The constant rise in house prices has been a topic of much interest and speculation. Despite occasional fluctuations, the overall trend suggests that house prices are unlikely to ever decrease significantly. This article aims to delve into various factors that contribute to this phenomenon, providing an objective analysis of why house prices continue to climb.

One key factor driving up house prices is the dynamic relationship between supply and demand. Limited land availability coupled with a growing population ensures a continuous demand for housing. As more people seek homes in desirable locations, the scarcity of available properties drives up their value. Additionally, economic growth and increasing income levels contribute to higher demand for housing, as individuals strive for better living standards and invest in property as a means of wealth accumulation.

Furthermore, population growth plays a significant role in the perpetuation of rising house prices. With an expanding population comes an increased need for housing, putting further strain on already limited resources. The increase in demand leads to higher competition among buyers and consequently drives up prices. Moreover, as urbanization continues unabated, particularly in major cities where job opportunities are concentrated, the pressure on housing markets intensifies even further.

In conclusion, several interrelated factors contribute to the steady rise in house prices over time. The intricate balance between supply and demand dynamics, coupled with population growth and economic factors like inflation and government policies all serve as catalysts for this phenomenon. Understanding these drivers allows us to grasp why house prices seem resistant to significant declines – giving homeowners and investors alike valuable insights into the long-term stability of real estate investments

Factors Driving Prices Up

One of the reasons why house prices will never go down is due to the continuous influx of foreign investors who view real estate as a safe and profitable investment, resulting in a high demand for properties and driving prices up. In recent years, there has been a significant increase in international investment in real estate markets across the globe. This trend can be attributed to various factors such as favorable real estate market trends, housing market predictions that indicate long-term property appreciation, and economic factors that make real estate an attractive option for investors.

Real estate market trends play a crucial role in driving up house prices. These trends are influenced by various factors such as population growth, urbanization, and changes in lifestyle preferences. As cities continue to expand and populations increase, the demand for housing also rises. Additionally, shifts in lifestyle preferences towards living in urban areas with access to amenities and job opportunities further contribute to the increasing demand for properties. These trends create an environment where scarcity of available properties drives prices higher.

Housing market predictions also influence investor behavior and contribute to rising house prices. Investors often rely on forecasts made by experts regarding future property values before making their investment decisions. When these predictions suggest long-term property appreciation, it attracts more investors who are willing to pay higher prices in anticipation of future gains. As more investors enter the market with this mindset, competition increases, leading to further Sell My House Fast Fort Worth price escalation.

The continuous influx of foreign investors into the real estate market is driven by these factors influencing property value as well as other economic considerations. Real estate is seen as a tangible asset that provides stability during times of economic uncertainty or volatility. Additionally, many countries offer incentives such as tax benefits or residency programs for foreign investors purchasing properties within their borders. These economic factors further enhance the appeal of investing in real estate.

One of the main reasons why house prices will never go down is due to the continuous influx of foreign investors who view real estate as a safe and profitable investment. Real estate market trends, housing market predictions, and economic factors all contribute to the high demand for properties and subsequently drive prices up. However, this is only one aspect of the supply and demand dynamics that influence house prices.

Supply and Demand Dynamics

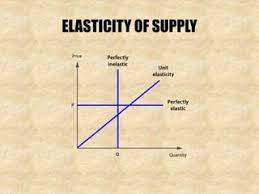

The interplay between the availability of properties and the level of demand for them creates a perpetually upward pressure on property values. This supply and demand dynamics is a key driver of property value appreciation. When there is high demand for housing but limited supply, prices tend to rise. Conversely, when supply exceeds demand, prices may stabilize or even decrease.

Understanding market trends in property pricing can shed light on the factors influencing supply and demand dynamics. Economic influences play a significant role in real estate. During periods of economic growth, job opportunities increase, leading to higher incomes and greater purchasing power among potential homebuyers. This increased demand can drive up property prices.

Additionally, the impact of inflation on home prices cannot be ignored. Inflation erodes the purchasing power of money over time, making housing more expensive. As general price levels rise due to inflation, so do construction costs and other expenses associated with homeownership. These increased costs are often passed onto buyers in the form of higher property prices.

The interplay between supply and demand dynamics is a fundamental factor driving property value appreciation. Market trends in property pricing, economic influences on real estate, and the impact of inflation all contribute to this perpetual upward pressure on house prices. Understanding these dynamics is crucial for individuals seeking to navigate the real estate market successfully.

Moving forward into our next section about ‘impact of population growth’, it becomes clear that population growth plays a significant role in shaping supply and demand dynamics in the housing market without any step being taken towards reducing house prices directly by external forces or governmental policies . Instead, the natural effects of population growth, such as increased demand for housing, lead to rising prices in the housing market. This can be attributed to the basic Sell My House Fast Texas economic principle of supply and demand, where a growing population creates a higher demand for housing, causing prices to increase as supply struggles to keep up. As a result, population growth indirectly influences the affordability and availability of housing, making it a critical factor to consider when analyzing the impact on housing prices.

