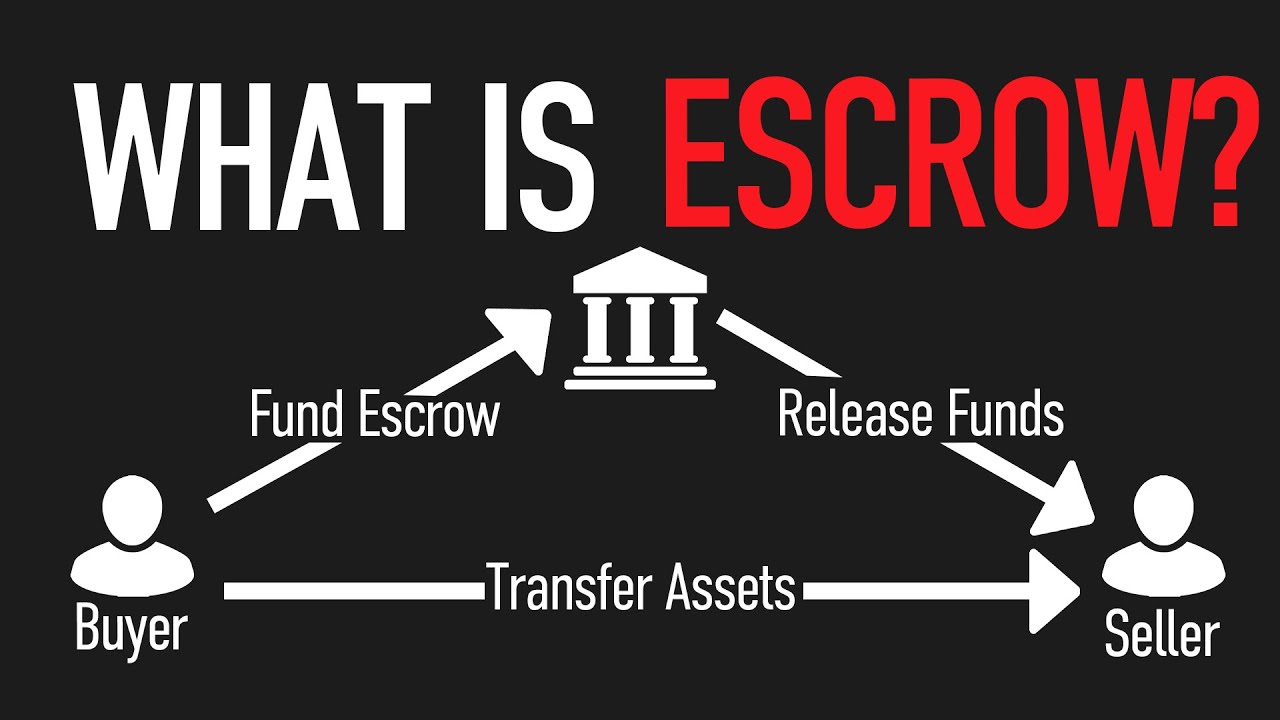

The purpose of an escrow is a fundamental concept in financial and legal transactions that aims to ensure the security and transparency of the process. By involving a trusted third party, typically an agent or institution, funds or assets are held and regulated until specific conditions are met by all parties involved. This article delves into the intricacies of escrow, its functioning, benefits, drawbacks, various types, the escrow process itself, as well as its paramount importance.

Escrow serves as a mechanism through which both buyers and sellers can engage in transactions with confidence. It acts as a safeguard against potential risks that may arise during any financial or legal agreement. The involvement of an impartial third party ensures that funds or assets are protected until certain predetermined conditions specified in the contract are fulfilled. This instills trust among all parties involved in the transaction by mitigating the chances of fraud or non-compliance with agreed-upon terms. Understanding how escrow works and its significance is crucial for individuals seeking mastery over financial transactions, providing them with the necessary knowledge to navigate this complex landscape effectively.

What is it?

