financial plan | Requires trust and collaboration |

| Offers guidance on long-term financial goals | Might have conflicting opinions |

Seeking the assistance of a knowledgeable financial advisor can be highly beneficial when determining housing affordability. Their expertise in personal finance allows them to evaluate an individual’s financial situation and provide tailored advice on what house they can afford based on their income, expenses, and other factors. Additionally, financial advisors offer guidance on strategies to increase purchasing power or save for a down payment. They serve as mentors throughout one’s homeownership journey, helping individuals make informed decisions and achieve long-term financial goals. While their services may come at a cost and require trust and collaboration, the value they bring in terms of peace of mind and mastery over one’s finances cannot be overstated.

Frequently Asked Questions

How do I determine the down payment amount for a house I can afford on a $100,000 annual income?

To determine the down payment amount for a house on a $100,000 annual income, consider using the general rule of thumb of 20% of the home’s purchase price. This ensures better loan terms and reduces the need for private mortgage insurance.

Are there any specific tax implications or benefits related to purchasing a house on a $100,000 yearly income?

There are specific tax implications and benefits related to purchasing a house on a $100,000 yearly income. These may include deductions for mortgage interest and property taxes, as well as potential eligibility for certain housing-related tax credits.

What are some key factors to consider when deciding between renting and buying a house on a $100,000 salary?

When deciding between renting and buying a house on a $100,000 salary, key factors to consider include financial stability, long-term goals, housing market conditions, mortgage rates, maintenance costs, and the potential for home appreciation or rental income.

Can I afford a house on a $100,000 income if I have student loan debt?

Having student loan debt on a $100,000 income may affect the affordability of a house. Consider your debt-to-income ratio, credit score, and other financial obligations to determine if you can comfortably afford a house.

Are there any government programs or initiatives that can assist individuals with a $100,000 income in purchasing a house?

There are government programs and initiatives that can assist individuals with a $100,000 income in purchasing a house. These include FHA loans, VA loans, and USDA loans, which offer low down payment options and favorable interest rates.