Impact of Population Growth

Population growth has a significant influence on the dynamics of supply and demand in the housing market, leading to an inevitable impact on property values. As the population increases, the demand for housing also rises. This increased demand puts pressure on the limited supply of available homes, causing prices to go up. Real estate market analysis shows that areas with high population growth tend to experience higher property values due to increased competition among buyers.

To further understand the relationship between population growth and property values, let’s examine some economic indicators for property values. One such indicator is the property market outlook, which takes into account factors like population growth rates, employment opportunities, and affordability levels. A positive property market outlook in an area with rapid population growth suggests that housing prices are likely to continue rising.

Another important aspect is how real estate and economic stability are interlinked. Population growth can contribute to economic development by attracting businesses and creating job opportunities. This can lead to an increase in household income levels, allowing more people to enter the housing market as potential buyers. As a result, this sustained economic stability further drives up property values.

Population growth plays a crucial role in shaping the future of the housing market. The increasing demand for housing due to population growth exerts upward pressure on property prices. Economic indicators for property values suggest that areas experiencing rapid population growth have a positive outlook for real estate markets. Moreover, real estate and economic stability go hand in hand as population growth contributes to economic development and higher household incomes which contribute to increased property values. The next section will delve into how inflation and other economic factors interact with house prices without explicitly stating ‘step’.

Inflation and Economic Factors

Inflation and various economic factors play a crucial role in shaping the trajectory of property values in the housing market. The rise or fall in general price levels, as measured by inflation, can directly impact home value preservation. When inflation increases, the cost of goods and services rises, including construction materials and labor costs involved in real estate development. As a result, the prices of homes also tend to increase to compensate for these rising expenses. Therefore, inflation can contribute to the appreciation of property values over time.

Moreover, real estate has long been considered a stable investment option that provides attractive returns over time. Investors often view properties as tangible assets that retain their value even during periods of economic uncertainty. In favorable economic conditions with low inflation rates, individuals may be more inclined to invest in real estate due to its potential for profitability. This increased demand for properties can drive up prices and further fuel the growth of property values.

To maximize returns on real estate investments, it is essential to consider anticipated changes in property values influenced by broader economic factors such as interest rates and employment levels. Low-interest rates make borrowing cheaper and encourage individuals to invest in real estate, increasing demand and pushing up prices. On the other hand, high unemployment rates may lead to decreased purchasing power and reduced demand for housing, potentially resulting in a decline or stagnation in property values.

Understanding how inflation and various economic factors affect property values is crucial for those interested in maximizing their returns on real estate investments. Inflation drives up construction costs which ultimately impact home prices positively. Real estate’s reputation as a profitable investment option attracts investors during periods of stable economic conditions. Additionally, considering broader economic indicators like interest rates and employment levels helps anticipate changes in property values accurately. Up next will be an exploration of government policies and regulations that influence house prices without needing any additional steps taken from here onwards . These policies and regulations can have a significant impact on the supply and demand dynamics of the housing market, ultimately affecting property values.

Government Policies and Regulations

Government policies and regulations play a pivotal role in shaping the dynamics of the housing market, exerting influence on property values through their impact on supply and demand. These policies can be both national and local in nature, with governments implementing measures to achieve various objectives such as promoting homeownership, ensuring affordable housing options, or regulating the real estate industry. Here are three key ways in which government policies and regulations affect house prices:

- Mortgage regulations: Governments often introduce regulations to control mortgage lending practices. For example, they may implement stricter guidelines for loan approval, require higher down payments, or limit the debt-to-income ratio for borrowers. These measures aim to prevent excessive borrowing and reduce the risk of a housing bubble forming. By making it more difficult for people to obtain mortgages, these regulations can dampen demand for houses and potentially lower prices.

- Land-use restrictions: Governments also impose land-use restrictions that impact housing supply. Zoning laws dictate how land can be used within certain areas, designating specific zones for residential, commercial, or industrial purposes. Restrictive zoning laws can limit the amount of available land for residential development and drive up prices due to limited supply relative to demand. Additionally, building codes and other regulations can add costs to construction projects, further affecting housing affordability.

- Taxation policies: Taxation policies can have significant effects on house prices by influencing both demand and supply factors. For instance, tax incentives such as mortgage interest deductions or capital gains exemptions may encourage homeownership and increase demand for houses. On the other hand, property taxes levied on homeowners contribute to monthly expenses associated with owning a home and may deter potential buyers. Moreover, government taxes imposed on real estate transactions (e.g., stamp duty) directly affect transaction costs in the housing market.

Government policies and regulations shape not only the trajectory of house prices but also the overall stability of the housing market itself. As we move into discussing investment and speculation in the next section, it is important to acknowledge how government interventions can have profound effects on these aspects of the housing market as well.