The purpose of an escrow is to act as a neutral third party that holds and protects funds or assets until all conditions of a transaction are met, ensuring a secure and fair exchange for all parties involved. Understanding escrow in home sales is essential for both buyers and sellers. When buying or selling a home, there are numerous financial aspects to consider, such as down payments, loan approvals, and property inspections. An escrow account in home transactions helps streamline the process by providing a secure platform where these funds can be held until all necessary steps have been completed.

One of the key benefits of using escrow services is that it provides protection for both the buyer and seller. For buyers, it ensures that their earnest money deposit is held safely until the deal is closed. This eliminates any risk of losing the money if the seller fails to meet their obligations. On the other hand, sellers benefit from knowing that the buyer’s funds are securely held in an escrow account while waiting for all requirements to be fulfilled.

Navigating escrow for a quick house sale can be challenging without proper understanding. However, utilizing an escrow service simplifies this process significantly. It allows buyers and sellers to focus on fulfilling their respective responsibilities without having to worry about managing funds directly. By having an impartial third party handle these Sell My House Fast Fort Worth financial matters, both parties can have peace of mind knowing that their interests are protected.

With an understanding of what an escrow is and its benefits in home sales transactions established, it is crucial to delve into how it works without getting bogged down in unnecessary details. The next section will explore the step-by-step process of how escrow operates in order to provide readers with a comprehensive understanding of this vital component in closing real estate deals.

An escrow serves as a neutral intermediary responsible for holding and protecting funds or assets during real estate transactions. Its purpose is to ensure fairness and security by preventing any premature release or misappropriation of funds until all conditions are met. By utilizing escrow services, both buyers and sellers can navigate the complexities of home sales with greater ease and confidence. The next section will provide a detailed explanation of how escrow works in practice.

How does it work?

Implemented as a neutral third-party arrangement, the escrow process involves holding funds or assets in trust until predetermined conditions are met. In real estate transactions, an escrow is typically opened to protect both the buyer and seller during the transaction. Once an offer is accepted, the buyer will deposit their earnest money into an escrow account. This shows the seller that the buyer is serious about purchasing the property while providing them with some security that they won’t lose out on other potential buyers. The escrow agent then holds onto these funds until all contractual obligations have been fulfilled.

During this period, various tasks are carried out to ensure a smooth transaction. These may include obtaining inspections, conducting appraisals, and verifying title information. The purpose of this process is to protect both parties from any potential risks or disputes that may arise before closing on the property. By holding funds or assets in escrow, it provides a level of assurance that each party will fulfill their obligations according to agreed-upon terms.

Once all conditions are met and both parties have fulfilled their responsibilities, such as completing necessary paperwork and obtaining financing approval, the escrow agent disburses funds accordingly. For example, in a real estate transaction, once all required documents have been signed and recorded with the appropriate authorities, the Sell My House Fast Texas escrow agent releases payment to the seller. This step ensures that neither party can back out of the agreement without just cause.

An escrow acts as a safeguard for both buyers and sellers involved in real estate transactions by ensuring that funds or assets are held securely until all agreed-upon conditions are met. It eliminates uncertainties and provides transparency throughout the process by involving a neutral third-party who oversees compliance with contractual obligations. However, while there are benefits to using an escrow service such as minimizing risks associated with fraudulent activities or breaches of contract obligations; there can also be drawbacks such as additional costs or delays caused by extended periods of negotiation between parties.

Benefits and drawbacks

One advantage of utilizing an escrow service is the assurance it provides to both parties involved in a real estate transaction, ensuring that funds or assets are securely held until all agreed-upon conditions are met. This adds a layer of security and peace of mind for both the buyer and the seller. The escrow process acts as a neutral third party, safeguarding the interests of both parties and reducing the risk of fraud or misappropriation of funds.

- It creates a transparent and fair transaction process: With an escrow service, all parties have access to detailed documentation regarding the terms and conditions of the transaction. This transparency helps build trust between buyers and sellers, as it allows them to review and confirm that everything is in line with their expectations before proceeding.

- It minimizes financial risks: By holding funds or assets in escrow until all conditions are satisfied, both buyers and sellers can be confident that they will receive what was promised. This eliminates concerns about non-payment or non-delivery, providing financial protection for all parties involved.

- It ensures a smooth closing process: The real estate closing process can be complex and time-consuming. Utilizing an escrow service streamlines this process by handling tasks such as title searches, document preparation, and transfer of ownership. This saves time for both buyers and sellers, allowing for quicker completion of transactions.

- It provides a secure platform for quick house sales: In situations where quick house sales are desired or necessary, an escrow service enables secure transactions within shorter timelines. Buyers can expedite their purchase without compromising on security measures, while sellers can ensure timely receipt of payment without worrying about potential fraud or disputes.

Utilizing an escrow service offers several benefits that contribute to secure and speedy real estate transactions. From creating transparency to minimizing financial risks and streamlining the closing process, escrow services provide reassurance to both buyers and sellers during their property transactions. With these advantages in mind, it is important to explore the different types of escrow services available.

Types of escrow

There are different categories of escrow services that cater to specific industries and transactions. One of the most common types of escrow is in the real estate industry. In real estate transactions, an escrow account is typically used to hold funds until all conditions of the sale have been met. This helps ensure a smooth and efficient transaction by streamlining the process and providing a neutral third party to handle the funds.

Another type of escrow service is in online transactions. With the increasing popularity of e-commerce, escrow services have become essential for ensuring secure payments between buyers and sellers. These types of escrow accounts hold funds until both parties are satisfied with the transaction, protecting both buyer and seller from potential fraud or disputes.

There are also specialized types of escrow services for specific industries such as technology or intellectual property. For example, in technology licensing agreements, an escrow account may be used to hold source code or other valuable assets until certain conditions are met. This provides security and peace of mind for both parties involved in the agreement.

There are various types of escrow services that serve different industries and transactions. From real estate to online transactions to specialized fields like technology licensing, these services play a crucial role in ensuring efficient and secure transactions. The use of escrow accounts helps streamline processes and provides a neutral third party to handle funds or assets until all conditions are met. Transitioning into the subsequent section about ‘escrow process’, it is important to understand how these different types function within their respective industries.

Escrow process

An essential aspect of the escrow process involves the careful review and verification of all relevant documents and conditions to ensure compliance with the agreed-upon terms and protect the interests of all parties involved. This step is crucial in streamlining the escrow process for sellers, as it helps to identify any potential issues or discrepancies early on, preventing delays or conflicts down the line. By thoroughly examining and confirming the validity of documents such as purchase agreements, title deeds, and loan documentation, escrow agents can ensure that both buyers and sellers are fully aware of their rights and obligations.

To further emphasize this point, it is important to consider three sub-lists within this aspect of the escrow process:

- Verification of Purchase Agreement: Escrow agents carefully review the purchase agreement to confirm that it accurately reflects the terms negotiated between the buyer and seller. This includes verifying details such as price, payment terms, contingencies, and timelines.

- Title Examination: The escrow process typically involves a thorough examination of the property’s title records. This ensures that there are no liens or encumbrances on the property that could affect its transferability.

- Confirmation of Loan Documentation: In cases where financing is involved, escrow agents will verify that all loan documentation is complete and accurate. This includes reviewing loan applications, disclosures, appraisal reports, and other related documents.

By implementing efficient home selling strategies such as accelerating home selling with escrow instead of opting for a direct sale, sellers can benefit from a streamlined process that ensures transparency and protects their interests. With proper verification procedures in place during escrow, both buyers and sellers can have confidence in their transaction.

Transitioning into discussing the importance of escrow without using ‘step,’ it becomes evident how central this process is for facilitating secure real estate transactions while minimizing risks for all parties involved.

Importance of escrow

Moving on from the explanation of the escrow process, it is important to understand the significance and importance of escrow in real estate transactions. Escrow plays a crucial role in ensuring a smooth and secure transfer of property ownership between buyers and sellers. It provides protection for both parties involved by acting as an impartial third party that holds funds and documents until all conditions of the sale are met.