Investment and Speculation

Investment and speculation in the housing market have a profound influence on its dynamics, shaping the potential for financial gains or losses and fueling emotions of excitement, anticipation, or anxiety among investors. The real estate market offers opportunities for investment and profitability, attracting individuals seeking to capitalize on the potential growth of their assets. However, successful investment strategies for sustained growth require careful consideration of various factors such as location, market trends, and economic conditions.

To make informed investment decisions in the housing market, it is crucial to understand the sellers guide and acquire knowledge about the process of selling a house. This guide provides valuable insights into pricing strategies, marketing techniques, and negotiation skills that can maximize profits when selling a property. By following this guide, sellers can navigate through the complex landscape of real estate transactions with confidence.

As we consider the future of real estate investments, it becomes evident that staying updated on market trends is essential. With advancements in technology and changes in consumer behavior, new opportunities may arise that could shape the housing market significantly. Investors who adapt to these changes by embracing innovative approaches will likely be better positioned to succeed in an evolving industry.

Understanding how investment and speculation impact housing dynamics is just one aspect of comprehending the complexities within this field. Market psychology plays a significant role in shaping buyer behavior and overall market sentiment. By delving into this subject further, we can gain valuable insights into why house prices may never go down due to psychological factors influencing demand and supply decisions made by buyers and sellers alike.

Investment strategies play a crucial role in determining how house prices fluctuate over time. By understanding key principles outlined in seller guides and staying abreast of changing market trends while considering innovative approaches to investments, individuals can position themselves for success in real estate endeavors. Furthermore, exploring market psychology sheds light on additional factors driving housing dynamics beyond purely economic considerations.

Market Psychology

Market psychology plays a crucial role in shaping buyer behavior and overall market sentiment, offering insights into the complex factors that influence demand and supply decisions within the housing market. Understanding the psychological aspects of buyers can provide valuable information for sellers and investors looking to maximize their profits. Here are four key elements of market psychology that impact the housing market:

- Fear of missing out (FOMO): In a competitive housing market, buyers often experience FOMO, fearing that if they do not act quickly, they will miss out on a desirable property. This fear drives up demand and can result in bidding wars, leading to higher prices. Sellers can take advantage of this by strategically pricing their homes slightly below market value or setting deadlines for offers.

- Herd mentality: People tend to follow the crowd when making decisions, including buying a house. If others are actively purchasing properties or there is positive media coverage about rising home prices, it creates a sense of urgency among potential buyers. This herd mentality can lead to increased demand and further drive up prices.

- Emotional attachment: Buying a home is often an emotional decision rather than purely financial. Buyers may fall in love with certain features or envision their future in a particular property. Sellers can capitalize on this emotional attachment by effectively staging their homes to create an inviting atmosphere that resonates with potential buyers’ desires.

- Seller’s market mindset: When the housing market strongly favors sellers due to low inventory levels and high demand, buyers may feel pressured to make quick decisions and offer higher prices than they initially intended. This seller’s market mindset contributes to price escalation as buyers compete for limited options.

For those selling homes in such competitive markets, understanding these psychological factors becomes essential when developing effective strategies for increasing home value and achieving quick sales at optimal prices through techniques like effective home staging and implementing smart marketing campaigns tailored for selling in a seller’s market.

Market psychology significantly impacts buyer behavior and overall market sentiment within the housing market. FOMO, herd mentality, emotional attachment, and the seller’s market mindset are all elements that shape buyer decision-making processes and contribute to price escalation. By understanding these psychological factors, sellers can develop strategies such as effective home staging and targeted marketing campaigns to increase home value and achieve quick sales in competitive markets.

Frequently Asked Questions

How do housing prices impact the overall economy?

Housing prices impact the overall economy by affecting consumer spending, construction activity, and household wealth. Rising prices can lead to increased borrowing and consumption while falling prices can dampen investment and economic growth.

What are some common misconceptions about the relationship between population growth and housing prices?

Some common misconceptions about the relationship between population growth and housing prices include the belief that population growth always leads to higher housing prices, when in reality, other factors such as supply and demand also play a significant role.

Are there any exceptions to the claim that house prices will never go down?

There are exceptions to the claim that house prices will never go down. Economic downturns, changes in government policies, and large-scale events like natural disasters can all contribute to temporary or permanent decreases in housing prices.

How do changes in interest rates affect housing prices?

Changes in interest rates can have a significant impact on housing prices. When interest rates decrease, it becomes cheaper to borrow money for a mortgage, leading to increased demand and potentially higher house prices. Conversely, higher interest rates can curb demand and lead to lower housing prices.

What role does the availability of credit play in determining house prices?

The availability of credit plays a crucial role in determining house prices. When credit is readily available, it increases the demand for housing and allows potential buyers to afford higher-priced properties, ultimately driving up house prices.

Other Articles You Might Enjoy