One of the key benefits of using an escrow service in real estate is its ability to provide security and minimize risks for both buyers and sellers. By holding funds in escrow, it ensures that the seller receives payment only when all terms and conditions have been fulfilled, such as completing necessary repairs or inspections. Likewise, buyers can be confident that their funds will not be released until they have received clear title to the property.

In addition to providing security, escrow also facilitates a more efficient transaction process. It helps streamline communication between all parties involved, including lenders, agents, attorneys, and title companies. This coordination ensures that all necessary paperwork is completed accurately and on time. Moreover, escrow services have extensive knowledge of local laws and regulations related to real estate transactions, which helps prevent any legal complications or delays.

Transition: Understanding the importance of escrow lays a foundation for considering various considerations for both buyers and sellers when utilizing this essential service.

Considerations for buyers and sellers

Considerations for buyers and sellers when utilizing escrow services include understanding the terms and conditions of the sale, ensuring clear communication with all parties involved, and verifying that necessary repairs or inspections are completed before funds are released.

- Understanding the terms and conditions of the sale is crucial for both buyers and sellers. This involves carefully reviewing the escrow agreement to fully comprehend their rights and obligations. Buyers should ensure that they understand the specific conditions under which they can cancel the transaction or request repairs before closing. Sellers, on the other hand, need to be aware of any potential contingencies that may impact their ability to receive payment. By having a comprehensive understanding of these terms, both parties can protect their interests throughout the escrow process.

- Clear communication is vital in any real estate transaction involving an escrow service. Buyers and sellers should maintain open lines of communication with one another as well as with their respective agents or attorneys. Regular updates regarding any changes in circumstances or issues that arise during the escrow period can help prevent misunderstandings and delays in closing. Additionally, being responsive to requests for information or documentation can facilitate a smoother transaction overall.

- Verifying that necessary repairs or inspections are completed before funds are released is an important consideration for both buyers and sellers using an escrow service. Buyers should conduct thorough inspections to identify any potential issues with the property before finalizing the purchase. If repairs are negotiated as part of the sale agreement, it is essential for sellers to ensure that these repairs are completed satisfactorily before releasing funds from escrow. By prioritizing this step, buyers can avoid purchasing a property with hidden defects while sellers can fulfill their responsibilities outlined in the sales contract.

When utilizing escrow services, it is crucial for buyers and sellers to consider understanding the terms and conditions of the sale thoroughly, maintaining clear communication throughout the process, and verifying that necessary repairs or inspections have been completed prior to fund release. By taking these considerations into account, both parties can navigate the escrow process more effectively and protect their interests in the transaction.

Frequently Asked Questions

Are there any risks involved in using escrow services?

Yes, there are risks involved in using escrow services. These include the potential for fraud or misrepresentation by the escrow agent, delays in receiving funds or goods, and disputes over the release of funds.

Can escrow be used for transactions involving digital assets or cryptocurrency?

Escrow can be used for transactions involving digital assets or cryptocurrency. It provides a neutral third party that holds the funds or assets until all conditions of the transaction are met, reducing the risk of fraud and ensuring a secure exchange.

Can the escrow process be expedited in urgent situations?

In urgent situations, the escrow process can be expedited by ensuring all parties involved are prompt in their actions and providing all necessary documentation. However, it is important to adhere to legal requirements and ensure a thorough review of the transaction is still conducted.

Are there any specific legal requirements or regulations for escrow services?

Yes, there are specific legal requirements and regulations for escrow services. These vary by jurisdiction but generally involve licensing, bonding, audits, and adherence to anti-money laundering laws to ensure the integrity of the escrow process.

How can buyers and sellers ensure the security and authenticity of the escrow service provider?

To ensure the security and authenticity of an escrow service provider, buyers and sellers can conduct thorough research on the company’s reputation, verify their licensing and certifications, review customer feedback, and seek guidance from legal professionals or financial advisors.

Other Articles You Might Enjoy

What Is The Quickest A House Sale Can Go Through